USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98<br />

FINANCIAL SECTION<br />

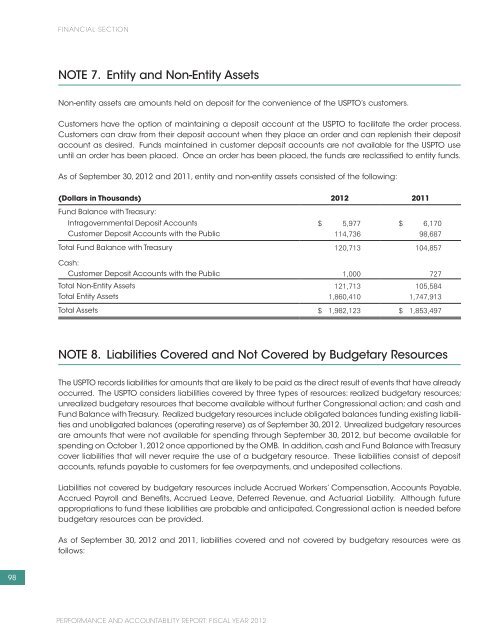

NOTE 7. Entity <strong>and</strong> Non-Entity Assets<br />

Non-entity assets are amounts held on deposit for the convenience of the <strong>USPTO</strong>’s customers.<br />

Customers have the option of maintaining a deposit account at the <strong>USPTO</strong> to facilitate the order process.<br />

Customers can draw from their deposit account when they place an order <strong>and</strong> can replenish their deposit<br />

account as desired. Funds maintained in customer deposit accounts are not available for the <strong>USPTO</strong> use<br />

until an order has been placed. Once an order has been placed, the funds are reclassified to entity funds.<br />

As of September 30, 2012 <strong>and</strong> 2011, entity <strong>and</strong> non-entity assets consisted of the following:<br />

(Dollars in Thous<strong>and</strong>s)<br />

Fund Balance with Treasury:<br />

2012 2011<br />

Intragovernmental Deposit Accounts $ 5,977 $ 6,170<br />

Customer Deposit Accounts with the Public 114,736 98,687<br />

Total Fund Balance with Treasury 120,713 104,857<br />

Cash:<br />

Customer Deposit Accounts with the Public 1,000 727<br />

Total Non-Entity Assets 121,713 105,584<br />

Total Entity Assets 1,860,410 1,747,913<br />

Total Assets $ 1,982,123 $ 1,853,497<br />

NOTE 8. Liabilities Covered <strong>and</strong> Not Covered by Budgetary Resources<br />

The <strong>USPTO</strong> records liabilities for amounts that are likely to be paid as the direct result of events that have already<br />

occurred. The <strong>USPTO</strong> considers liabilities covered by three types of resources: realized budgetary resources;<br />

unrealized budgetary resources that become available without further Congressional action; <strong>and</strong> cash <strong>and</strong><br />

Fund Balance with Treasury. Realized budgetary resources include obligated balances funding existing liabilities<br />

<strong>and</strong> unobligated balances (operating reserve) as of September 30, 2012. Unrealized budgetary resources<br />

are amounts that were not available for spending through September 30, 2012, but become available for<br />

spending on October 1, 2012 once apportioned by the OMB. In addition, cash <strong>and</strong> Fund Balance with Treasury<br />

cover liabilities that will never require the use of a budgetary resource. These liabilities consist of deposit<br />

accounts, refunds payable to customers for fee overpayments, <strong>and</strong> undeposited collections.<br />

Liabilities not covered by budgetary resources include Accrued Workers’ Compensation, Accounts Payable,<br />

Accrued Payroll <strong>and</strong> Benefits, Accrued Leave, Deferred Revenue, <strong>and</strong> Actuarial Liability. Although future<br />

appropriations to fund these liabilities are probable <strong>and</strong> anticipated, Congressional action is needed before<br />

budgetary resources can be provided.<br />

As of September 30, 2012 <strong>and</strong> 2011, liabilities covered <strong>and</strong> not covered by budgetary resources were as<br />

follows:<br />

PERFORMANCE AND ACCOUNTABILITY REPORT: FISCAL YEAR 2012

![Printable version [PDF] - United States Patent and Trademark Office](https://img.yumpu.com/51835259/1/184x260/printable-version-pdf-united-states-patent-and-trademark-office.jpg?quality=85)