USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

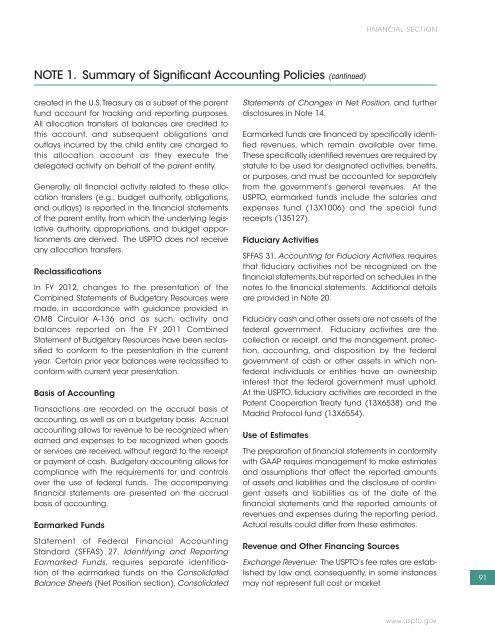

NOTE 1. Summary of Significant Accounting Policies (continued)<br />

created in the U.S. Treasury as a subset of the parent<br />

fund account for tracking <strong>and</strong> reporting purposes.<br />

All allocation transfers of balances are credited to<br />

this account, <strong>and</strong> subsequent obligations <strong>and</strong><br />

outlays incurred by the child entity are charged to<br />

this allocation account as they execute the<br />

delegated activity on behalf of the parent entity.<br />

Generally, all financial activity related to these allocation<br />

transfers (e.g., budget authority, obligations,<br />

<strong>and</strong> outlays) is reported in the financial statements<br />

of the parent entity, from which the underlying legislative<br />

authority, appropriations, <strong>and</strong> budget apportionments<br />

are derived. The <strong>USPTO</strong> does not receive<br />

any allocation transfers.<br />

Reclassifications<br />

In FY 2012, changes to the presentation of the<br />

Combined Statements of Budgetary Resources were<br />

made, in accordance with guidance provided in<br />

OMB Circular A-136 <strong>and</strong> as such, activity <strong>and</strong><br />

balances reported on the FY 2011 Combined<br />

Statement of Budgetary Resources have been reclassified<br />

to conform to the presentation in the current<br />

year. Certain prior year balances were reclassified to<br />

conform with current year presentation.<br />

Basis of Accounting<br />

Transactions are recorded on the accrual basis of<br />

accounting, as well as on a budgetary basis. Accrual<br />

accounting allows for revenue to be recognized when<br />

earned <strong>and</strong> expenses to be recognized when goods<br />

or services are received, without regard to the receipt<br />

or payment of cash. Budgetary accounting allows for<br />

compliance with the requirements for <strong>and</strong> controls<br />

over the use of federal funds. The accompanying<br />

financial statements are presented on the accrual<br />

basis of accounting.<br />

Earmarked Funds<br />

Statement of Federal Financial Accounting<br />

St<strong>and</strong>ard (SFFAS) 27, Identifying <strong>and</strong> <strong>Report</strong>ing<br />

Earmarked Funds, requires separate identification<br />

of the earmarked funds on the Consolidated<br />

Balance Sheets (Net Position section), Consolidated<br />

Statements of Changes in Net Position, <strong>and</strong> further<br />

disclosures in Note 14.<br />

Earmarked funds are financed by specifically identified<br />

revenues, which remain available over time.<br />

These specifically identified revenues are required by<br />

statute to be used for designated activities, benefits,<br />

or purposes, <strong>and</strong> must be accounted for separately<br />

from the government’s general revenues. At the<br />

<strong>USPTO</strong>, earmarked funds include the salaries <strong>and</strong><br />

expenses fund (13X1006) <strong>and</strong> the special fund<br />

receipts (135127).<br />

Fiduciary Activities<br />

SFFAS 31, Accounting for Fiduciary Activities, requires<br />

that fiduciary activities not be recognized on the<br />

financial statements, but reported on schedules in the<br />

notes to the financial statements. Additional details<br />

are provided in Note 20.<br />

Fiduciary cash <strong>and</strong> other assets are not assets of the<br />

federal government. Fiduciary activities are the<br />

collection or receipt, <strong>and</strong> the management, protection,<br />

accounting, <strong>and</strong> disposition by the federal<br />

government of cash or other assets in which nonfederal<br />

individuals or entities have an ownership<br />

interest that the federal government must uphold.<br />

At the <strong>USPTO</strong>, fiduciary activities are recorded in the<br />

<strong>Patent</strong> Cooperation Treaty fund (13X6538) <strong>and</strong> the<br />

Madrid Protocol fund (13X6554).<br />

Use of Estimates<br />

The preparation of financial statements in conformity<br />

with GAAP requires management to make estimates<br />

<strong>and</strong> assumptions that affect the reported amounts<br />

of assets <strong>and</strong> liabilities <strong>and</strong> the disclosure of contingent<br />

assets <strong>and</strong> liabilities as of the date of the<br />

financial statements <strong>and</strong> the reported amounts of<br />

revenues <strong>and</strong> expenses during the reporting period.<br />

Actual results could differ from these estimates.<br />

Revenue <strong>and</strong> Other Financing Sources<br />

FINANCIAL SECTION<br />

Exchange Revenue: The <strong>USPTO</strong>’s fee rates are established<br />

by law <strong>and</strong>, consequently, in some instances<br />

may not represent full cost or market<br />

www.uspto.gov<br />

91

![Printable version [PDF] - United States Patent and Trademark Office](https://img.yumpu.com/51835259/1/184x260/printable-version-pdf-united-states-patent-and-trademark-office.jpg?quality=85)