Filing at a Glance General Information - Delaware Insurance ...

Filing at a Glance General Information - Delaware Insurance ...

Filing at a Glance General Information - Delaware Insurance ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ALLSTATE INDEMNITY COMPANY<br />

VOLUNTARY PRIVATE PASSENGER AUTOMOBILE<br />

DELAWARE<br />

FORMULA CALCULATIONS FOR RATE LEVEL INDICATIONS<br />

Attachment II<br />

Page 1<br />

The d<strong>at</strong>a used in the calcul<strong>at</strong>ion of the r<strong>at</strong>e level indic<strong>at</strong>ion was selected in accordance with the<br />

consider<strong>at</strong>ions listed in Section 3.2 of Actuarial Standard of Practice No. 23, D<strong>at</strong>a Quality. The<br />

calcul<strong>at</strong>ion of the r<strong>at</strong>e level indic<strong>at</strong>ion is consistent with the St<strong>at</strong>ement of Principles Regarding<br />

Property and Casualty <strong>Insurance</strong> R<strong>at</strong>emaking.<br />

A r<strong>at</strong>e level indic<strong>at</strong>ion is a test of the adequacy of expected revenues versus expected costs<br />

during the future policy period. Therefore, to derive the indic<strong>at</strong>ed r<strong>at</strong>e level need accur<strong>at</strong>ely,<br />

Allst<strong>at</strong>e's historical premium and loss experience needs to be adjusted. In accordance with<br />

Section 3.1 of Actuarial Standard of Practice No. 13, Trending Procedures in Property/Casualty<br />

<strong>Insurance</strong> R<strong>at</strong>emaking, Allst<strong>at</strong>e trends the underlying historical experience for premiums, losses,<br />

and fixed expenses to appropri<strong>at</strong>ely reflect historical and projected changes in these components<br />

of the r<strong>at</strong>e level indic<strong>at</strong>ions. In addition, historical premiums must be adjusted to reflect the<br />

current r<strong>at</strong>e level; and historical losses must be adjusted to reflect expected development over<br />

time and to smooth the actual losses due to c<strong>at</strong>astrophes. Details of these necessary adjustments<br />

to the historical d<strong>at</strong>a used in the r<strong>at</strong>e level indic<strong>at</strong>ion are described in this memorandum. The<br />

adjustments have been applied to <strong>Delaware</strong>’s premium and loss experience in deriving the<br />

indic<strong>at</strong>ed r<strong>at</strong>e level changes by coverage.<br />

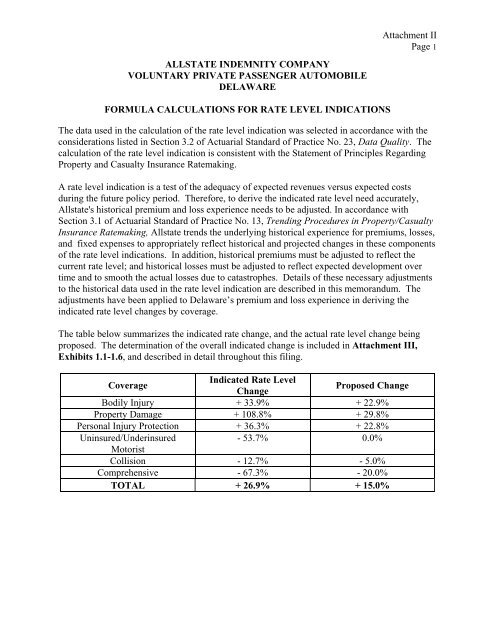

The table below summarizes the indic<strong>at</strong>ed r<strong>at</strong>e change, and the actual r<strong>at</strong>e level change being<br />

proposed. The determin<strong>at</strong>ion of the overall indic<strong>at</strong>ed change is included in Attachment III,<br />

Exhibits 1.1-1.6, and described in detail throughout this filing.<br />

Coverage<br />

Indic<strong>at</strong>ed R<strong>at</strong>e Level<br />

Change<br />

Proposed Change<br />

Bodily Injury + 33.9% + 22.9%<br />

Property Damage + 108.8% + 29.8%<br />

Personal Injury Protection + 36.3% + 22.8%<br />

Uninsured/Underinsured<br />

Motorist<br />

- 53.7% 0.0%<br />

Collision - 12.7% - 5.0%<br />

Comprehensive - 67.3% - 20.0%<br />

TOTAL + 26.9% + 15.0%