Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

Annual report 2010 - Dexia.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

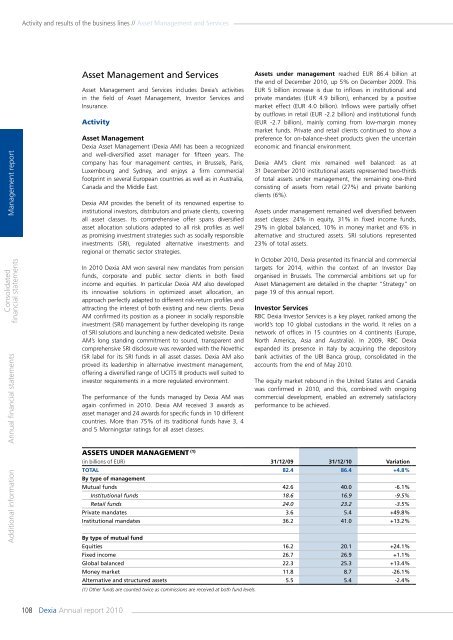

Activity and results of the business lines // Asset Management and ServicesManagement <strong>report</strong>Consolidatedfinancial statementsAdditional information <strong>Annual</strong> financial statementsAsset Management and ServicesAsset Management and Services includes <strong>Dexia</strong>’s activitiesin the field of Asset Management, Investor Services andInsurance.ActivityAsset Management<strong>Dexia</strong> Asset Management (<strong>Dexia</strong> AM) has been a recognizedand well-diversified asset manager for fifteen years. The<strong>com</strong>pany has four management centres, in Brussels, Paris,Luxembourg and Sydney, and enjoys a firm <strong>com</strong>mercialfootprint in several European countries as well as in Australia,Canada and the Middle East.<strong>Dexia</strong> AM provides the benefit of its renowned expertise toinstitutional investors, distributors and private clients, coveringall asset classes. Its <strong>com</strong>prehensive offer spans diversifiedasset allocation solutions adapted to all risk profiles as wellas promising investment strategies such as socially responsibleinvestments (SRI), regulated alternative investments andregional or thematic sector strategies.In <strong>2010</strong> <strong>Dexia</strong> AM won several new mandates from pensionfunds, corporate and public sector clients in both fixedin<strong>com</strong>e and equities. In particular <strong>Dexia</strong> AM also developedits innovative solutions in optimized asset allocation, anapproach perfectly adapted to different risk-return profiles andattracting the interest of both existing and new clients. <strong>Dexia</strong>AM confirmed its position as a pioneer in socially responsibleinvestment (SRI) management by further developing its rangeof SRI solutions and launching a new dedicated website. <strong>Dexia</strong>AM’s long standing <strong>com</strong>mitment to sound, transparent and<strong>com</strong>prehensive SRI disclosure was rewarded with the NovethicISR label for its SRI funds in all asset classes. <strong>Dexia</strong> AM alsoproved its leadership in alternative investment management,offering a diversified range of UCITS III products well suited toinvestor requirements in a more regulated environment.The performance of the funds managed by <strong>Dexia</strong> AM wasagain confirmed in <strong>2010</strong>. <strong>Dexia</strong> AM received 3 awards asasset manager and 24 awards for specific funds in 10 differentcountries. More than 75% of its traditional funds have 3, 4and 5 Morningstar ratings for all asset classes.Assets under management reached EUR 86.4 billion atthe end of December <strong>2010</strong>, up 5% on December 2009. ThisEUR 5 billion increase is due to inflows in institutional andprivate mandates (EUR 4.9 billion), enhanced by a positivemarket effect (EUR 4.0 billion). Inflows were partially offsetby outflows in retail (EUR -2.2 billion) and institutional funds(EUR -2.7 billion), mainly <strong>com</strong>ing from low-margin moneymarket funds. Private and retail clients continued to show apreference for on-balance-sheet products given the uncertaineconomic and financial environment.<strong>Dexia</strong> AM’s client mix remained well balanced: as at31 December <strong>2010</strong> institutional assets represented two-thirdsof total assets under management, the remaining one-thirdconsisting of assets from retail (27%) and private bankingclients (6%).Assets under management remained well diversified betweenasset classes: 24% in equity, 31% in fixed in<strong>com</strong>e funds,29% in global balanced, 10% in money market and 6% inalternative and structured assets. SRI solutions represented23% of total assets.In October <strong>2010</strong>, <strong>Dexia</strong> presented its financial and <strong>com</strong>mercialtargets for 2014, within the context of an Investor Dayorganised in Brussels. The <strong>com</strong>mercial ambitions set up forAsset Management are detailed in the chapter “Strategy” onpage 19 of this annual <strong>report</strong>.Investor ServicesRBC <strong>Dexia</strong> Investor Services is a key player, ranked among theworld’s top 10 global custodians in the world. It relies on anetwork of offices in 15 countries on 4 continents (Europe,North America, Asia and Australia). In 2009, RBC <strong>Dexia</strong>expanded its presence in Italy by acquiring the depositorybank activities of the UBI Banca group, consolidated in theaccounts from the end of May <strong>2010</strong>.The equity market rebound in the United States and Canadawas confirmed in <strong>2010</strong>, and this, <strong>com</strong>bined with ongoing<strong>com</strong>mercial development, enabled an extremely satisfactoryperformance to be achieved.Assets under management (1)(in billions of EUR) 31/12/09 31/12/10 VariationTotal 82.4 86.4 +4.8%By type of managementMutual funds 42.6 40.0 -6.1%Institutional funds 18.6 16.9 -9.5%Retail funds 24.0 23.2 -3.5%Private mandates 3.6 5.4 +49.8%Institutional mandates 36.2 41.0 +13.2%By type of mutual fundEquities 16.2 20.1 +24.1%Fixed in<strong>com</strong>e 26.7 26.9 +1.1%Global balanced 22.3 25.3 +13.4%Money market 11.8 8.7 -26.1%Alternative and structured assets 5.5 5.4 -2.4%(1) Other funds are counted twice as <strong>com</strong>missions are received at both fund levels.108 <strong>Dexia</strong> <strong>Annual</strong> <strong>report</strong> <strong>2010</strong>