Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

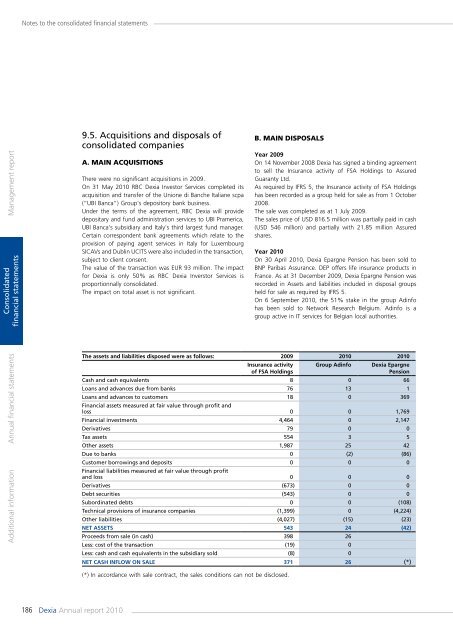

Notes to the consolidated financial statementsManagement <strong>report</strong>Consolidatedfinancial statements9.5. Acquisitions and disposals ofconsolidated <strong>com</strong>paniesA. Main acquisitionsThere were no significant acquisitions in 2009.On 31 May <strong>2010</strong> RBC <strong>Dexia</strong> Investor Services <strong>com</strong>pleted itsacquisition and transfer of the Unione di Banche Italiane scpa(“UBI Banca“) Group's depository bank business.Under the terms of the agreement, RBC <strong>Dexia</strong> will providedepositary and fund administration services to UBI Pramerica,UBI Banca's subsidiary and Italy's third largest fund manager.Certain correspondent bank agreements which relate to theprovision of paying agent services in Italy for LuxembourgSICAVs and Dublin UCITS were also included in the transaction,subject to client consent.The value of the transaction was EUR 93 million. The impactfor <strong>Dexia</strong> is only 50% as RBC <strong>Dexia</strong> Inverstor Services isproportionnally consolidated.The impact on total asset is not significant.B. Main disposalsYear 2009On 14 November 2008 <strong>Dexia</strong> has signed a binding agreementto sell the Insurance activity of FSA Holdings to AssuredGuaranty Ltd.As required by IFRS 5, the Insurance activity of FSA Holdingshas been recorded as a group held for sale as from 1 October2008.The sale was <strong>com</strong>pleted as at 1 July 2009.The sales price of USD 816.5 million was partially paid in cash(USD 546 million) and partially with 21.85 million Assuredshares.Year <strong>2010</strong>On 30 April <strong>2010</strong>, <strong>Dexia</strong> Epargne Pension has been sold toBNP Paribas Assurance. DEP offers life insurance products inFrance. As at 31 December 2009, <strong>Dexia</strong> Epargne Pension wasrecorded in Assets and liabilities included in disposal groupsheld for sale as required by IFRS 5.On 6 September <strong>2010</strong>, the 51% stake in the group Adinfohas been sold to Network Research Belgium. Adinfo is agroup active in IT services for Belgian local authorities.Additional information <strong>Annual</strong> financial statementsThe assets and liabilities disposed were as follows: 2009 <strong>2010</strong> <strong>2010</strong>Insurance activityof FSA HoldingsGroup Adinfo<strong>Dexia</strong> EpargnePensionCash and cash equivalents 8 0 66Loans and advances due from banks 76 13 1Loans and advances to customers 18 0 369Financial assets measured at fair value through profit andloss 0 0 1,769Financial investments 4,464 0 2,147Derivatives 79 0 0Tax assets 554 3 5Other assets 1,987 25 42Due to banks 0 (2) (86)Customer borrowings and deposits 0 0 0Financial liabilities measured at fair value through profitand loss 0 0 0Derivatives (673) 0 0Debt securities (543) 0 0Subordinated debts 0 0 (108)Technical provisions of insurance <strong>com</strong>panies (1,399) 0 (4,224)Other liabilities (4,027) (15) (23)Net assets 543 24 (42)Proceeds from sale (in cash) 398 26Less: cost of the transaction (19) 0Less: cash and cash equivalents in the subsidiary sold (8) 0Net cash inflow on sale 371 26 (*)(*) In accordance with sale contract, the sales conditions can not be disclosed.186 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>