Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

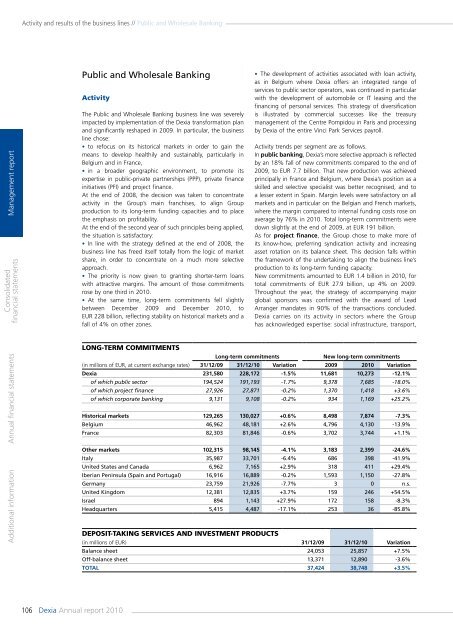

Activity and results of the business lines // Public and Wholesale BankingManagement <strong>report</strong>Consolidatedfinancial statementsPublic and Wholesale BankingActivityThe Public and Wholesale Banking business line was severelyimpacted by implementation of the <strong>Dexia</strong> transformation planand significantly reshaped in 2009. In particular, the businessline chose:• to refocus on its historical markets in order to gain themeans to develop healthily and sustainably, particularly inBelgium and in France,• in a broader geographic environment, to promote itsexpertise in public-private partnerships (PPP), private financeinitiatives (PFI) and project finance.At the end of 2008, the decision was taken to concentrateactivity in the Group’s main franchises, to align Groupproduction to its long-term funding capacities and to placethe emphasis on profitability.At the end of the second year of such principles being applied,the situation is satisfactory:• In line with the strategy defined at the end of 2008, thebusiness line has freed itself totally from the logic of marketshare, in order to concentrate on a much more selectiveapproach.• The priority is now given to granting shorter-term loanswith attractive margins. The amount of those <strong>com</strong>mitmentsrose by one third in <strong>2010</strong>.• At the same time, long-term <strong>com</strong>mitments fell slightlybetween December 2009 and December <strong>2010</strong>, toEUR 228 billion, reflecting stability on historical markets and afall of 4% on other zones.• The development of activities associated with loan activity,as in Belgium where <strong>Dexia</strong> offers an integrated range ofservices to public sector operators, was continued in particularwith the development of automobile or IT leasing and thefinancing of personal services. This strategy of diversificationis illustrated by <strong>com</strong>mercial successes like the treasurymanagement of the Centre Pompidou in Paris and processingby <strong>Dexia</strong> of the entire Vinci Park Services payroll.Activity trends per segment are as follows.In public banking, <strong>Dexia</strong>’s more selective approach is reflectedby an 18% fall of new <strong>com</strong>mitments <strong>com</strong>pared to the end of2009, to EUR 7.7 billion. That new production was achievedprincipally in France and Belgium, where <strong>Dexia</strong>’s position as askilled and selective specialist was better recognised, and toa lesser extent in Spain. Margin levels were satisfactory on allmarkets and in particular on the Belgian and French markets,where the margin <strong>com</strong>pared to internal funding costs rose onaverage by 76% in <strong>2010</strong>. Total long-term <strong>com</strong>mitments weredown slightly at the end of 2009, at EUR 191 billion.As for project finance, the Group chose to make more ofits know-how, preferring syndication activity and increasingasset rotation on its balance sheet. This decision falls withinthe framework of the undertaking to align the business line’sproduction to its long-term funding capacity.New <strong>com</strong>mitments amounted to EUR 1.4 billion in <strong>2010</strong>, fortotal <strong>com</strong>mitments of EUR 27.9 billion, up 4% on 2009.Throughout the year, the strategy of ac<strong>com</strong>panying majorglobal sponsors was confirmed with the award of LeadArranger mandates in 90% of the transactions concluded.<strong>Dexia</strong> carries on its activity in sectors where the Grouphas acknowledged expertise: social infrastructure, transport,Additional information <strong>Annual</strong> financial statementsLong-term <strong>com</strong>mitmentsLong-term <strong>com</strong>mitmentsNew long-term <strong>com</strong>mitments(in millions of EUR, at current exchange rates) 31/12/09 31/12/10 Variation 2009 <strong>2010</strong> Variation<strong>Dexia</strong> 231,580 228,172 -1.5% 11,681 10,273 -12.1%of which public sector 194,524 191,193 -1.7% 9,378 7,685 -18.0%of which project finance 27,926 27,871 -0.2% 1,370 1,418 +3.6%of which corporate banking 9,131 9,108 -0.2% 934 1,169 +25.2%Historical markets 129,265 130,027 +0.6% 8,498 7,874 -7.3%Belgium 46,962 48,181 +2.6% 4,796 4,130 -13.9%France 82,303 81,846 -0.6% 3,702 3,744 +1.1%Other markets 102,315 98,145 -4.1% 3,183 2,399 -24.6%Italy 35,987 33,701 -6.4% 686 398 -41.9%United States and Canada 6,962 7,165 +2.9% 318 411 +29.4%Iberian Peninsula (Spain and Portugal) 16,916 16,889 -0.2% 1,593 1,150 -27.8%Germany 23,759 21,926 -7.7% 3 0 n.s.United Kingdom 12,381 12,835 +3.7% 159 246 +54.5%Israel 894 1,143 +27.9% 172 158 -8.3%Headquarters 5,415 4,487 -17.1% 253 36 -85.8%Deposit-taking services and investment products(in millions of EUR) 31/12/09 31/12/10 VariationBalance sheet 24,053 25,857 +7.5%Off-balance sheet 13,371 12,890 -3.6%Total 37,424 38,748 +3.5%106 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>