Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8. Intangible assets – cont<strong>in</strong>ued<br />

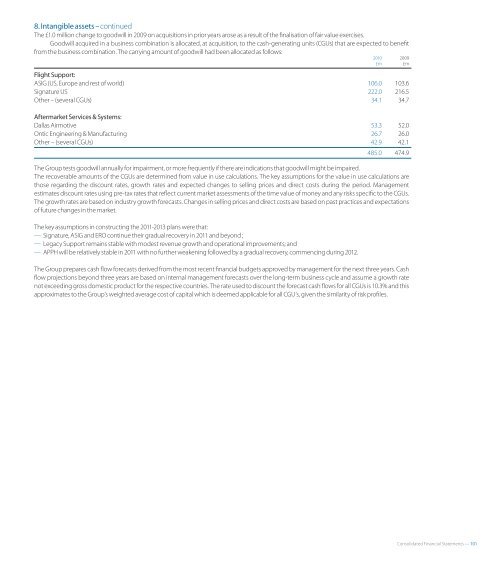

The £1.0 million change to goodwill <strong>in</strong> 2009 on acquisitions <strong>in</strong> prior years arose as a result of the fnalisation of fair value exercises.<br />

Goodwill acquired <strong>in</strong> a bus<strong>in</strong>ess comb<strong>in</strong>ation is allocated, at acquisition, to the cash-generat<strong>in</strong>g units (CGUs) that are expected to beneft<br />

from the bus<strong>in</strong>ess comb<strong>in</strong>ation. The carry<strong>in</strong>g amount of goodwill had been allocated as follows:<br />

<strong>2010</strong> 2009<br />

£m £m<br />

Flight Support:<br />

ASIG (US, Europe and rest of world) 106.0 103.6<br />

Signature US 222.0 216.5<br />

Other – (several CGUs) 34.1 34.7<br />

Aftermarket Services & Systems:<br />

Dallas Airmotive 53.3 52.0<br />

Ontic Eng<strong>in</strong>eer<strong>in</strong>g & Manufactur<strong>in</strong>g 26.7 26.0<br />

Other – (several CGUs) 42.9 42.1<br />

485.0 474.9<br />

The Group tests goodwill annually for impairment, or more frequently if there are <strong>in</strong>dications that goodwill might be impaired.<br />

The recoverable amounts of the CGUs are determ<strong>in</strong>ed from value <strong>in</strong> use calculations. The key assumptions for the value <strong>in</strong> use calculations are<br />

those regard<strong>in</strong>g the discount rates, growth rates and expected changes to sell<strong>in</strong>g prices and direct costs dur<strong>in</strong>g the period. Management<br />

estimates discount rates us<strong>in</strong>g pre-tax rates that refect current market assessments of the time value of money and any risks specifc to the CGUs.<br />

The growth rates are based on <strong>in</strong>dustry growth forecasts. Changes <strong>in</strong> sell<strong>in</strong>g prices and direct costs are based on past practices and expectations<br />

of future changes <strong>in</strong> the market.<br />

The key assumptions <strong>in</strong> construct<strong>in</strong>g the 2011-2013 plans were that:<br />

— Signature, ASIG and ERO cont<strong>in</strong>ue their gradual recovery <strong>in</strong> 2011 and beyond ;<br />

— Legacy Support rema<strong>in</strong>s stable with modest revenue growth and operational improvements; and<br />

— APPH will be relatively stable <strong>in</strong> 2011 with no further weaken<strong>in</strong>g followed by a gradual recovery, commenc<strong>in</strong>g dur<strong>in</strong>g 2012.<br />

The Group prepares cash fow forecasts derived from the most recent fnancial budgets approved by management for the next three years. Cash<br />

fow projections beyond three years are based on <strong>in</strong>ternal management forecasts over the long-term bus<strong>in</strong>ess cycle and assume a growth rate<br />

not exceed<strong>in</strong>g gross domestic product for the respective countries. The rate used to discount the forecast cash fows for all CGUs is 10.3% and this<br />

approximates to the Group’s weighted average cost of capital which is deemed applicable for all CGU’s, given the similarity of risk prof les.<br />

Consolidated F<strong>in</strong>ancial Statements — 101