Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ancial statements Notes to the Consolidated F<strong>in</strong>ancial Statements – cont<strong>in</strong>ued<br />

85 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Consolidated<br />

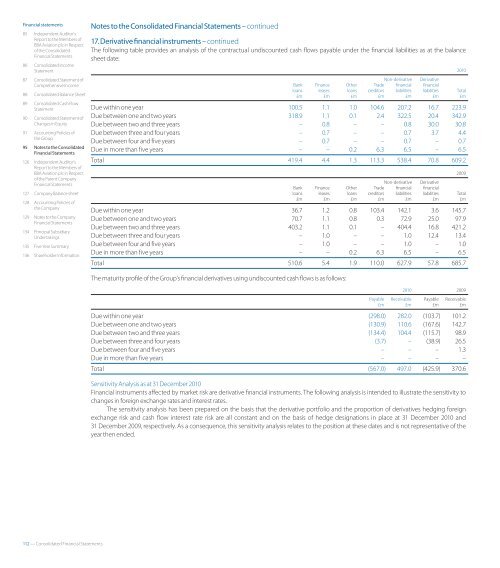

17. Derivative fnancial <strong>in</strong>struments – cont<strong>in</strong>ued<br />

The follow<strong>in</strong>g table provides an analysis of the contractual undiscounted cash fows payable under the fnancial liabilities as at the balance<br />

F<strong>in</strong>ancial Statements<br />

sheet date:<br />

86 Consolidated Income<br />

Statement <strong>2010</strong><br />

87 Consolidated Statement of Non-derivative Derivative<br />

Comprehensive Income Bank F<strong>in</strong>ance Other Trade f<strong>in</strong>ancial f<strong>in</strong>ancial<br />

88 Consolidated Balance Sheet<br />

loans<br />

£m<br />

leases<br />

£m<br />

loans<br />

£m<br />

creditors<br />

£m<br />

liabilities<br />

£m<br />

liabilities<br />

£m<br />

Total<br />

£m<br />

89 Consolidated Cash Flow<br />

Statement Due with<strong>in</strong> one year 100.5 1.1 1.0 104.6 207.2 16.7 223.9<br />

90 Consolidated Statement of<br />

Changes <strong>in</strong> Equity<br />

Due between one and two years<br />

Due between two and three years<br />

318.9<br />

–<br />

1.1<br />

0.8<br />

0.1<br />

–<br />

2.4<br />

–<br />

322.5<br />

0.8<br />

20.4<br />

30.0<br />

342.9<br />

30.8<br />

91 Account<strong>in</strong>g Policies of Due between three and four years – 0.7 – – 0.7 3.7 4.4<br />

the Group<br />

Due between four and five years – 0.7 – – 0.7 – 0.7<br />

95 Notes to the Consolidated<br />

F<strong>in</strong>ancial Statements<br />

Due <strong>in</strong> more than five years – – 0.2 6.3 6.5 – 6.5<br />

126<br />

129<br />

134<br />

135<br />

136<br />

Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Parent Company<br />

F<strong>in</strong>ancial Statements<br />

127 Company Balance sheet<br />

128 Account<strong>in</strong>g Policies of<br />

the Company<br />

Notes to the Company<br />

F<strong>in</strong>ancial Statements<br />

Pr<strong>in</strong>cipal Subsidiary<br />

Undertak<strong>in</strong>gs<br />

Five Year Summary<br />

Shareholder Information<br />

Total<br />

112 — Consolidated F<strong>in</strong>ancial Statements<br />

Due with<strong>in</strong> one year<br />

Due between one and two years<br />

Due between two and three years<br />

Due between three and four years<br />

Due between four and five years<br />

Due <strong>in</strong> more than five years<br />

419.4<br />

Bank<br />

loans<br />

£m<br />

36.7<br />

70.7<br />

403.2<br />

–<br />

–<br />

–<br />

4.4<br />

F<strong>in</strong>ance<br />

leases<br />

£m<br />

1.2<br />

1.1<br />

1.1<br />

1.0<br />

1.0<br />

–<br />

1.3<br />

Other<br />

loans<br />

£m<br />

0.8<br />

0.8<br />

0.1<br />

–<br />

–<br />

0.2<br />

113.3 538.4<br />

Non-derivative<br />

Trade fnancial<br />

creditors liabilities<br />

£m £m<br />

103.4 142.1<br />

0.3 72.9<br />

– 404.4<br />

– 1.0<br />

– 1.0<br />

6.3 6.5<br />

70.8<br />

Derivative<br />

fnancial<br />

liabilities<br />

£m<br />

Total 510.6 5.4 1.9 110.0 627.9 57.8 685.7<br />

The maturity profle of the Group’s fnancial derivatives us<strong>in</strong>g undiscounted cash fows is as follows:<br />

Payable<br />

£m<br />

Receivable<br />

£m<br />

3.6<br />

25.0<br />

16.8<br />

12.4<br />

–<br />

–<br />

609.2<br />

2009<br />

Total<br />

£m<br />

145.7<br />

97.9<br />

421.2<br />

13.4<br />

1.0<br />

6.5<br />

<strong>2010</strong> 2009<br />

Payable<br />

£m<br />

Receivable<br />

£m<br />

Due with<strong>in</strong> one year (298.0) 282.0 (103.7) 101.2<br />

Due between one and two years (130.9) 110.6 (167.6) 142.7<br />

Due between two and three years (134.4) 104.4 (115.7) 98.9<br />

Due between three and four years (3.7) – (38.9) 26.5<br />

Due between four and five years – – – 1.3<br />

Due <strong>in</strong> more than five years – – – –<br />

Total (567.0) 497.0 (425.9) 370.6<br />

Sensitivity Analysis as at 31 December <strong>2010</strong><br />

F<strong>in</strong>ancial <strong>in</strong>struments afected by market risk are derivative fnancial <strong>in</strong>struments. The follow<strong>in</strong>g analysis is <strong>in</strong>tended to illustrate the sensitivity to<br />

changes <strong>in</strong> foreign exchange rates and <strong>in</strong>terest rates.<br />

The sensitivity analysis has been prepared on the basis that the derivative portfolio and the proportion of derivatives hedg<strong>in</strong>g foreign<br />

exchange risk and cash fow <strong>in</strong>terest rate risk are all constant and on the basis of hedge designations <strong>in</strong> place at 31 December <strong>2010</strong> and<br />

31 December 2009, respectively. As a consequence, this sensitivity analysis relates to the position at these dates and is not representative of the<br />

year then ended.