The Rainforests of Cameroon - PROFOR

The Rainforests of Cameroon - PROFOR

The Rainforests of Cameroon - PROFOR

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

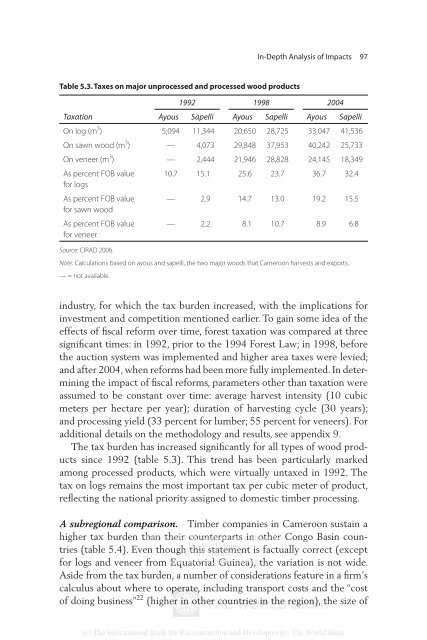

In-Depth Analysis <strong>of</strong> Impacts 97Table 5.3. Taxes on major unprocessed and processed wood products1992 1998 2004TaxationAyous Sapelli Ayous Sapelli Ayous SapelliOn log (m 3 ) 5,094 11,344 20,650 28,725 33,047 41,536On sawn wood (m 3 ) — 4,073 29,848 37,953 40,242 25,733On veneer (m 3 ) — 2,444 21,946 28,828 24,145 18,349As percent FOB value 10.7 15.1 25.6 23.7 36.7 32.4for logsAs percent FOB value — 2.9 14.7 13.0 19.2 15.5for sawn woodAs percent FOB valuefor veneer— 2.2 8.1 10.7 8.9 6.8Source: CIRAD 2006.Note: Calculations based on ayous and sapelli, the two major woods that <strong>Cameroon</strong> harvests and exports.— = not available.industry, for which the tax burden increased, with the implications forinvestment and competition mentioned earlier. To gain some idea <strong>of</strong> theeffects <strong>of</strong> fiscal reform over time, forest taxation was compared at threesignificant times: in 1992, prior to the 1994 Forest Law; in 1998, beforethe auction system was implemented and higher area taxes were levied;and after 2004, when reforms had been more fully implemented. In determiningthe impact <strong>of</strong> fiscal reforms, parameters other than taxation wereassumed to be constant over time: average harvest intensity (10 cubicmeters per hectare per year); duration <strong>of</strong> harvesting cycle (30 years);and processing yield (33 percent for lumber; 55 percent for veneers). Foradditional details on the methodology and results, see appendix 9.<strong>The</strong> tax burden has increased significantly for all types <strong>of</strong> wood productssince 1992 (table 5.3). This trend has been particularly markedamong processed products, which were virtually untaxed in 1992. <strong>The</strong>tax on logs remains the most important tax per cubic meter <strong>of</strong> product,reflecting the national priority assigned to domestic timber processing.A subregional comparison. Timber companies in <strong>Cameroon</strong> sustain ahigher tax burden than Delivered their by counterparts <strong>The</strong> World Bank e-library in other to: Congo Basin countries(table 5.4). Even though IP this : 192.86.100.34 statement is factually correct (except<strong>The</strong> World Bankfor logs and veneer from Mon, Equatorial 09 Nov 2009 Guinea), 17:06:18the variation is not wide.Aside from the tax burden, a number <strong>of</strong> considerations feature in a firm’scalculus about where to operate, including transport costs and the “cost<strong>of</strong> doing business” 22 (higher in other countries in the region), the size <strong>of</strong>(c) <strong>The</strong> International Bank for Reconstruction and Development / <strong>The</strong> World Bank