Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16. Bank overdraft and loans – cont<strong>in</strong>ued<br />

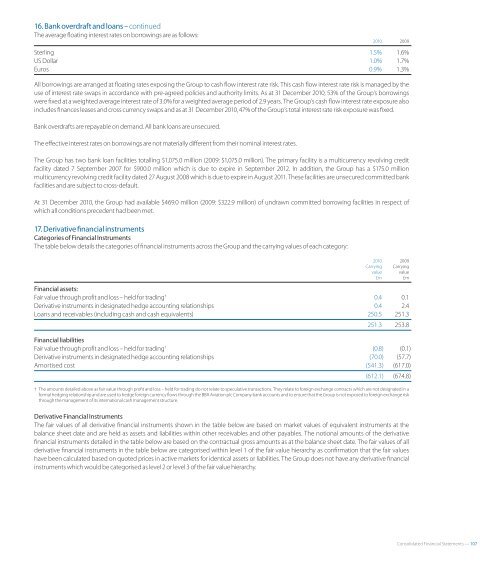

The average foat<strong>in</strong>g <strong>in</strong>terest rates on borrow<strong>in</strong>gs are as follows:<br />

<strong>2010</strong> 2009<br />

Sterl<strong>in</strong>g 1.5% 1.6%<br />

US Dollar 1.0% 1.7%<br />

Euros 0.9% 1.3%<br />

All borrow<strong>in</strong>gs are arranged at foat<strong>in</strong>g rates expos<strong>in</strong>g the Group to cash fow <strong>in</strong>terest rate risk. This cash fow <strong>in</strong>terest rate risk is managed by the<br />

use of <strong>in</strong>terest rate swaps <strong>in</strong> accordance with pre-agreed policies and authority limits. As at 31 December <strong>2010</strong>, 53% of the Group’s borrow<strong>in</strong>gs<br />

were fxed at a weighted average <strong>in</strong>terest rate of 3.0% for a weighted average period of 2.9 years. The Group’s cash fow <strong>in</strong>terest rate exposure also<br />

<strong>in</strong>cludes fnances leases and cross currency swaps and as at 31 December <strong>2010</strong>, 47% of the Group’s total <strong>in</strong>terest rate risk exposure was fxed.<br />

Bank overdrafts are repayable on demand. All bank loans are unsecured.<br />

The efective <strong>in</strong>terest rates on borrow<strong>in</strong>gs are not materially diferent from their nom<strong>in</strong>al <strong>in</strong>terest rates.<br />

The Group has two bank loan facilities totall<strong>in</strong>g $1,075.0 million (2009: $1,075.0 million). The primary facility is a multicurrency revolv<strong>in</strong>g credit<br />

facility dated 7 September 2007 for $900.0 million which is due to expire <strong>in</strong> September 2012. In addition, the Group has a $175.0 million<br />

multicurrency revolv<strong>in</strong>g credit facility dated 27 August 2008 which is due to expire <strong>in</strong> August 2011. These facilities are unsecured committed bank<br />

facilities and are subject to cross-default.<br />

At 31 December <strong>2010</strong>, the Group had available $469.0 million (2009: $322.9 million) of undrawn committed borrow<strong>in</strong>g facilities <strong>in</strong> respect of<br />

which all conditions precedent had been met.<br />

17. Derivative f nancial <strong>in</strong>struments<br />

Categories of F<strong>in</strong>ancial Instruments<br />

The table below details the categories of fnancial <strong>in</strong>struments across the Group and the carry<strong>in</strong>g values of each category:<br />

<strong>2010</strong> 2009<br />

Carry<strong>in</strong>g Carry<strong>in</strong>g<br />

value value<br />

£m £m<br />

F<strong>in</strong>ancial assets:<br />

Fair value through profit and loss – held for trad<strong>in</strong>g † 0.4 0.1<br />

Derivative <strong>in</strong>struments <strong>in</strong> designated hedge account<strong>in</strong>g relationships 0.4 2.4<br />

Loans and receivables (<strong>in</strong>clud<strong>in</strong>g cash and cash equivalents) 250.5 251.3<br />

251.3 253.8<br />

F<strong>in</strong>ancial liabilities<br />

Fair value through profit and loss – held for trad<strong>in</strong>g † (0.8) (0.1)<br />

Derivative <strong>in</strong>struments <strong>in</strong> designated hedge account<strong>in</strong>g relationships (70.0) (57.7)<br />

Amortised cost (541.3) (617.0)<br />

(612.1) (674.8)<br />

† The amounts detailed above as fair value through proft and loss – held for trad<strong>in</strong>g do not relate to speculative transactions. They relate to foreign exchange contracts which are not designated <strong>in</strong> a<br />

formal hedg<strong>in</strong>g relationship and are used to hedge foreign currency fows through the <strong>BBA</strong> <strong>Aviation</strong> plc Company bank accounts and to ensure that the Group is not exposed to foreign exchange risk<br />

through the management of its <strong>in</strong>ternational cash management structure.<br />

Derivative F<strong>in</strong>ancial Instruments<br />

The fair values of all derivative fnancial <strong>in</strong>struments shown <strong>in</strong> the table below are based on market values of equivalent <strong>in</strong>struments at the<br />

balance sheet date and are held as assets and liabilities with<strong>in</strong> other receivables and other payables. The notional amounts of the derivative<br />

fnancial <strong>in</strong>struments detailed <strong>in</strong> the table below are based on the contractual gross amounts as at the balance sheet date. The fair values of all<br />

derivative fnancial <strong>in</strong>struments <strong>in</strong> the table below are categorised with<strong>in</strong> level 1 of the fair value hierarchy as confrmation that the fair values<br />

have been calculated based on quoted prices <strong>in</strong> active markets for identical assets or liabilities. The Group does not have any derivative f nancial<br />

<strong>in</strong>struments which would be categorised as level 2 or level 3 of the fair value hierarchy.<br />

Consolidated F<strong>in</strong>ancial Statements — 107