Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

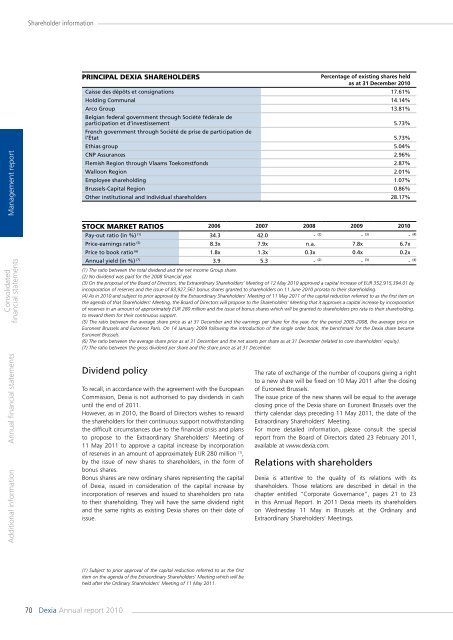

Shareholder informationManagement <strong>report</strong>Consolidatedfinancial statementsPRINCIPAL DEXIA SHAREHOLDERSPercentage of existing shares heldas at 31 December <strong>2010</strong>Caisse des dépôts et consignations 17.61%Holding Communal 14.14%Arco Group 13.81%Belgian federal government through Société fédérale departicipation et d’investissement 5.73%French government through Société de prise de participation del’État 5.73%Ethias group 5.04%CNP Assurances 2.96%Flemish Region through Vlaams Toekomstfonds 2.87%Walloon Region 2.01%Employee shareholding 1.07%Brussels-Capital Region 0.86%Other institutional and individual shareholders 28.17%STOCK MARKET RATIOS 2006 2007 2008 2009 <strong>2010</strong>Pay-out ratio (in %) (1) 34.3 42.0 - (2) - (3) - (4)Price-earnings ratio (5) 8.3x 7.9x n.a. 7.8x 6.7xPrice to book ratio (6) 1.8x 1.3x 0.3x 0.4x 0.2x<strong>Annual</strong> yield (in %) (7) 3.9 5.3 - (2) - (3) - (4)(1) The ratio between the total dividend and the net in<strong>com</strong>e Group share.(2) No dividend was paid for the 2008 financial year.(3) On the proposal of the Board of Directors, the Extraordinary Shareholders’ Meeting of 12 May <strong>2010</strong> approved a capital increase of EUR 352,915,394.01 byincorporation of reserves and the issue of 83,927,561 bonus shares granted to shareholders on 11 June <strong>2010</strong> prorata to their shareholding.(4) As in <strong>2010</strong> and subject to prior approval by the Extraordinary Shareholders’ Meeting of 11 May 2011 of the capital reduction referred to as the first item onthe agenda of that Shareholders’ Meeting, the Board of Directors will propose to the Shareholders’ Meeting that it approves a capital increase by incorporationof reserves in an amount of approximately EUR 280 million and the issue of bonus shares which will be granted to shareholders pro rata to their shareholding,to reward them for their continuous support.(5) The ratio between the average share price as at 31 December and the earnings per share for the year. For the period 2005-2008, the average price onEuronext Brussels and Euronext Paris. On 14 January 2009 following the introduction of the single order book, the benchmark for the <strong>Dexia</strong> share becameEuronext Brussels.(6) The ratio between the average share price as at 31 December and the net assets per share as at 31 December (related to core shareholders’ equity).(7) The ratio between the gross dividend per share and the share price as at 31 December.Additional information <strong>Annual</strong> financial statementsDividend policyTo recall, in accordance with the agreement with the EuropeanCommission, <strong>Dexia</strong> is not authorised to pay dividends in cashuntil the end of 2011.However, as in <strong>2010</strong>, the Board of Directors wishes to rewardthe shareholders for their continuous support notwithstandingthe difficult circumstances due to the financial crisis and plansto propose to the Extraordinary Shareholders’ Meeting of11 May 2011 to approve a capital increase by incorporationof reserves in an amount of approximately EUR 280 million (1) ,by the issue of new shares to shareholders, in the form ofbonus shares.Bonus shares are new ordinary shares representing the capitalof <strong>Dexia</strong>, issued in consideration of the capital increase byincorporation of reserves and issued to shareholders pro ratato their shareholding. They will have the same dividend rightand the same rights as existing <strong>Dexia</strong> shares on their date ofissue.The rate of exchange of the number of coupons giving a rightto a new share will be fixed on 10 May 2011 after the closingof Euronext Brussels.The issue price of the new shares will be equal to the averageclosing price of the <strong>Dexia</strong> share on Euronext Brussels over thethirty calendar days preceding 11 May 2011, the date of theExtraordinary Shareholders’ Meeting.For more detailed information, please consult the special<strong>report</strong> from the Board of Directors dated 23 February 2011,available at www.dexia.<strong>com</strong>.Relations with shareholders<strong>Dexia</strong> is attentive to the quality of its relations with itsshareholders. Those relations are described in detail in thechapter entitled “Corporate Governance”, pages 21 to 23in this <strong>Annual</strong> Report. In 2011 <strong>Dexia</strong> meets its shareholderson Wednesday 11 May in Brussels at the Ordinary andExtraordinary Shareholders’ Meetings.(1) Subject to prior approval of the capital reduction referred to as the firstitem on the agenda of the Extraordinary Shareholders’ Meeting which will beheld after the Ordinary Shareholders’ Meeting of 11 May 2011.70 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>