Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ancial statements Notes to the Consolidated F<strong>in</strong>ancial Statements – cont<strong>in</strong>ued<br />

85 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Consolidated<br />

F<strong>in</strong>ancial Statements<br />

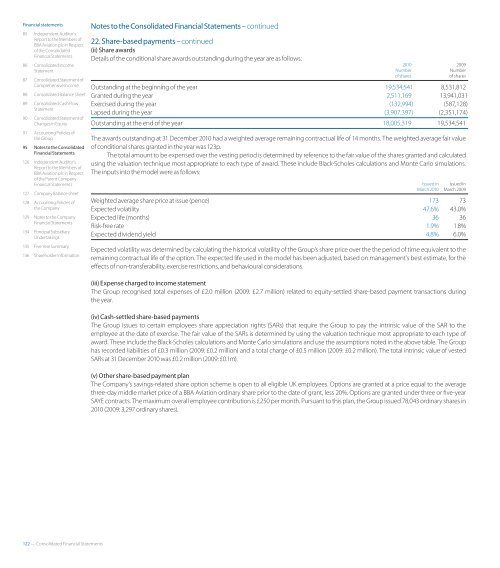

22. Share-based payments – cont<strong>in</strong>ued<br />

(ii) Share awards<br />

Details of the conditional share awards outstand<strong>in</strong>g dur<strong>in</strong>g the year are as follows:<br />

86 Consolidated Income <strong>2010</strong> 2009<br />

Statement Number Number<br />

87 Consolidated Statement of<br />

of shares of shares<br />

Comprehensive Income Outstand<strong>in</strong>g at the beg<strong>in</strong>n<strong>in</strong>g of the year 19,534,541 8,531,812<br />

88 Consolidated Balance Sheet Granted dur<strong>in</strong>g the year 2,511,169 13,941,031<br />

89 Consolidated Cash Flow<br />

Statement<br />

Exercised dur<strong>in</strong>g the year<br />

Lapsed dur<strong>in</strong>g the year<br />

(132,994)<br />

(3,907,397)<br />

(587,128)<br />

(2,351,174)<br />

90 Consolidated Statement of<br />

Changes <strong>in</strong> Equity Outstand<strong>in</strong>g at the end of the year 18,005,319 19,534,541<br />

91 Account<strong>in</strong>g Policies of<br />

the Group<br />

95 Notes to the Consolidated<br />

F<strong>in</strong>ancial Statements<br />

126 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Parent Company<br />

F<strong>in</strong>ancial Statements<br />

127 Company Balance sheet<br />

128 Account<strong>in</strong>g Policies of<br />

the Company<br />

129 Notes to the Company<br />

F<strong>in</strong>ancial Statements<br />

134 Pr<strong>in</strong>cipal Subsidiary<br />

Undertak<strong>in</strong>gs<br />

135 Five Year Summary<br />

136 Shareholder Information<br />

122 — Consolidated F<strong>in</strong>ancial Statements<br />

The awards outstand<strong>in</strong>g at 31 December <strong>2010</strong> had a weighted average rema<strong>in</strong><strong>in</strong>g contractual life of 14 months. The weighted average fair value<br />

of conditional shares granted <strong>in</strong> the year was 123p.<br />

The total amount to be expensed over the vest<strong>in</strong>g period is determ<strong>in</strong>ed by reference to the fair value of the shares granted and calculated<br />

us<strong>in</strong>g the valuation technique most appropriate to each type of award. These <strong>in</strong>clude Black-Scholes calculations and Monte Carlo simulations.<br />

The <strong>in</strong>puts <strong>in</strong>to the model were as follows:<br />

Issued <strong>in</strong> Issued <strong>in</strong><br />

March <strong>2010</strong> March 2009<br />

Weighted average share price at issue (pence) 173 73<br />

Expected volatility 47.6% 43.0%<br />

Expected life (months) 36 36<br />

Risk-free rate 1.9% 1.8%<br />

Expected dividend yield 4.8% 6.0%<br />

Expected volatility was determ<strong>in</strong>ed by calculat<strong>in</strong>g the historical volatility of the Group’s share price over the the period of time equivalent to the<br />

rema<strong>in</strong><strong>in</strong>g contractual life of the option. The expected life used <strong>in</strong> the model has been adjusted, based on management’s best estimate, for the<br />

efects of non-transferability, exercise restrictions, and behavioural considerations.<br />

(iii) Expense charged to <strong>in</strong>come statement<br />

The Group recognised total expenses of £2.0 million (2009: £2.7 million) related to equity-settled share-based payment transactions dur<strong>in</strong>g<br />

the year.<br />

(iv) Cash-settled share-based payments<br />

The Group issues to certa<strong>in</strong> employees share appreciation rights (SARs) that require the Group to pay the <strong>in</strong>tr<strong>in</strong>sic value of the SAR to the<br />

employee at the date of exercise. The fair value of the SARs is determ<strong>in</strong>ed by us<strong>in</strong>g the valuation technique most appropriate to each type of<br />

award. These <strong>in</strong>clude the Black-Scholes calculations and Monte Carlo simulations and use the assumptions noted <strong>in</strong> the above table. The Group<br />

has recorded liabilities of £0.3 million (2009: £0.2 million) and a total charge of £0.5 million (2009: £0.2 million). The total <strong>in</strong>tr<strong>in</strong>sic value of vested<br />

SARs at 31 December <strong>2010</strong> was £0.2 million (2009: £0.1m).<br />

(v) Other share-based payment plan<br />

The Company’s sav<strong>in</strong>gs-related share option scheme is open to all eligible UK employees. Options are granted at a price equal to the average<br />

three-day middle market price of a <strong>BBA</strong> <strong>Aviation</strong> ord<strong>in</strong>ary share prior to the date of grant, less 20%. Options are granted under three or fve-year<br />

SAYE contracts. The maximum overall employee contribution is £250 per month. Pursuant to this plan, the Group issued 78,043 ord<strong>in</strong>ary shares <strong>in</strong><br />

<strong>2010</strong> (2009: 3,297 ord<strong>in</strong>ary shares).