Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

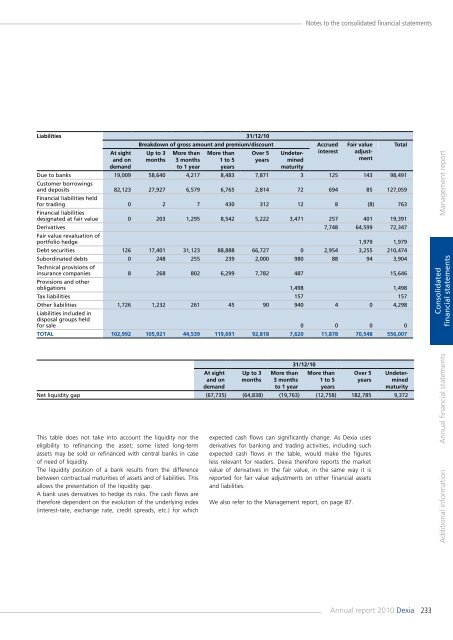

Notes to the consolidated financial statementsLiabilities 31/12/10At sightand ondemandBreakdown of gross amount and premium/discountUp to 3monthsMore than3 monthsto 1 yearMore than1 to 5yearsOver 5yearsFair valueadjustmentUndeterminedmaturityAccruedinterestDue to banks 19,009 58,640 4,217 8,483 7,871 3 125 143 98,491Customer borrowingsand deposits 82,123 27,927 6,579 6,765 2,814 72 694 85 127,059Financial liabilities heldfor trading 0 2 7 430 312 12 8 (8) 763Financial liabilitiesdesignated at fair value 0 203 1,295 8,542 5,222 3,471 257 401 19,391Derivatives 7,748 64,599 72,347Fair value revaluation ofportfolio hedge 1,979 1,979Debt securities 126 17,401 31,123 88,888 66,727 0 2,954 3,255 210,474Subordinated debts 0 248 255 239 2,000 980 88 94 3,904Technical provisions ofinsurance <strong>com</strong>panies 8 268 802 6,299 7,782 487 15,646Provisions and otherobligations 1,498 1,498Tax liabilities 157 157Other liabilities 1,726 1,232 261 45 90 940 4 0 4,298Liabilities included indisposal groups heldfor sale 0 0 0 0Total 102,992 105,921 44,539 119,691 92,818 7,620 11,878 70,548 556,007TotalManagement <strong>report</strong>Consolidatedfinancial statementsAt sightand ondemandUp to 3monthsMore than3 monthsto 1 year31/12/10More than1 to 5yearsOver 5yearsUndeterminedmaturityNet liquidity gap (67,735) (64,838) (19,763) (12,758) 182,785 9,372This table does not take into account the liquidity nor theeligibility to refinancing the asset; some listed long-termassets may be sold or refinanced with central banks in caseof need of liquidity.The liquidity position of a bank results from the differencebetween contractual maturities of assets and of liabilities. Thisallows the presentation of the liquidity gap.A bank uses derivatives to hedge its risks. The cash flows aretherefore dependent on the evolution of the underlying index(interest-rate, exchange rate, credit spreads, etc.) for whichexpected cash flows can significantly change. As <strong>Dexia</strong> usesderivatives for banking and trading activities, including suchexpected cash flows in the table, would make the figuresless relevant for readers. <strong>Dexia</strong> therefore <strong>report</strong>s the marketvalue of derivatives in the fair value, in the same way it is<strong>report</strong>ed for fair value adjustments on other financial assetsand liabilities.We also refer to the Management <strong>report</strong>, on page 87.Additional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>233