Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

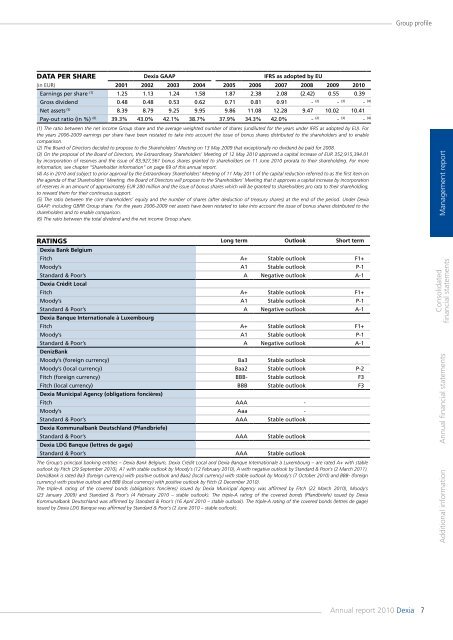

Group profileDATA PER SHARE <strong>Dexia</strong> GAAP IFRS as adopted by EU(in EUR) 2001 2002 2003 2004 2005 2006 2007 2008 2009 <strong>2010</strong>Earnings per share (1) 1.25 1.13 1.24 1.58 1.87 2.38 2.08 (2.42) 0.55 0.39Gross dividend 0.48 0.48 0.53 0.62 0.71 0.81 0.91 - (2) - (3) - (4)Net assets (5) 8.39 8.79 9.25 9.95 9.86 11.08 12.28 9.47 10.02 10.41Pay-out ratio (in %) (6) 39.3% 43.0% 42.1% 38.7% 37.9% 34.3% 42.0% - (2) - (3) - (4)(1) The ratio between the net in<strong>com</strong>e Group share and the average weighted number of shares (undiluted for the years under IFRS as adopted by EU). Forthe years 2006-2009 earnings per share have been restated to take into account the issue of bonus shares distributed to the shareholders and to enable<strong>com</strong>parison.(2) The Board of Directors decided to propose to the Shareholders’ Meeting on 13 May 2009 that exceptionally no dividend be paid for 2008.(3) On the proposal of the Board of Directors, the Extraordinary Shareholders’ Meeting of 12 May <strong>2010</strong> approved a capital increase of EUR 352,915,394.01by incorporation of reserves and the issue of 83,927,561 bonus shares granted to shareholders on 11 June <strong>2010</strong> prorata to their shareholding. For moreinformation, see chapter “Shareholder information” on page 69 of this annual <strong>report</strong>.(4) As in <strong>2010</strong> and subject to prior approval by the Extraordinary Shareholders’ Meeting of 11 May 2011 of the capital reduction referred to as the first item onthe agenda of that Shareholders’ Meeting, the Board of Directors will propose to the Shareholders’ Meeting that it approves a capital increase by incorporationof reserves in an amount of approximately EUR 280 million and the issue of bonus shares which will be granted to shareholders pro rata to their shareholding,to reward them for their continuous support.(5) The ratio between the core shareholders’ equity and the number of shares (after deduction of treasury shares) at the end of the period. Under <strong>Dexia</strong>GAAP: including GBRR Group share. For the years 2006-2009 net assets have been restated to take into account the issue of bonus shares distributed to theshareholders and to enable <strong>com</strong>parison.(6) The ratio between the total dividend and the net in<strong>com</strong>e Group share.Management <strong>report</strong>Ratings Long term Outlook Short term<strong>Dexia</strong> Bank BelgiumFitch A+ Stable outlook F1+Moody’s A1 Stable outlook P-1Standard & Poor’s A Negative outlook A-1<strong>Dexia</strong> Crédit LocalFitch A+ Stable outlook F1+Moody’s A1 Stable outlook P-1Standard & Poor’s A Negative outlook A-1<strong>Dexia</strong> Banque Internationale à LuxembourgFitch A+ Stable outlook F1+Moody’s A1 Stable outlook P-1Standard & Poor’s A Negative outlook A-1DenizBankMoody’s (foreign currency) Ba3 Stable outlookMoody’s (local currency) Baa2 Stable outlook P-2Fitch (foreign currency) BBB- Stable outlook F3Fitch (local currency) BBB Stable outlook F3<strong>Dexia</strong> Municipal Agency (obligations foncières)Fitch AAA -Moody’s Aaa -Standard & Poor’s AAA Stable outlook<strong>Dexia</strong> Kommunalbank Deutschland (Pfandbriefe)Standard & Poor’s AAA Stable outlook<strong>Dexia</strong> LDG Banque (lettres de gage)Standard & Poor’s AAA Stable outlookThe Group’s principal banking entities – <strong>Dexia</strong> Bank Belgium, <strong>Dexia</strong> Crédit Local and <strong>Dexia</strong> Banque Internationale à Luxembourg – are rated A+ with stableoutlook by Fitch (29 September <strong>2010</strong>), A1 with stable outlook by Moody’s (12 February <strong>2010</strong>), A with negative outlook by Standard & Poor’s (2 March 2011).DenizBank is rated Ba3 (foreign currency) with positive outlook and Baa2 (local currency) with stable outlook by Moody’s (7 October <strong>2010</strong>) and BBB- (foreigncurrency) with positive outlook and BBB (local currency) with positive outlook by Fitch (2 December <strong>2010</strong>).The triple-A rating of the covered bonds (obligations foncières) issued by <strong>Dexia</strong> Municipal Agency was affirmed by Fitch (22 March <strong>2010</strong>), Moody’s(23 January 2009) and Standard & Poor’s (4 February <strong>2010</strong> – stable outlook). The triple-A rating of the covered bonds (Pfandbriefe) issued by <strong>Dexia</strong>Kommunalbank Deutschland was affirmed by Standard & Poor’s (16 April <strong>2010</strong> – stable outlook). The triple-A rating of the covered bonds (lettres de gage)issued by <strong>Dexia</strong> LDG Banque was affirmed by Standard & Poor’s (2 June <strong>2010</strong> – stable outlook).Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>7