Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ancial statements Notes to the Consolidated F<strong>in</strong>ancial Statements – cont<strong>in</strong>ued<br />

85 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Consolidated<br />

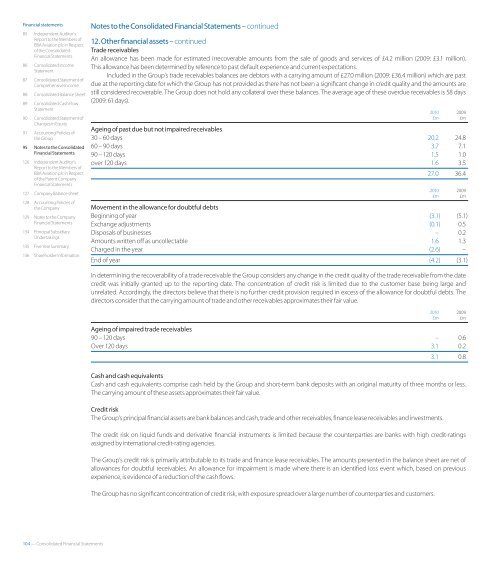

12. Other fnancial assets – cont<strong>in</strong>ued<br />

Trade receivables<br />

F<strong>in</strong>ancial Statements<br />

An allowance has been made for estimated irrecoverable amounts from the sale of goods and services of £4.2 million (2009: £3.1 million).<br />

86<br />

87<br />

Consolidated Income<br />

Statement<br />

Consolidated Statement of<br />

Comprehensive Income<br />

This allowance has been determ<strong>in</strong>ed by reference to past default experience and current expectations.<br />

Included <strong>in</strong> the Group’s trade receivables balances are debtors with a carry<strong>in</strong>g amount of £27.0 million (2009: £36.4 million) which are past<br />

due at the report<strong>in</strong>g date for which the Group has not provided as there has not been a signifcant change <strong>in</strong> credit quality and the amounts are<br />

88 Consolidated Balance Sheet still considered recoverable. The Group does not hold any collateral over these balances. The average age of these overdue receivables is 58 days<br />

(2009: 61 days).<br />

89 Consolidated Cash Flow<br />

Statement<br />

<strong>2010</strong> 2009<br />

90 Consolidated Statement of £m £m<br />

Changes <strong>in</strong> Equity<br />

Age<strong>in</strong>g of past due but not impaired receivables<br />

– 60 days 20.2 24.8<br />

– 90 days 3.7 7.1<br />

– 120 days 1.5 1.0<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Parent Company<br />

F<strong>in</strong>ancial Statements<br />

120 days 1.6<br />

27.0<br />

3.5<br />

36.4<br />

91 Account<strong>in</strong>g Policies of<br />

the Group 30<br />

95 Notes to the Consolidated 60<br />

F<strong>in</strong>ancial Statements 90<br />

126 Independent Auditor’s over<br />

127 Company Balance sheet<br />

128 Account<strong>in</strong>g Policies of<br />

the Company Movement <strong>in</strong> the allowance for doubtful debts<br />

129 Notes to the Company Beg<strong>in</strong>n<strong>in</strong>g of<br />

F<strong>in</strong>ancial Statements Exchange<br />

134 Pr<strong>in</strong>cipal Subsidiary<br />

Undertak<strong>in</strong>gs<br />

Disposals of<br />

135 Five Year Summary<br />

136 Shareholder Information<br />

104 — Consolidated F<strong>in</strong>ancial Statements<br />

<strong>2010</strong> 2009<br />

£m £m<br />

year (3.1) (5.1)<br />

adjustments (0.1) 0.5<br />

bus<strong>in</strong>esses – 0.2<br />

Amounts written off as uncollectable 1.6 1.3<br />

Charged <strong>in</strong> the year (2.6) –<br />

End of year (4.2) (3.1)<br />

In determ<strong>in</strong><strong>in</strong>g the recoverability of a trade receivable the Group considers any change <strong>in</strong> the credit quality of the trade receivable from the date<br />

credit was <strong>in</strong>itially granted up to the report<strong>in</strong>g date. The concentration of credit risk is limited due to the customer base be<strong>in</strong>g large and<br />

unrelated. Accord<strong>in</strong>gly, the directors believe that there is no further credit provision required <strong>in</strong> excess of the allowance for doubtful debts. The<br />

directors consider that the carry<strong>in</strong>g amount of trade and other receivables approximates their fair value.<br />

<strong>2010</strong> 2009<br />

£m £m<br />

Age<strong>in</strong>g of impaired trade receivables<br />

90 – 120 days – 0.6<br />

Over 120 days 3.1 0.2<br />

3.1 0.8<br />

Cash and cash equivalents<br />

Cash and cash equivalents comprise cash held by the Group and short-term bank deposits with an orig<strong>in</strong>al maturity of three months or less.<br />

The carry<strong>in</strong>g amount of these assets approximates their fair value.<br />

Credit risk<br />

The Group’s pr<strong>in</strong>cipal fnancial assets are bank balances and cash, trade and other receivables, fnance lease receivables and <strong>in</strong>vestments.<br />

The credit risk on liquid funds and derivative fnancial <strong>in</strong>struments is limited because the counterparties are banks with high credit-rat<strong>in</strong>gs<br />

assigned by <strong>in</strong>ternational credit-rat<strong>in</strong>g agencies.<br />

The Group’s credit risk is primarily attributable to its trade and fnance lease receivables. The amounts presented <strong>in</strong> the balance sheet are net of<br />

allowances for doubtful receivables. An allowance for impairment is made where there is an identifed loss event which, based on previous<br />

experience, is evidence of a reduction of the cash fows.<br />

The Group has no signifcant concentration of credit risk, with exposure spread over a large number of counterparties and customers.