European Journal of Scientific Research - EuroJournals

European Journal of Scientific Research - EuroJournals

European Journal of Scientific Research - EuroJournals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

299 Ilhan Meric, Charles W. McCall and Gulser Meric<br />

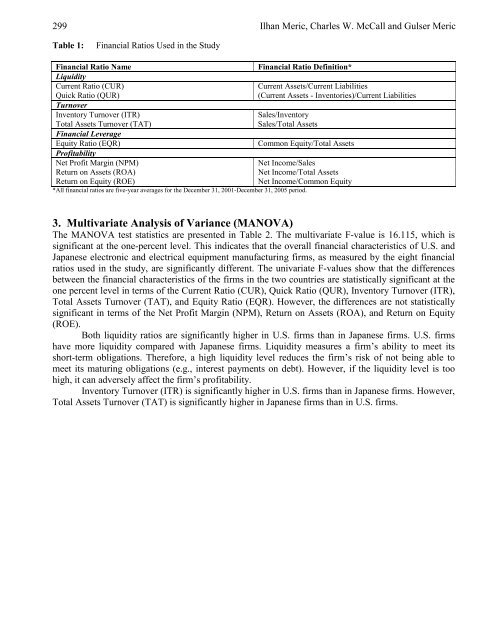

Table 1: Financial Ratios Used in the Study<br />

Financial Ratio Name Financial Ratio Definition*<br />

Liquidity<br />

Current Ratio (CUR) Current Assets/Current Liabilities<br />

Quick Ratio (QUR) (Current Assets - Inventories)/Current Liabilities<br />

Turnover<br />

Inventory Turnover (ITR) Sales/Inventory<br />

Total Assets Turnover (TAT) Sales/Total Assets<br />

Financial Leverage<br />

Equity Ratio (EQR) Common Equity/Total Assets<br />

Pr<strong>of</strong>itability<br />

Net Pr<strong>of</strong>it Margin (NPM) Net Income/Sales<br />

Return on Assets (ROA) Net Income/Total Assets<br />

Return on Equity (ROE) Net Income/Common Equity<br />

*All financial ratios are five-year averages for the December 31, 2001-December 31, 2005 period.<br />

3. Multivariate Analysis <strong>of</strong> Variance (MANOVA)<br />

The MANOVA test statistics are presented in Table 2. The multivariate F-value is 16.115, which is<br />

significant at the one-percent level. This indicates that the overall financial characteristics <strong>of</strong> U.S. and<br />

Japanese electronic and electrical equipment manufacturing firms, as measured by the eight financial<br />

ratios used in the study, are significantly different. The univariate F-values show that the differences<br />

between the financial characteristics <strong>of</strong> the firms in the two countries are statistically significant at the<br />

one percent level in terms <strong>of</strong> the Current Ratio (CUR), Quick Ratio (QUR), Inventory Turnover (ITR),<br />

Total Assets Turnover (TAT), and Equity Ratio (EQR). However, the differences are not statistically<br />

significant in terms <strong>of</strong> the Net Pr<strong>of</strong>it Margin (NPM), Return on Assets (ROA), and Return on Equity<br />

(ROE).<br />

Both liquidity ratios are significantly higher in U.S. firms than in Japanese firms. U.S. firms<br />

have more liquidity compared with Japanese firms. Liquidity measures a firm’s ability to meet its<br />

short-term obligations. Therefore, a high liquidity level reduces the firm’s risk <strong>of</strong> not being able to<br />

meet its maturing obligations (e.g., interest payments on debt). However, if the liquidity level is too<br />

high, it can adversely affect the firm’s pr<strong>of</strong>itability.<br />

Inventory Turnover (ITR) is significantly higher in U.S. firms than in Japanese firms. However,<br />

Total Assets Turnover (TAT) is significantly higher in Japanese firms than in U.S. firms.