Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

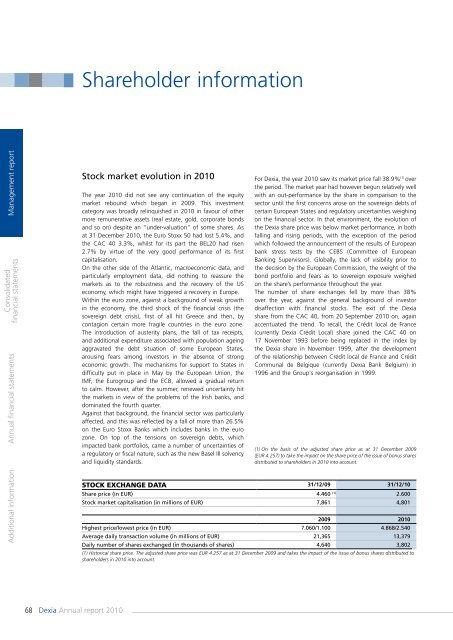

Shareholder informationManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsStock market evolution in <strong>2010</strong>The year <strong>2010</strong> did not see any continuation of the equitymarket rebound which began in 2009. This investmentcategory was broadly relinquished in <strong>2010</strong> in favour of othermore remunerative assets (real estate, gold, corporate bondsand so on) despite an “under-valuation” of some shares. Asat 31 December <strong>2010</strong>, the Euro Stoxx 50 had lost 5.4%, andthe CAC 40 3.3%, whilst for its part the BEL20 had risen2.7% by virtue of the very good performance of its firstcapitalisation.On the other side of the Atlantic, macroeconomic data, andparticularly employment data, did nothing to reassure themarkets as to the robustness and the recovery of the USeconomy, which might have triggered a recovery in Europe.Within the euro zone, against a background of weak growthin the economy, the third shock of the financial crisis (thesovereign debt crisis), first of all hit Greece and then, bycontagion certain more fragile countries in the euro zone.The introduction of austerity plans, the fall of tax receipts,and additional expenditure associated with population ageingaggravated the debt situation of some European States,arousing fears among investors in the absence of strongeconomic growth. The mechanisms for support to States indifficulty put in place in May by the European Union, theIMF, the Eurogroup and the ECB, allowed a gradual returnto calm. However, after the summer, renewed uncertainty hitthe markets in view of the problems of the Irish banks, anddominated the fourth quarter.Against that background, the financial sector was particularlyaffected, and this was reflected by a fall of more than 26.5%on the Euro Stoxx Banks which includes banks in the eurozone. On top of the tensions on sovereign debts, whichimpacted bank portfolios, came a number of uncertainties ofa regulatory or fiscal nature, such as the new Basel III solvencyand liquidity standards.For <strong>Dexia</strong>, the year <strong>2010</strong> saw its market price fall 38.9% (1) overthe period. The market year had however begun relatively wellwith an out-performance by the share in <strong>com</strong>parison to thesector until the first concerns arose on the sovereign debts ofcertain European States and regulatory uncertainties weighingon the financial sector. In that environment, the evolution ofthe <strong>Dexia</strong> share price was below market performance, in bothfalling and rising periods, with the exception of the periodwhich followed the announcement of the results of Europeanbank stress tests by the CEBS (Committee of EuropeanBanking Supervisors). Globally, the lack of visibility prior tothe decision by the European Commission, the weight of thebond portfolio and fears as to sovereign exposure weighedon the share’s performance throughout the year.The number of share exchanges fell by more than 38%over the year, against the general background of investordisaffection with financial stocks. The exit of the <strong>Dexia</strong>share from the CAC 40, from 20 September <strong>2010</strong> on, againaccentuated the trend. To recall, the Crédit local de France(currently <strong>Dexia</strong> Crédit Local) share joined the CAC 40 on17 November 1993 before being replaced in the index bythe <strong>Dexia</strong> share in November 1999, after the developmentof the relationship between Crédit local de France and CréditCommunal de Belgique (currently <strong>Dexia</strong> Bank Belgium) in1996 and the Group's reorganisation in 1999.(1) On the basis of the adjusted share price as at 31 December 2009(EUR 4.257) to take the impact on the share price of the issue of bonus sharesdistributed to shareholders in <strong>2010</strong> into account.Stock exchange data 31/12/09 31/12/10Share price (in EUR) 4.460 (1) 2.600Stock market capitalisation (in millions of EUR) 7,861 4,8012009 <strong>2010</strong>Highest price/lowest price (in EUR) 7.060/1.100 4.868/2.540Average daily transaction volume (in millions of EUR) 21,365 13,379Daily number of shares exchanged (in thousands of shares) 4,640 3,802(1) Historical share price. The adjusted share price was EUR 4.257 as at 31 December 2009 and takes the impact of the issue of bonus shares distributed toshareholders in <strong>2010</strong> into account.68 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>