Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Annual Report 2010 in PDF - BBA Aviation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F<strong>in</strong>ancial statements Notes to the Consolidated F<strong>in</strong>ancial Statements – cont<strong>in</strong>ued<br />

85 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Consolidated<br />

F<strong>in</strong>ancial Statements<br />

17. Derivative fnancial <strong>in</strong>struments – cont<strong>in</strong>ued<br />

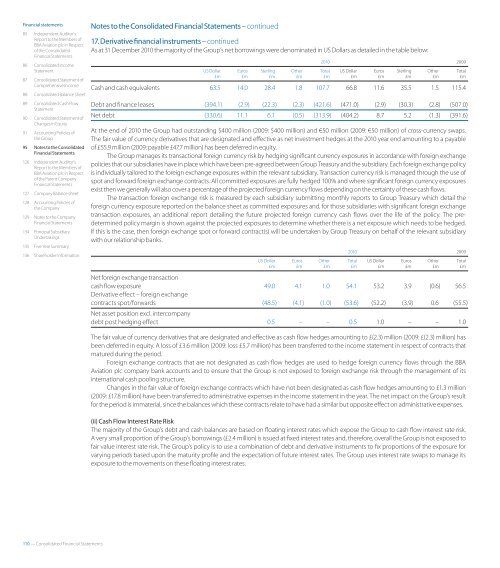

As at 31 December <strong>2010</strong> the majority of the Group’s net borrow<strong>in</strong>gs were denom<strong>in</strong>ated <strong>in</strong> US Dollars as detailed <strong>in</strong> the table below:<br />

86 Consolidated Income<br />

<strong>2010</strong> 2009<br />

Statement US Dollar Euros Sterl<strong>in</strong>g Other Total US Dollar Euros Sterl<strong>in</strong>g Other Total<br />

87 Consolidated Statement of<br />

Comprehensive Income<br />

£m £m £m £m £m £m £m £m £m £m<br />

88 Consolidated Balance Sheet<br />

89 Consolidated Cash Flow<br />

Statement<br />

90 Consolidated Statement of<br />

Changes <strong>in</strong> Equity<br />

91 Account<strong>in</strong>g Policies of<br />

the Group<br />

95 Notes to the Consolidated<br />

F<strong>in</strong>ancial Statements<br />

126 Independent Auditor’s<br />

<strong>Report</strong> to the Members of<br />

<strong>BBA</strong> <strong>Aviation</strong> plc <strong>in</strong> Respect<br />

of the Parent Company<br />

F<strong>in</strong>ancial Statements<br />

127 Company Balance sheet<br />

128 Account<strong>in</strong>g Policies of<br />

the Company<br />

129 Notes to the Company<br />

F<strong>in</strong>ancial Statements<br />

134 Pr<strong>in</strong>cipal Subsidiary<br />

Undertak<strong>in</strong>gs<br />

135 Five Year Summary<br />

136 Shareholder Information<br />

110 — Consolidated F<strong>in</strong>ancial Statements<br />

Cash and cash equivalents 63.5 14.0 28.4 1.8 107.7 66.8 11.6 35.5 1.5 115.4<br />

Debt and f<strong>in</strong>ance leases (394.1) (2.9) (22.3) (2.3) (421.6) (471.0) (2.9) (30.3) (2.8) (507.0)<br />

Net debt (330.6) 11.1 6.1 (0.5) (313.9) (404.2) 8.7 5.2 (1.3) (391.6)<br />

At the end of <strong>2010</strong> the Group had outstand<strong>in</strong>g $400 million (2009: $400 million) and €50 million (2009: €50 million) of cross-currency swaps.<br />

The fair value of currency derivatives that are designated and efective as net <strong>in</strong>vestment hedges at the <strong>2010</strong> year end amount<strong>in</strong>g to a payable<br />

of £55.9 million (2009: payable £47.7 million) has been deferred <strong>in</strong> equity.<br />

The Group manages its transactional foreign currency risk by hedg<strong>in</strong>g signifcant currency exposures <strong>in</strong> accordance with foreign exchange<br />

policies that our subsidiaries have <strong>in</strong> place which have been pre-agreed between Group Treasury and the subsidiary. Each foreign exchange policy<br />

is <strong>in</strong>dividually tailored to the foreign exchange exposures with<strong>in</strong> the relevant subsidiary. Transaction currency risk is managed through the use of<br />

spot and forward foreign exchange contracts. All committed exposures are fully hedged 100% and where signifcant foreign currency exposures<br />

exist then we generally will also cover a percentage of the projected foreign currency fows depend<strong>in</strong>g on the certa<strong>in</strong>ty of these cash fows.<br />

The transaction foreign exchange risk is measured by each subsidiary submitt<strong>in</strong>g monthly reports to Group Treasury which detail the<br />

foreign currency exposure reported on the balance sheet as committed exposures and, for those subsidiaries with signifcant foreign exchange<br />

transaction exposures, an additional report detail<strong>in</strong>g the future projected foreign currency cash fows over the life of the policy. The predeterm<strong>in</strong>ed<br />

policy marg<strong>in</strong> is shown aga<strong>in</strong>st the projected exposures to determ<strong>in</strong>e whether there is a net exposure which needs to be hedged.<br />

If this is the case, then foreign exchange spot or forward contract(s) will be undertaken by Group Treasury on behalf of the relevant subsidiary<br />

with our relationship banks.<br />

<strong>2010</strong> 2009<br />

US Dollar Euros Other Total US Dollar Euros Other Total<br />

£m £m £m £m £m £m £m £m<br />

Net foreign exchange transaction<br />

cash flow exposure<br />

Derivative effect – foreign exchange<br />

49.0 4.1 1.0 54.1 53.2 3.9 (0.6) 56.5<br />

contracts spot/forwards<br />

Net asset position excl. <strong>in</strong>tercompany<br />

(48.5) (4.1) (1.0) (53.6) (52.2) (3.9) 0.6 (55.5)<br />

debt post hedg<strong>in</strong>g effect 0.5 – – 0.5 1.0 – – 1.0<br />

The fair value of currency derivatives that are designated and efective as cash fow hedges amount<strong>in</strong>g to £(2.3) million (2009: £(2.3) million) has<br />

been deferred <strong>in</strong> equity. A loss of £3.6 million (2009: loss £5.7 million) has been transferred to the <strong>in</strong>come statement <strong>in</strong> respect of contracts that<br />

matured dur<strong>in</strong>g the period.<br />

Foreign exchange contracts that are not designated as cash fow hedges are used to hedge foreign currency fows through the <strong>BBA</strong><br />

<strong>Aviation</strong> plc company bank accounts and to ensure that the Group is not exposed to foreign exchange risk through the management of its<br />

<strong>in</strong>ternational cash pool<strong>in</strong>g structure.<br />

Changes <strong>in</strong> the fair value of foreign exchange contracts which have not been designated as cash fow hedges amount<strong>in</strong>g to £1.3 million<br />

(2009: £17.8 million) have been transferred to adm<strong>in</strong>istrative expenses <strong>in</strong> the <strong>in</strong>come statement <strong>in</strong> the year. The net impact on the Group’s result<br />

for the period is immaterial, s<strong>in</strong>ce the balances which these contracts relate to have had a similar but opposite efect on adm<strong>in</strong>istrative expenses.<br />

(ii) Cash Flow Interest Rate Risk<br />

The majority of the Group’s debt and cash balances are based on foat<strong>in</strong>g <strong>in</strong>terest rates which expose the Group to cash fow <strong>in</strong>terest rate risk.<br />

A very small proportion of the Group’s borrow<strong>in</strong>gs (£2.4 million) is issued at fxed <strong>in</strong>terest rates and, therefore, overall the Group is not exposed to<br />

fair value <strong>in</strong>terest rate risk. The Group’s policy is to use a comb<strong>in</strong>ation of debt and derivative <strong>in</strong>struments to fx proportions of the exposure for<br />

vary<strong>in</strong>g periods based upon the maturity profle and the expectation of future <strong>in</strong>terest rates. The Group uses <strong>in</strong>terest rate swaps to manage its<br />

exposure to the movements on these foat<strong>in</strong>g <strong>in</strong>terest rates.