Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F<strong>in</strong>ancial statements Notes to the Consolidated F<strong>in</strong>ancial Statements – cont<strong>in</strong>ued<br />

85 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Consolidated<br />

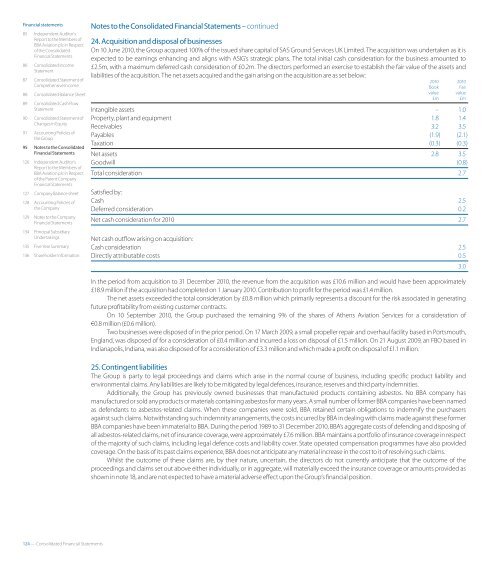

24. Acquisition and disposal of bus<strong>in</strong>esses<br />

On 10 June <strong>2010</strong>, the Group acquired 100% of the issued share capital of SAS Ground Services UK Limited. The acquisition was undertaken as it is<br />

F<strong>in</strong>ancial Statements<br />

expected to be earn<strong>in</strong>gs enhanc<strong>in</strong>g and aligns with ASIG’s strategic plans. The total <strong>in</strong>itial cash consideration for the bus<strong>in</strong>ess amounted to<br />

86 Consolidated Income<br />

Statement<br />

£2.5m, with a maximum deferred cash consideration of £0.2m. The directors performed an exercise to establish the fair value of the assets and<br />

liabilities of the acquisition. The net assets acquired and the ga<strong>in</strong> aris<strong>in</strong>g on the acquisition are as set below:<br />

87 Consolidated Statement of<br />

Comprehensive Income<br />

<strong>2010</strong><br />

Book<br />

88 Consolidated Balance Sheet<br />

value<br />

£m<br />

89 Consolidated Cash Flow<br />

Statement Intangible assets – 1.0<br />

90 Consolidated Statement of Property, plant and equipment 1.8 1.4<br />

Changes <strong>in</strong> Equity<br />

Receivables 3.2 3.5<br />

91<br />

95<br />

Account<strong>in</strong>g Policies of<br />

the Group<br />

Notes to the Consolidated<br />

Payables<br />

Taxation<br />

(1.9)<br />

(0.3)<br />

(2.1)<br />

(0.3)<br />

F<strong>in</strong>ancial Statements Net assets 2.8 3.5<br />

126 Independent Auditor’s Goodwill (0.8)<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect Total<br />

of the Parent Company<br />

F<strong>in</strong>ancial Statements<br />

consideration 2.7<br />

127 Company Balance sheet Satisfied by:<br />

128 Account<strong>in</strong>g Policies of Cash 2.5<br />

the Company Deferred consideration 0.2<br />

129 Notes to the Company<br />

Net cash consideration for <strong>2010</strong> 2.7<br />

F<strong>in</strong>ancial Statements<br />

134 Pr<strong>in</strong>cipal Subsidiary<br />

Undertak<strong>in</strong>gs Net cash outflow aris<strong>in</strong>g on acquisition:<br />

135 Five Year Summary Cash consideration 2.5<br />

136 Shareholder Information Directly attributable costs 0.5<br />

3.0<br />

124 — Consolidated F<strong>in</strong>ancial Statements<br />

In the period from acquisition to 31 December <strong>2010</strong>, the revenue from the acquisition was £10.6 million and would have been approximately<br />

£18.9 million if the acquisition had completed on 1 January <strong>2010</strong>. Contribution to proft for the period was £1.4 million.<br />

The net assets exceeded the total consideration by £0.8 million which primarily represents a discount for the risk associated <strong>in</strong> generat<strong>in</strong>g<br />

future proftability from exist<strong>in</strong>g customer contracts.<br />

On 10 September <strong>2010</strong>, the Group purchased the rema<strong>in</strong><strong>in</strong>g 9% of the shares of Athens <strong>Aviation</strong> Services for a consideration of<br />

€0.8 million (£0.6 million).<br />

Two bus<strong>in</strong>esses were disposed of <strong>in</strong> the prior period. On 17 March 2009, a small propeller repair and overhaul facility based <strong>in</strong> Portsmouth,<br />

England, was disposed of for a consideration of £0.4 million and <strong>in</strong>curred a loss on disposal of £1.5 million. On 21 August 2009, an FBO based <strong>in</strong><br />

Indianapolis, Indiana, was also disposed of for a consideration of £3.3 million and which made a proft on disposal of £1.1 million.<br />

25. Cont<strong>in</strong>gent liabilities<br />

The Group is party to legal proceed<strong>in</strong>gs and claims which arise <strong>in</strong> the normal course of bus<strong>in</strong>ess, <strong>in</strong>clud<strong>in</strong>g specifc product liability and<br />

environmental claims. Any liabilities are likely to be mitigated by legal defences, <strong>in</strong>surance, reserves and third party <strong>in</strong>demnities.<br />

Additionally, the Group has previously owned bus<strong>in</strong>esses that manufactured products conta<strong>in</strong><strong>in</strong>g asbestos. No <strong>BBA</strong> company has<br />

manufactured or sold any products or materials conta<strong>in</strong><strong>in</strong>g asbestos for many years. A small number of former <strong>BBA</strong> companies have been named<br />

as defendants to asbestos-related claims. When these companies were sold, <strong>BBA</strong> reta<strong>in</strong>ed certa<strong>in</strong> obligations to <strong>in</strong>demnify the purchasers<br />

aga<strong>in</strong>st such claims. Notwithstand<strong>in</strong>g such <strong>in</strong>demnity arrangements, the costs <strong>in</strong>curred by <strong>BBA</strong> <strong>in</strong> deal<strong>in</strong>g with claims made aga<strong>in</strong>st these former<br />

<strong>BBA</strong> companies have been immaterial to <strong>BBA</strong>. Dur<strong>in</strong>g the period 1989 to 31 December <strong>2010</strong>, <strong>BBA</strong>’s aggregate costs of defend<strong>in</strong>g and dispos<strong>in</strong>g of<br />

all asbestos-related claims, net of <strong>in</strong>surance coverage, were approximately £7.6 million. <strong>BBA</strong> ma<strong>in</strong>ta<strong>in</strong>s a portfolio of <strong>in</strong>surance coverage <strong>in</strong> respect<br />

of the majority of such claims, <strong>in</strong>clud<strong>in</strong>g legal defence costs and liability cover. State operated compensation programmes have also provided<br />

coverage. On the basis of its past claims experience, <strong>BBA</strong> does not anticipate any material <strong>in</strong>crease <strong>in</strong> the cost to it of resolv<strong>in</strong>g such claims.<br />

Whilst the outcome of these claims are, by their nature, uncerta<strong>in</strong>, the directors do not currently anticipate that the outcome of the<br />

proceed<strong>in</strong>gs and claims set out above either <strong>in</strong>dividually, or <strong>in</strong> aggregate, will materially exceed the <strong>in</strong>surance coverage or amounts provided as<br />

shown <strong>in</strong> note 18, and are not expected to have a material adverse efect upon the Group’s f nancial position.<br />

<strong>2010</strong><br />

Fair<br />

value<br />

£m