USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

FINANCIAL SECTION<br />

NOTE 10. Actuarial Liability<br />

The FECA provides income <strong>and</strong> medical cost protection to covered federal civilian employees injured on the<br />

job <strong>and</strong> for those who have contracted a work-related occupational disease, <strong>and</strong> beneficiaries of employees<br />

whose death is attributable to a job-related injury or occupational disease. Claims incurred for benefits<br />

under the FECA for the <strong>USPTO</strong>’s employees are administered by the DOL <strong>and</strong> are paid ultimately by the <strong>USPTO</strong>.<br />

The DOL estimated the future workers compensation liability by applying actuarial procedures developed to<br />

estimate the liability for FECA benefits. The actuarial liability estimates for FECA benefits include the expected<br />

liability for death, disability, medical, <strong>and</strong> miscellaneous costs for approved compensation cases, plus a<br />

component for incurred but not reported claims. The actuarial liability is updated annually.<br />

The DOL method of determining the liability uses historical benefit payment patterns for a specific incurred<br />

period to predict the ultimate payments for that period. Consistent with past practice, these projected<br />

annual benefit payments have been discounted to present value using the OMB’s economic assumptions<br />

for ten-year Treasury notes <strong>and</strong> bonds. Interest rate assumptions utilized for discounting were as follows:<br />

2012 2011<br />

2.29% in year 1, 3.54% in year 1,<br />

3.14% in year 2, 4.03% in year 2,<br />

<strong>and</strong> thereafter <strong>and</strong> thereafter<br />

Based on information provided by the DOL, the U.S. Department of Commerce estimated the <strong>USPTO</strong>’s liability<br />

as of September 30, 2012 <strong>and</strong> 2011 was $8,209 thous<strong>and</strong> <strong>and</strong> $8,406 thous<strong>and</strong>, respectively.<br />

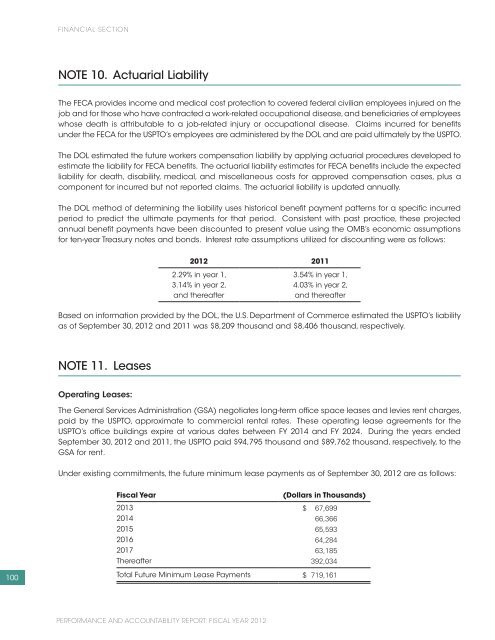

NOTE 11. Leases<br />

Operating Leases:<br />

The General Services Administration (GSA) negotiates long-term office space leases <strong>and</strong> levies rent charges,<br />

paid by the <strong>USPTO</strong>, approximate to commercial rental rates. These operating lease agreements for the<br />

<strong>USPTO</strong>’s office buildings expire at various dates between FY 2014 <strong>and</strong> FY 2024. During the years ended<br />

September 30, 2012 <strong>and</strong> 2011, the <strong>USPTO</strong> paid $94,795 thous<strong>and</strong> <strong>and</strong> $89,762 thous<strong>and</strong>, respectively, to the<br />

GSA for rent.<br />

Under existing commitments, the future minimum lease payments as of September 30, 2012 are as follows:<br />

Fiscal Year (Dollars in Thous<strong>and</strong>s)<br />

2013 $ 67,699<br />

2014 66,366<br />

2015 65,593<br />

2016 64,284<br />

2017 63,185<br />

Thereafter 392,034<br />

Total Future Minimum Lease Payments $ 719,161<br />

PERFORMANCE AND ACCOUNTABILITY REPORT: FISCAL YEAR 2012

![Printable version [PDF] - United States Patent and Trademark Office](https://img.yumpu.com/51835259/1/184x260/printable-version-pdf-united-states-patent-and-trademark-office.jpg?quality=85)