Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

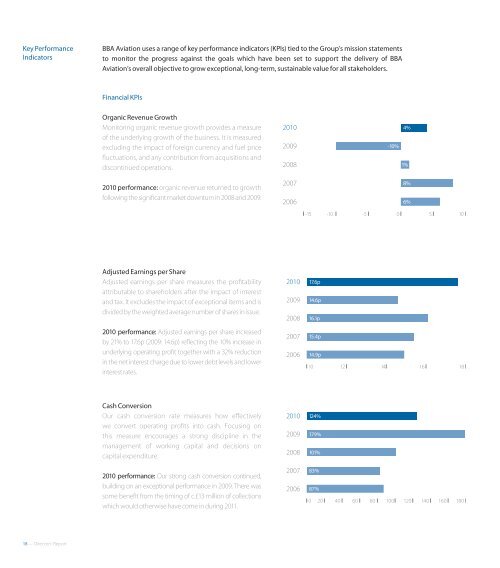

Key Performance <strong>BBA</strong> <strong>Aviation</strong> uses a range of key performance <strong>in</strong>dicators (KPIs) tied to the Group’s mission statements<br />

Indicators to monitor the progress aga<strong>in</strong>st the goals which have been set to support the delivery of <strong>BBA</strong><br />

<strong>Aviation</strong>’s overall objective to grow exceptional, long-term, susta<strong>in</strong>able value for all stakeholders.<br />

18 — Directors’ <strong>Report</strong><br />

F<strong>in</strong>ancial KPIs<br />

Organic Revenue Growth<br />

Monitor<strong>in</strong>g organic revenue growth provides a measure<br />

of the underly<strong>in</strong>g growth of the bus<strong>in</strong>ess. It is measured<br />

exclud<strong>in</strong>g the impact of foreign currency and fuel price<br />

fuctuations, and any contribution from acquisitions and<br />

discont<strong>in</strong>ued operations.<br />

<strong>2010</strong> performance: organic revenue returned to growth<br />

follow<strong>in</strong>g the signifcant market downturn <strong>in</strong> 2008 and 2009.<br />

Adjusted Earn<strong>in</strong>gs per Share<br />

Adjusted earn<strong>in</strong>gs per share measures the proftability<br />

attributable to shareholders after the impact of <strong>in</strong>terest<br />

and tax. It excludes the impact of exceptional items and is<br />

divided by the weighted average number of shares <strong>in</strong> issue.<br />

<strong>2010</strong> performance: Adjusted earn<strong>in</strong>gs per share <strong>in</strong>creased<br />

by 21% to 17.6p (2009: 14.6p) refect<strong>in</strong>g the 10% <strong>in</strong>crease <strong>in</strong><br />

underly<strong>in</strong>g operat<strong>in</strong>g proft together with a 32% reduction<br />

<strong>in</strong> the net <strong>in</strong>terest charge due to lower debt levels and lower<br />

<strong>in</strong>terest rates.<br />

Cash Conversion<br />

Our cash conversion rate measures how ef ectively<br />

we convert operat<strong>in</strong>g profts <strong>in</strong>to cash. Focus<strong>in</strong>g on<br />

this measure encourages a strong discipl<strong>in</strong>e <strong>in</strong> the<br />

management of work<strong>in</strong>g capital and decisions on<br />

capital expenditure.<br />

<strong>2010</strong> performance: Our strong cash conversion cont<strong>in</strong>ued,<br />

build<strong>in</strong>g on an exceptional performance <strong>in</strong> 2009. There was<br />

some beneft from the tim<strong>in</strong>g of c.£13 million of collections<br />

which would otherwise have come <strong>in</strong> dur<strong>in</strong>g 2011.<br />

<strong>2010</strong><br />

2009<br />

2008<br />

2007<br />

2006<br />

<strong>2010</strong><br />

2009<br />

2008<br />

2007<br />

2006<br />

<strong>2010</strong><br />

2009<br />

2008<br />

2007<br />

2006<br />

-10%<br />

6%<br />

-15 -10 -5 0 5 10<br />

17.6p<br />

14.6p<br />

16.1p<br />

15.4p<br />

14.9p<br />

10 12 14 16 18<br />

124%<br />

179%<br />

101%<br />

83%<br />

87%<br />

0 20 40 60 80 100 120 140 160 180<br />

4%<br />

1%<br />

8%