Kingscote Airport Business Case Appendices - Kangaroo Island ...

Kingscote Airport Business Case Appendices - Kangaroo Island ...

Kingscote Airport Business Case Appendices - Kangaroo Island ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

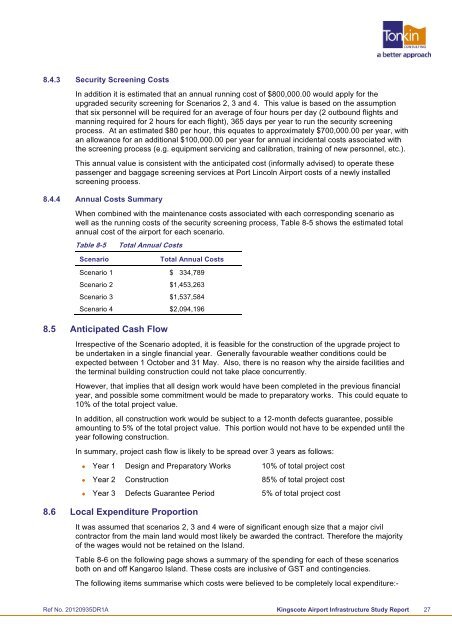

8.4.3 Security Screening CostsIn addition it is estimated that an annual running cost of $800,000.00 would apply for theupgraded security screening for Scenarios 2, 3 and 4. This value is based on the assumptionthat six personnel will be required for an average of four hours per day (2 outbound flights andmanning required for 2 hours for each flight), 365 days per year to run the security screeningprocess. At an estimated $80 per hour, this equates to approximately $700,000.00 per year, withan allowance for an additional $100,000.00 per year for annual incidental costs associated withthe screening process (e.g. equipment servicing and calibration, training of new personnel, etc.).This annual value is consistent with the anticipated cost (informally advised) to operate thesepassenger and baggage screening services at Port Lincoln <strong>Airport</strong> costs of a newly installedscreening process.8.4.4 Annual Costs SummaryWhen combined with the maintenance costs associated with each corresponding scenario aswell as the running costs of the security screening process, Table 8-5 shows the estimated totalannual cost of the airport for each scenario.Table 8-5Total Annual CostsScenarioTotal Annual CostsScenario 1 $ 334,789Scenario 2 $1,453,263Scenario 3 $1,537,584Scenario 4 $2,094,1968.5 Anticipated Cash FlowIrrespective of the Scenario adopted, it is feasible for the construction of the upgrade project tobe undertaken in a single financial year. Generally favourable weather conditions could beexpected between 1 October and 31 May. Also, there is no reason why the airside facilities andthe terminal building construction could not take place concurrently.However, that implies that all design work would have been completed in the previous financialyear, and possible some commitment would be made to preparatory works. This could equate to10% of the total project value.In addition, all construction work would be subject to a 12-month defects guarantee, possibleamounting to 5% of the total project value. This portion would not have to be expended until theyear following construction.In summary, project cash flow is likely to be spread over 3 years as follows: Year 1 Design and Preparatory Works 10% of total project cost Year 2 Construction 85% of total project cost Year 3 Defects Guarantee Period 5% of total project cost8.6 Local Expenditure ProportionIt was assumed that scenarios 2, 3 and 4 were of significant enough size that a major civilcontractor from the main land would most likely be awarded the contract. Therefore the majorityof the wages would not be retained on the <strong>Island</strong>.Table 8-6 on the following page shows a summary of the spending for each of these scenariosboth on and off <strong>Kangaroo</strong> <strong>Island</strong>. These costs are inclusive of GST and contingencies.The following items summarise which costs were believed to be completely local expenditure:-Ref No. 20120935DR1A <strong>Kingscote</strong> <strong>Airport</strong> Infrastructure Study Report 27