Statement of in<strong>com</strong>eManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements(in EUR) 31/12/2009 31/12/<strong>2010</strong>I. Operating in<strong>com</strong>e 7,926,197 35,806,312D. Other operating in<strong>com</strong>e 7,926,197 35,806,312II. Operating charges (167,797,864) (183,807,548)B. Services and other goods (133,671,022) (116,537,566)C. Remuneration, social security costs and pensions (40,580,189) (59,109,038)D. Depreciation of and amounts written off on formation expenses,intangible and tangible fixed assets (5,879,606) (6,520,382)F. Increase (-); decrease (+) in provisions for liabilities and charges 13,226,809 (1,150,728)G. Other operating charges (893,856) (489,834)III. Operating loss (159,871,667) (148,001,236)IV. Financial in<strong>com</strong>e 111,000,792 133,864,195A. In<strong>com</strong>e from financial fixed assets 62,594,834 37,658,336B. In<strong>com</strong>e from current assets 3,950,759 89,382,696C. Other financial in<strong>com</strong>e 44,455,199 6,823,163V. Financial charges (86,443,868) (54,966,383)A. Debt charges (72,452,681) (47,051,697)C. Other financial charges (13,991,187) (7,914,686)VI. Current profit/loss (-) before taxes (135,314,743) (69,103,424)VII. Exceptional in<strong>com</strong>e 24,610,006 64,413D. Gains on disposal of fixed assets 6 64,413E. Other exceptional in<strong>com</strong>e 24,610,000 0VIII. Exceptional charges (50,037,098) (5,191,625,699)A. Exceptional depreciation of and exceptional amounts written offformation expenses, intangible and tangible fixed assets 0 (6,493)B. Amounts written financial fixed assets 0 (5,086,000,000)C. Provisions for exceptional liabilities and charges (49,330,849) (105,619,206)D. Loss on disposal of fixed assets (706,249) 0IX. Profit/loss (-) for the period before taxes (160,741,835) (5,260,664,710)X. In<strong>com</strong>e taxes 66,926,665 72,458,110A. In<strong>com</strong>e taxes 0 (1,396)B. Adjustment of in<strong>com</strong>e taxes and write-back of tax provisions 66,926,665 72,459,506XI. Profit/loss (-) for the period (93,815,170) (5,188,206,600)XIII. Profit/loss (-) to be appropriated (93,815,170) (5,188,206,600)Profit brought forward of the previous period 1,215,112,379 1,121,297,209Profit/loss (-) for the period to be appropriated (93,815,170) (5,188,206,600)Profit/(loss) (-) to be appropriated 1,121,297,209 (4,066,909,391)242 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>

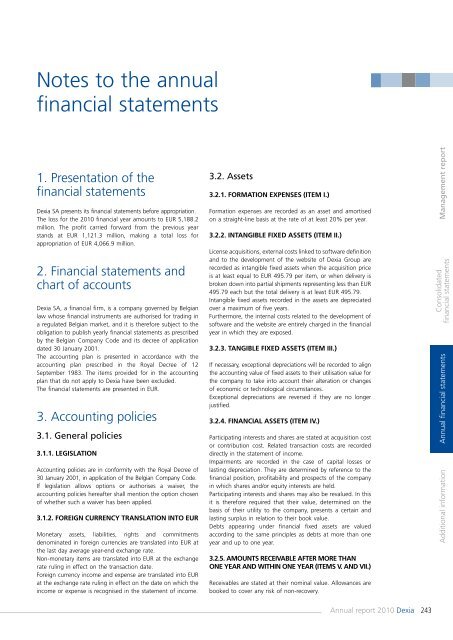

Notes to the annualfinancial statements1. Presentation of thefinancial statements<strong>Dexia</strong> SA presents its financial statements before appropriation.The loss for the <strong>2010</strong> financial year amounts to EUR 5,188.2million. The profit carried forward from the previous yearstands at EUR 1,121.3 million, making a total loss forappropriation of EUR 4,066.9 million.2. Financial statements andchart of accounts<strong>Dexia</strong> SA, a financial firm, is a <strong>com</strong>pany governed by Belgianlaw whose financial instruments are authorised for trading ina regulated Belgian market, and it is therefore subject to theobligation to publish yearly financial statements as prescribedby the Belgian Company Code and its decree of applicationdated 30 January 2001.The accounting plan is presented in accordance with theaccounting plan prescribed in the Royal Decree of 12September 1983. The items provided for in the accountingplan that do not apply to <strong>Dexia</strong> have been excluded.The financial statements are presented in EUR.3. Accounting policies3.1. General policies3.1.1. LEGISLATIONAccounting policies are in conformity with the Royal Decree of30 January 2001, in application of the Belgian Company Code.If legislation allows options or authorises a waiver, theaccounting policies hereafter shall mention the option chosenof whether such a waiver has been applied.3.1.2. FOREIGN CURRENCY TRANSLATION INTO EURMonetary assets, liabilities, rights and <strong>com</strong>mitmentsdenominated in foreign currencies are translated into EUR atthe last day average year-end exchange rate.Non-monetary items are translated into EUR at the exchangerate ruling in effect on the transaction date.Foreign currency in<strong>com</strong>e and expense are translated into EURat the exchange rate ruling in effect on the date on which thein<strong>com</strong>e or expense is recognised in the statement of in<strong>com</strong>e.3.2. Assets3.2.1. FORMATION EXPENSES (ITEM I.)Formation expenses are recorded as an asset and amortisedon a straight-line basis at the rate of at least 20% per year.3.2.2. INTANGIBLE FIXED ASSETS (ITEM II.)License acquisitions, external costs linked to software definitionand to the development of the website of <strong>Dexia</strong> Group arerecorded as intangible fixed assets when the acquisition priceis at least equal to EUR 495.79 per item, or when delivery isbroken down into partial shipments representing less than EUR495.79 each but the total delivery is at least EUR 495.79.Intangible fixed assets recorded in the assets are depreciatedover a maximum of five years.Furthermore, the internal costs related to the development ofsoftware and the website are entirely charged in the financialyear in which they are exposed.3.2.3. TANGIBLE FIXED ASSETS (ITEM III.)If necessary, exceptional depreciations will be recorded to alignthe accounting value of fixed assets to their utilisation value forthe <strong>com</strong>pany to take into account their alteration or changesof economic or technological circumstances.Exceptional depreciations are reversed if they are no longerjustified.3.2.4. FINANCIAL ASSETS (ITEM IV.)Participating interests and shares are stated at acquisition costor contribution cost. Related transaction costs are recordeddirectly in the statement of in<strong>com</strong>e.Impairments are recorded in the case of capital losses orlasting depreciation. They are determined by reference to thefinancial position, profitability and prospects of the <strong>com</strong>panyin which shares and/or equity interests are held.Participating interests and shares may also be revalued. In thisit is therefore required that their value, determined on thebasis of their utility to the <strong>com</strong>pany, presents a certain andlasting surplus in relation to their book value.Debts appearing under financial fixed assets are valuedaccording to the same principles as debts at more than oneyear and up to one year.3.2.5. AMOUNTS RECEIVABLE AFTER MORE THANONE YEAR AND WITHIN ONE YEAR (ITEMS V. AND VII.)Receivables are stated at their nominal value. Allowances arebooked to cover any risk of non-recovery.Management <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statements<strong>Annual</strong> <strong>report</strong> <strong>2010</strong> <strong>Dexia</strong>243

- Page 1:

A n n u a lr e p o r t2 0 1 0

- Page 4 and 5:

4 Group profile8 Message from the c

- Page 6 and 7:

Group profileManagement reportConso

- Page 8 and 9:

Group profileRESULTS Dexia GAAP IFR

- Page 10 and 11:

Message from the ChairmenManagement

- Page 12 and 13:

2010 and early 2011 highlightsManag

- Page 14 and 15:

2010 and early 2011 highlightsDecem

- Page 16 and 17:

Update on the transformation planMa

- Page 18 and 19:

Update on the transformation planMa

- Page 20 and 21:

StrategyManagement reportConsolidat

- Page 22 and 23:

Declaration of corporategovernanceM

- Page 24 and 25:

Declaration of corporate governance

- Page 26 and 27:

Declaration of corporate governance

- Page 28 and 29:

Declaration of corporate governance

- Page 30 and 31:

Declaration of corporate governance

- Page 32 and 33:

Declaration of corporate governance

- Page 34 and 35:

Declaration of corporate governance

- Page 36 and 37:

Declaration of corporate governance

- Page 38 and 39:

Declaration of corporate governance

- Page 40 and 41:

Declaration of corporate governance

- Page 42 and 43:

Declaration of corporate governance

- Page 44 and 45:

Declaration of corporate governance

- Page 46 and 47:

Declaration of corporate governance

- Page 48 and 49:

Declaration of corporate governance

- Page 50 and 51:

Declaration of corporate governance

- Page 52 and 53:

Declaration of corporate governance

- Page 54 and 55:

Declaration of corporate governance

- Page 56 and 57:

Declaration of corporate governance

- Page 58 and 59:

Declaration of corporate governance

- Page 60 and 61:

Declaration of corporate governance

- Page 62 and 63:

Declaration of corporate governance

- Page 64 and 65:

Declaration of corporate governance

- Page 66 and 67:

Declaration of corporate governance

- Page 68 and 69:

Declaration of corporate governance

- Page 70 and 71:

Shareholder informationManagement r

- Page 72 and 73:

Shareholder informationManagement r

- Page 74 and 75:

Human ResourcesMEMBERS OF STAFFGEND

- Page 76 and 77:

Human ResourcesFinally, questions r

- Page 78 and 79:

Sustainable developmentEnergy perfo

- Page 80 and 81:

Risk managementManagement reportCon

- Page 82 and 83:

Risk managementThe Operational Risk

- Page 84 and 85:

Risk managementManagement reportCon

- Page 86 and 87:

Risk managementManagement reportCon

- Page 88 and 89:

Risk managementManagement reportCon

- Page 90 and 91:

Risk managementManagement reportCon

- Page 92 and 93:

Risk managementManagement reportCon

- Page 94 and 95:

Risk managementManagement reportCon

- Page 96 and 97:

Risk managementManagement reportCon

- Page 98 and 99:

Capital managementManagement report

- Page 100 and 101:

Capital managementEconomic capitalE

- Page 102 and 103:

Financial resultsConsolidated state

- Page 104 and 105:

Financial resultsManagement reportC

- Page 106 and 107:

Activity and results of the busines

- Page 108 and 109:

Activity and results of the busines

- Page 110 and 111:

Activity and results of the busines

- Page 112 and 113:

Activity and results of the busines

- Page 114 and 115:

Activity and results of the busines

- Page 116:

Activity and results of the busines

- Page 119 and 120:

C o n s o l i d a t e d f i n a n c

- Page 121 and 122:

Liabilities Note 31/12/09 31/12/10(

- Page 123 and 124:

Consolidated statementof changes in

- Page 125 and 126:

Gains and losses not recognised in

- Page 127 and 128:

Consolidated cash flow statement(in

- Page 129 and 130:

Notes to the consolidated financial

- Page 131 and 132:

Notes to the consolidated financial

- Page 133:

Notes to the consolidated financial

- Page 136 and 137:

Notes to the consolidated financial

- Page 138 and 139:

Notes to the consolidated financial

- Page 140 and 141:

Notes to the consolidated financial

- Page 142:

Notes to the consolidated financial

- Page 145:

Notes to the consolidated financial

- Page 148 and 149:

Notes to the consolidated financial

- Page 151 and 152:

Notes to the consolidated financial

- Page 153 and 154:

Notes to the consolidated financial

- Page 155 and 156:

Notes to the consolidated financial

- Page 157 and 158:

Notes to the consolidated financial

- Page 159 and 160:

Notes to the consolidated financial

- Page 161 and 162:

Notes to the consolidated financial

- Page 163 and 164:

Notes to the consolidated financial

- Page 165 and 166:

Notes to the consolidated financial

- Page 167 and 168:

Notes to the consolidated financial

- Page 169 and 170:

Notes to the consolidated financial

- Page 171 and 172:

Notes to the consolidated financial

- Page 173 and 174:

Notes to the consolidated financial

- Page 175 and 176:

Notes to the consolidated financial

- Page 177 and 178:

Notes to the consolidated financial

- Page 179 and 180:

Notes to the consolidated financial

- Page 181 and 182:

Notes to the consolidated financial

- Page 183 and 184:

Notes to the consolidated financial

- Page 185 and 186:

Notes to the consolidated financial

- Page 187 and 188:

Notes to the consolidated financial

- Page 189 and 190:

Notes to the consolidated financial

- Page 191 and 192:

Notes to the consolidated financial

- Page 193 and 194: Notes to the consolidated financial

- Page 195 and 196: Notes to the consolidated financial

- Page 197 and 198: Notes to the consolidated financial

- Page 199 and 200: Notes to the consolidated financial

- Page 201 and 202: Notes to the consolidated financial

- Page 203 and 204: Notes to the consolidated financial

- Page 205 and 206: Notes to the consolidated financial

- Page 207 and 208: Notes to the consolidated financial

- Page 209 and 210: Notes to the consolidated financial

- Page 211 and 212: Notes to the consolidated financial

- Page 213 and 214: Notes to the consolidated financial

- Page 215 and 216: Notes to the consolidated financial

- Page 217 and 218: Notes to the consolidated financial

- Page 219 and 220: Notes to the consolidated financial

- Page 221 and 222: Notes to the consolidated financial

- Page 223 and 224: Notes to the consolidated financial

- Page 225 and 226: Notes to the consolidated financial

- Page 227 and 228: Notes to the consolidated financial

- Page 229 and 230: Notes to the consolidated financial

- Page 231 and 232: Notes to the consolidated financial

- Page 233 and 234: Notes to the consolidated financial

- Page 235 and 236: Notes to the consolidated financial

- Page 237 and 238: Dexia saStatutory Auditor's reporto

- Page 240 and 241: 240 Balance sheet241 Off-balance-sh

- Page 242 and 243: Balance sheet(before income appropr

- Page 246 and 247: Notes to the annual financial state

- Page 248 and 249: Notes to the annual financial state

- Page 250 and 251: Notes to the annual financial state

- Page 252 and 253: Notes to the annual financial state

- Page 254 and 255: Notes to the annual financial state

- Page 256 and 257: Notes to the annual financial state

- Page 258 and 259: Notes to the annual financial state

- Page 260 and 261: Notes to the annual financial state

- Page 262 and 263: Statutory Auditor's reportManagemen

- Page 264 and 265: Additional informationManagement re

- Page 267 and 268: Photographs: page 8: C. LEBEDINSKY/