Declaration of corporate governanceManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsNotifications under the legislation ontransparencyUnder the terms of the Law of 2 May 2007 (the “Law”) relatingto the publication of major holdings in issuers the shares ofwhich are admitted for trading on a regulated market andthe Royal Decree dealing with its execution dated 14 February2008, which entered into force on 1 September 2008, andon the basis of Article 5 of the articles of association of <strong>Dexia</strong>SA, shareholders are obliged to notify their holding to theBanking, Finance and Insurance Commission and to <strong>Dexia</strong>,insofar as it reaches a threshold of 1%, 3%, then 5% or amultiple of 5%.To calculate percentages of holdings, the numerator consistsof the number of voting rights attached to shares conferringvoting rights or not associated with shares, reduced orincreased by the number of voting rights which may beacquired on the exercise of similar financial instruments heldby the person making the declaration. The denominatorconsists of the total of existing voting rights in <strong>Dexia</strong> SA aspublished on the website.Moreover, in application of the “Protocol on the prudentialstructure of the <strong>Dexia</strong> Group” (cf. “Corporate governance”on page 63), <strong>Dexia</strong> SA has asked its main shareholdersto inform the <strong>com</strong>pany and the Banking, Finance andInsurance Commission as soon as possible prior to any of theaforementioned transactions.During the year <strong>2010</strong>, <strong>Dexia</strong> SA received various notificationsfrom its shareholders, namely:• on 26 February <strong>2010</strong>, a transparency notification was sentto BlackRock Inc. the holding of which exceeded the statutorythreshold of 1% on 24 February <strong>2010</strong>;• on 25 March <strong>2010</strong>, BlackRock Inc. sent a new transparencynotification according to which their holding passed backbelow the statutory threshold of 1% on 22 March <strong>2010</strong>;• on 1 September <strong>2010</strong>, the shareholders which hadconcluded an agreement under which they are deemed toconstitute “persons acting in concert” (cf. point Legislationon tender offers hereafter) under the meaning of Belgianlegislation relating to tender offers notified their holding inthe capital of <strong>Dexia</strong> SA following the crossing by Ethias Groupof the legal threshold of 5% on 26 August <strong>2010</strong>;• on 17 September <strong>2010</strong> BlackRock Inc. notified its holdingin the capital of <strong>Dexia</strong> SA above the statutory threshold of1% on 13 September <strong>2010</strong>;• on 3 November <strong>2010</strong>, BlackRock Inc. sent a newtransparency notification according to which their holdingpassed back below the statutory threshold of 1% on 28October <strong>2010</strong>.All of these notifications are published in full on the <strong>Dexia</strong>SA internet site.It emerges from these notifications that no shareholder,other than the reference shareholders listed in the table onpage 21, holds more than 1% of the share capital of <strong>Dexia</strong>SA as at 31 December <strong>2010</strong>.Legislation on tender offers“Grandfathering” regimeUnder the terms of Article 74 of the Law of 1 April 2007relating to public takeover bids, persons which as at1 September 2007, either alone or in concert, hold morethan 30% of the voting securities of a Belgian <strong>com</strong>panyadmitted to trading on a regulated market are not subjectto the obligation to launch a public takeover bid on theshares of the said <strong>com</strong>pany provided in particular that for21 February 2008 at the latest they have sent a notificationto the Banking, Finance and Insurance Commission and a<strong>com</strong>munication to the said <strong>com</strong>pany.On 30 August 2007, <strong>Dexia</strong> SA was informed of theconclusion by certain of its shareholders (Arcofin, HoldingCommunal, Caisse des dépôts et consignations, Ethias andCNP Assurances) of an agreement under the terms of whichthey are deemed to constitute “persons acting in concert”within the meaning of the Law of 1 April 2007 relating topublic takeover bids. The holding of the shareholders actingin concert in the capital of <strong>Dexia</strong> SA exceeds a threshold of50%.This agreement was the object of a notification to theCBFA and a <strong>com</strong>munication to <strong>Dexia</strong> SA in accordance withArticle 74 § 6 and 7 of the Law of 1 April 2007 relating topublic takeover bids.The principal elements of that <strong>com</strong>munication are publishedon the <strong>Dexia</strong> SA internet site.Moreover, in accordance with Article 74 § 8 of the said Law,the parties acting in concert must annually notify any changeto their holding which has taken place since 1 September2007.Within this context, each year <strong>Dexia</strong> SA receives an updatelisting the transactions carried out on <strong>Dexia</strong> shares by thedifferent shareholders acting in concert (and associatedparties) as well as, if such should be the case, any changes ofcontrol holding within the meaning of Article 74 § 8 of thesaid Law. The essential of the notifications received in <strong>2010</strong>,which are available in full on the <strong>Dexia</strong> SA internet site underthe heading “Legal Information/Belgian tender offer rules”, islisted in the following table.66 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>

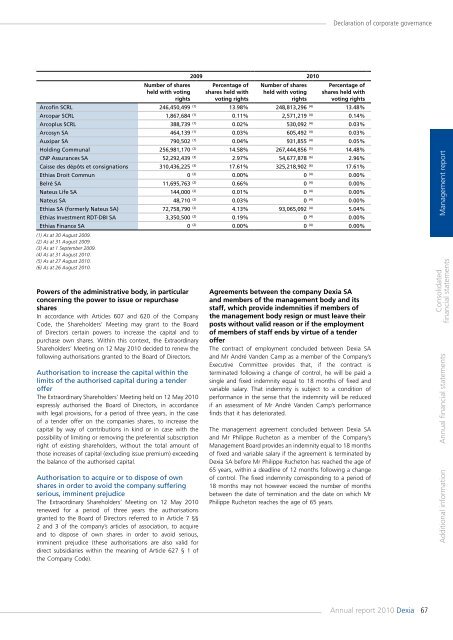

Declaration of corporate governanceNumber of sharesheld with votingrights2009 <strong>2010</strong>Percentage ofshares held withvoting rightsNumber of sharesheld with votingrightsPercentage ofshares held withvoting rightsArcofin SCRL 246,450,499 (1) 13.98% 248,813,296 (4) 13.48%Arcopar SCRL 1,867,684 (1) 0.11% 2,571,219 (4) 0.14%Arcoplus SCRL 388,739 (1) 0.02% 530,092 (4) 0.03%Arcosyn SA 464,139 (1) 0.03% 605,492 (4) 0.03%Auxipar SA 790,502 (1) 0.04% 931,855 (4) 0.05%Holding Communal 256,981,170 (2) 14.58% 267,444,856 (5) 14.48%CNP Assurances SA 52,292,439 (3) 2.97% 54,677,878 (6) 2.96%Caisse des dépôts et consignations 310,436,225 (3) 17.61% 325,218,902 (6) 17.61%Ethias Droit Commun 0 (2) 0.00% 0 (4) 0.00%Belré SA 11,695,763 (2) 0.66% 0 (4) 0.00%Nateus Life SA 144,000 (2) 0.01% 0 (4) 0.00%Nateus SA 48,710 (2) 0.03% 0 (4) 0.00%Ethias SA (formerly Nateus SA) 72,758,790 (2) 4.13% 93,065,092 (4) 5.04%Ethias Investment RDT-DBI SA 3,350,500 (2) 0.19% 0 (4) 0.00%Ethias Finance SA 0 (2) 0.00% 0 (4) 0.00%(1) As at 30 August 2009.(2) As at 31 August 2009.(3) As at 1 September 2009.(4) As at 31 August <strong>2010</strong>.(5) As at 27 August <strong>2010</strong>.(6) As at 26 August <strong>2010</strong>.Powers of the administrative body, in particularconcerning the power to issue or repurchasesharesIn accordance with Articles 607 and 620 of the CompanyCode, the Shareholders’ Meeting may grant to the Boardof Directors certain powers to increase the capital and topurchase own shares. Within this context, the ExtraordinaryShareholders’ Meeting on 12 May <strong>2010</strong> decided to renew thefollowing authorisations granted to the Board of Directors.Authorisation to increase the capital within thelimits of the authorised capital during a tenderofferThe Extraordinary Shareholders’ Meeting held on 12 May <strong>2010</strong>expressly authorised the Board of Directors, in accordancewith legal provisions, for a period of three years, in the caseof a tender offer on the <strong>com</strong>panies shares, to increase thecapital by way of contributions in kind or in case with thepossibility of limiting or removing the preferential subscriptionright of existing shareholders, without the total amount ofthose increases of capital (excluding issue premium) exceedingthe balance of the authorised capital.Authorisation to acquire or to dispose of ownshares in order to avoid the <strong>com</strong>pany sufferingserious, imminent prejudiceThe Extraordinary Shareholders’ Meeting on 12 May <strong>2010</strong>renewed for a period of three years the authorisationsgranted to the Board of Directors referred to in Article 7 §§2 and 3 of the <strong>com</strong>pany’s articles of association, to acquireand to dispose of own shares in order to avoid serious,imminent prejudice (these authorisations are also valid fordirect subsidiaries within the meaning of Article 627 § 1 ofthe Company Code).Agreements between the <strong>com</strong>pany <strong>Dexia</strong> SAand members of the management body and itsstaff, which provide indemnities if members ofthe management body resign or must leave theirposts without valid reason or if the employmentof members of staff ends by virtue of a tenderofferThe contract of employment concluded between <strong>Dexia</strong> SAand Mr André Vanden Camp as a member of the Company’sExecutive Committee provides that, if the contract isterminated following a change of control, he will be paid asingle and fixed indemnity equal to 18 months of fixed andvariable salary. That indemnity is subject to a condition ofperformance in the sense that the indemnity will be reducedif an assessment of Mr André Vanden Camp’s performancefinds that it has deteriorated.The management agreement concluded between <strong>Dexia</strong> SAand Mr Philippe Rucheton as a member of the Company’sManagement Board provides an indemnity equal to 18 monthsof fixed and variable salary if the agreement is terminated by<strong>Dexia</strong> SA before Mr Philippe Rucheton has reached the age of65 years, within a deadline of 12 months following a changeof control. The fixed indemnity corresponding to a period of18 months may not however exceed the number of monthsbetween the date of termination and the date on which MrPhilippe Rucheton reaches the age of 65 years.Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>67