Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

17. Derivative fnancial <strong>in</strong>struments – cont<strong>in</strong>ued<br />

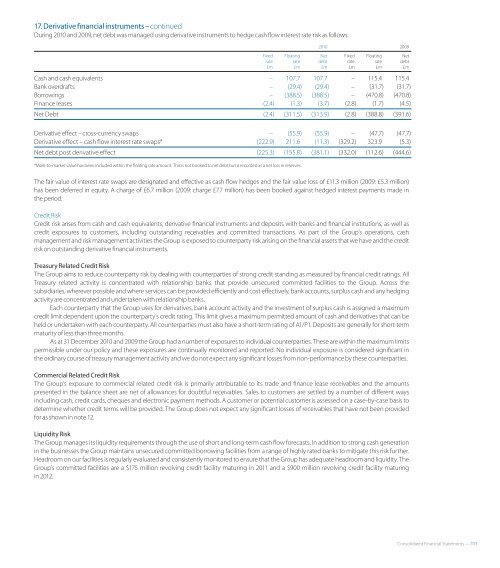

Dur<strong>in</strong>g <strong>2010</strong> and 2009, net debt was managed us<strong>in</strong>g derivative <strong>in</strong>struments to hedge cash fow <strong>in</strong>terest rate risk as follows:<br />

Fixed<br />

rate<br />

£m<br />

Float<strong>in</strong>g<br />

rate<br />

£m<br />

<strong>2010</strong> 2009<br />

Cash and cash equivalents – 107.7 107.7 – 115.4 115.4<br />

Bank overdrafts – (29.4) (29.4) – (31.7) (31.7)<br />

Borrow<strong>in</strong>gs – (388.5) (388.5) – (470.8) (470.8)<br />

F<strong>in</strong>ance leases (2.4) (1.3) (3.7) (2.8) (1.7) (4.5)<br />

Net Debt (2.4) (311.5) (313.9) (2.8) (388.8) (391.6)<br />

Derivative effect – cross-currency swaps – (55.9) (55.9) – (47.7) (47.7)<br />

Derivative effect – cash flow <strong>in</strong>terest rate swaps* (222.9) 211.6 (11.3) (329.2) 323.9 (5.3)<br />

Net debt post derivative effect (225.3) (155.8) (381.1) (332.0) (112.6) (444.6)<br />

*Mark-to-market value has been <strong>in</strong>cluded with<strong>in</strong> the foat<strong>in</strong>g rate amount. This is not booked to net debt but is recorded as a net loss <strong>in</strong> reserves.<br />

The fair value of <strong>in</strong>terest rate swaps are designated and efective as cash fow hedges and the fair value loss of £11.3 million (2009: £5.3 million)<br />

has been deferred <strong>in</strong> equity. A charge of £6.7 million (2009: charge £7.7 million) has been booked aga<strong>in</strong>st hedged <strong>in</strong>terest payments made <strong>in</strong><br />

the period.<br />

Credit Risk<br />

Credit risk arises from cash and cash equivalents, derivative fnancial <strong>in</strong>struments and deposits with banks and fnancial <strong>in</strong>stitutions, as well as<br />

credit exposures to customers, <strong>in</strong>clud<strong>in</strong>g outstand<strong>in</strong>g receivables and committed transactions. As part of the Group’s operations, cash<br />

management and risk management activities the Group is exposed to counterparty risk aris<strong>in</strong>g on the fnancial assets that we have and the credit<br />

risk on outstand<strong>in</strong>g derivative f nancial <strong>in</strong>struments.<br />

Treasury Related Credit Risk<br />

The Group aims to reduce counterparty risk by deal<strong>in</strong>g with counterparties of strong credit stand<strong>in</strong>g as measured by fnancial credit rat<strong>in</strong>gs. All<br />

Treasury related activity is concentrated with relationship banks that provide unsecured committed facilities to the Group. Across the<br />

subsidiaries, wherever possible and where services can be provided efciently and cost efectively, bank accounts, surplus cash and any hedg<strong>in</strong>g<br />

activity are concentrated and undertaken with relationship banks.<br />

Each counterparty that the Group uses for derivatives, bank account activity and the <strong>in</strong>vestment of surplus cash is assigned a maximum<br />

credit limit dependent upon the counterparty’s credit rat<strong>in</strong>g. This limit gives a maximum permitted amount of cash and derivatives that can be<br />

held or undertaken with each counterparty. All counterparties must also have a short-term rat<strong>in</strong>g of A1/P1. Deposits are generally for short-term<br />

maturity of less than three months.<br />

As at 31 December <strong>2010</strong> and 2009 the Group had a number of exposures to <strong>in</strong>dividual counterparties. These are with<strong>in</strong> the maximum limits<br />

permissible under our policy and these exposures are cont<strong>in</strong>ually monitored and reported. No <strong>in</strong>dividual exposure is considered signif cant <strong>in</strong><br />

the ord<strong>in</strong>ary course of treasury management activity and we do not expect any signifcant losses from non-performance by these counterparties.<br />

Commercial Related Credit Risk<br />

The Group’s exposure to commercial related credit risk is primarily attributable to its trade and fnance lease receivables and the amounts<br />

presented <strong>in</strong> the balance sheet are net of allowances for doubtful receivables. Sales to customers are settled by a number of dif erent ways<br />

<strong>in</strong>clud<strong>in</strong>g cash, credit cards, cheques and electronic payment methods. A customer or potential customer is assessed on a case-by-case basis to<br />

determ<strong>in</strong>e whether credit terms will be provided. The Group does not expect any signifcant losses of receivables that have not been provided<br />

for as shown <strong>in</strong> note 12.<br />

Liquidity Risk<br />

The Group manages its liquidity requirements through the use of short and long-term cash fow forecasts. In addition to strong cash generation<br />

<strong>in</strong> the bus<strong>in</strong>esses the Group ma<strong>in</strong>ta<strong>in</strong>s unsecured committed borrow<strong>in</strong>g facilities from a range of highly rated banks to mitigate this risk further.<br />

Headroom on our facilities is regularly evaluated and consistently monitored to ensure that the Group has adequate headroom and liquidity. The<br />

Group’s committed facilities are a $175 million revolv<strong>in</strong>g credit facility matur<strong>in</strong>g <strong>in</strong> 2011 and a $900 million revolv<strong>in</strong>g credit facility matur<strong>in</strong>g<br />

<strong>in</strong> 2012.<br />

Net<br />

debt<br />

£m<br />

Fixed<br />

rate<br />

£m<br />

Float<strong>in</strong>g<br />

rate<br />

£m<br />

Net<br />

debt<br />

£m<br />

Consolidated F<strong>in</strong>ancial Statements — 111