The Rainforests of Cameroon - PROFOR

The Rainforests of Cameroon - PROFOR

The Rainforests of Cameroon - PROFOR

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

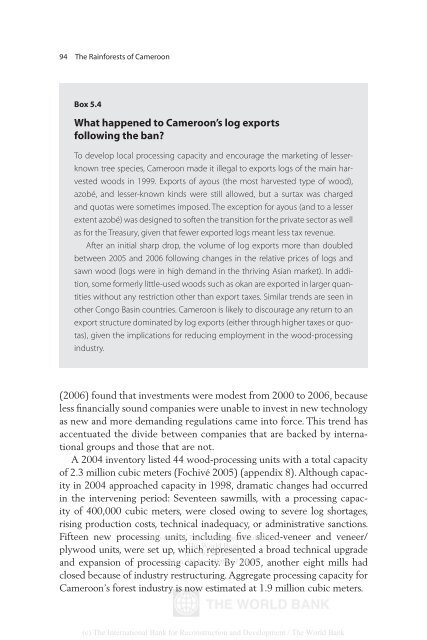

94 <strong>The</strong> <strong>Rainforests</strong> <strong>of</strong> <strong>Cameroon</strong>Box 5.4What happened to <strong>Cameroon</strong>’s log exportsfollowing the ban?To develop local processing capacity and encourage the marketing <strong>of</strong> lesserknowntree species, <strong>Cameroon</strong> made it illegal to exports logs <strong>of</strong> the main harvestedwoods in 1999. Exports <strong>of</strong> ayous (the most harvested type <strong>of</strong> wood),azobé, and lesser-known kinds were still allowed, but a surtax was chargedand quotas were sometimes imposed. <strong>The</strong> exception for ayous (and to a lesserextent azobé) was designed to s<strong>of</strong>ten the transition for the private sector as wellas for the Treasury, given that fewer exported logs meant less tax revenue.After an initial sharp drop, the volume <strong>of</strong> log exports more than doubledbetween 2005 and 2006 following changes in the relative prices <strong>of</strong> logs andsawn wood (logs were in high demand in the thriving Asian market). In addition,some formerly little-used woods such as okan are exported in larger quantitieswithout any restriction other than export taxes. Similar trends are seen inother Congo Basin countries. <strong>Cameroon</strong> is likely to discourage any return to anexport structure dominated by log exports (either through higher taxes or quotas),given the implications for reducing employment in the wood-processingindustry.(2006) found that investments were modest from 2000 to 2006, becauseless financially sound companies were unable to invest in new technologyas new and more demanding regulations came into force. This trend hasaccentuated the divide between companies that are backed by internationalgroups and those that are not.A 2004 inventory listed 44 wood-processing units with a total capacity<strong>of</strong> 2.3 million cubic meters (Fochivé 2005) (appendix 8). Although capacityin 2004 approached capacity in 1998, dramatic changes had occurredin the intervening period: Seventeen sawmills, with a processing capacity<strong>of</strong> 400,000 cubic meters, were closed owing to severe log shortages,rising production costs, technical inadequacy, or administrative sanctions.Fifteen new processing Delivered units, by <strong>The</strong> including World Bank five e-library sliced-veneer to: and veneer/<strong>The</strong> World Bankplywood units, were set up, which IP : 192.86.100.34 represented a broad technical upgradeand expansion <strong>of</strong> processing Mon, capacity. 09 Nov 2009 By 17:06:18 2005, another eight mills hadclosed because <strong>of</strong> industry restructuring. Aggregate processing capacity for<strong>Cameroon</strong>’s forest industry is now estimated at 1.9 million cubic meters.(c) <strong>The</strong> International Bank for Reconstruction and Development / <strong>The</strong> World Bank