Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

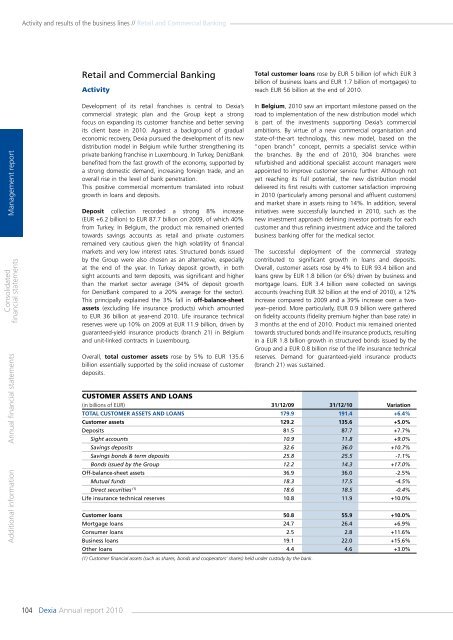

Activity and results of the business lines // Retail and Commercial BankingRetail and Commercial BankingActivityTotal customer loans rose by EUR 5 billion (of which EUR 3billion of business loans and EUR 1.7 billion of mortgages) toreach EUR 56 billion at the end of <strong>2010</strong>.Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsDevelopment of its retail franchises is central to <strong>Dexia</strong>’s<strong>com</strong>mercial strategic plan and the Group kept a strongfocus on expanding its customer franchise and better servingits client base in <strong>2010</strong>. Against a background of gradualeconomic recovery, <strong>Dexia</strong> pursued the development of its newdistribution model in Belgium while further strengthening itsprivate banking franchise in Luxembourg. In Turkey, DenizBankbenefited from the fast growth of the economy, supported bya strong domestic demand, increasing foreign trade, and anoverall rise in the level of bank penetration.This positive <strong>com</strong>mercial momentum translated into robustgrowth in loans and deposits.Deposit collection recorded a strong 8% increase(EUR +6.2 billion) to EUR 87.7 billion on 2009, of which 40%from Turkey. In Belgium, the product mix remained orientedtowards savings accounts as retail and private customersremained very cautious given the high volatility of financialmarkets and very low interest rates. Structured bonds issuedby the Group were also chosen as an alternative, especiallyat the end of the year. In Turkey deposit growth, in bothsight accounts and term deposits, was significant and higherthan the market sector average (34% of deposit growthfor DenizBank <strong>com</strong>pared to a 20% average for the sector).This principally explained the 3% fall in off-balance-sheetassets (excluding life insurance products) which amountedto EUR 36 billion at year-end <strong>2010</strong>. Life insurance technicalreserves were up 10% on 2009 at EUR 11.9 billion, driven byguaranteed-yield insurance products (branch 21) in Belgiumand unit-linked contracts in Luxembourg.Overall, total customer assets rose by 5% to EUR 135.6billion essentially supported by the solid increase of customerdeposits.In Belgium, <strong>2010</strong> saw an important milestone passed on theroad to implementation of the new distribution model whichis part of the investments supporting <strong>Dexia</strong>’s <strong>com</strong>mercialambitions. By virtue of a new <strong>com</strong>mercial organisation andstate-of-the-art technology, this new model, based on the“open branch” concept, permits a specialist service withinthe branches. By the end of <strong>2010</strong>, 304 branches wererefurbished and additional specialist account managers wereappointed to improve customer service further. Although notyet reaching its full potential, the new distribution modeldelivered its first results with customer satisfaction improvingin <strong>2010</strong> (particularly among personal and affluent customers)and market share in assets rising to 14%. In addition, severalinitiatives were successfully launched in <strong>2010</strong>, such as thenew investment approach defining investor portraits for eachcustomer and thus refining investment advice and the tailoredbusiness banking offer for the medical sector.The successful deployment of the <strong>com</strong>mercial strategycontributed to significant growth in loans and deposits.Overall, customer assets rose by 4% to EUR 93.4 billion andloans grew by EUR 1.8 billion (or 6%) driven by business andmortgage loans. EUR 3.4 billion were collected on savingsaccounts (reaching EUR 32 billion at the end of <strong>2010</strong>), a 12%increase <strong>com</strong>pared to 2009 and a 39% increase over a twoyear--period.More particularly, EUR 0.9 billion were gatheredon fidelity accounts (fidelity premium higher than base rate) in3 months at the end of <strong>2010</strong>. Product mix remained orientedtowards structured bonds and life insurance products, resultingin a EUR 1.8 billion growth in structured bonds issued by theGroup and a EUR 0.8 billion rise of the life insurance technicalreserves. Demand for guaranteed-yield insurance products(branch 21) was sustained.Customer assets and loans(in billions of EUR) 31/12/09 31/12/10 VariationTOTAL CUSTOMER ASSETS AND LOANS 179.9 191.4 +6.4%Customer assets 129.2 135.6 +5.0%Deposits 81.5 87.7 +7.7%Sight accounts 10.9 11.8 +9.0%Savings deposits 32.6 36.0 +10.7%Savings bonds & term deposits 25.8 25.5 -1.1%Bonds issued by the Group 12.2 14.3 +17.0%Off-balance-sheet assets 36.9 36.0 -2.5%Mutual funds 18.3 17.5 -4.5%Direct securities (1) 18.6 18.5 -0.4%Life insurance technical reserves 10.8 11.9 +10.0%Customer loans 50.8 55.9 +10.0%Mortgage loans 24.7 26.4 +6.9%Consumer loans 2.5 2.8 +11.6%Business loans 19.1 22.0 +15.6%Other loans 4.4 4.6 +3.0%(1) Customer financial assets (such as shares, bonds and cooperators’ shares) held under custody by the bank.104 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>