USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

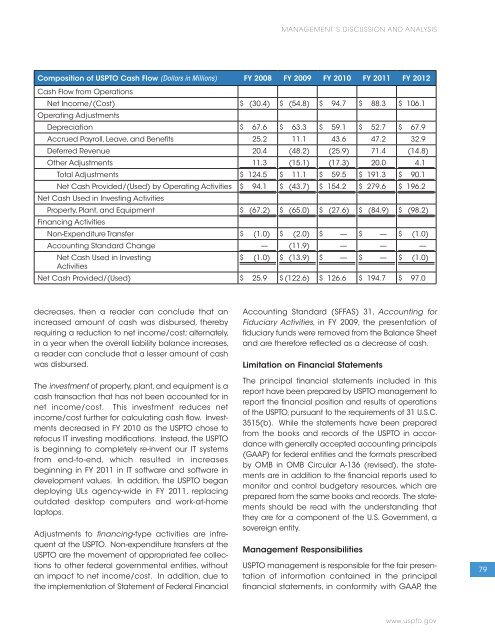

Composition of <strong>USPTO</strong> Cash Flow (Dollars in Millions) FY 2008 FY 2009 FY 2010 FY 2011 FY 2012<br />

Cash Flow from Operations<br />

Net Income/(Cost) $ (30.4) $ (54.8) $ 94.7 $ 88.3 $ 106.1<br />

Operating Adjustments<br />

Depreciation $ 67.6 $ 63.3 $ 59.1 $ 52.7 $ 67.9<br />

Accrued Payroll, Leave, <strong>and</strong> Benefits 25.2 11.1 43.6 47.2 32.9<br />

Deferred Revenue 20.4 (48.2) (25.9) 71.4 (14.8)<br />

Other Adjustments 11.3 (15.1) (17.3) 20.0 4.1<br />

Total Adjustments $ 124.5 $ 11.1 $ 59.5 $ 191.3 $ 90.1<br />

Net Cash Provided/(Used) by Operating Activities $ 94.1 $ (43.7) $ 154.2 $ 279.6 $ 196.2<br />

Net Cash Used in Investing Activities<br />

Property, Plant, <strong>and</strong> Equipment $ (67.2) $ (65.0) $ (27.6) $ (84.9) $ (98.2)<br />

Financing Activities<br />

Non-Expenditure Transfer $ (1.0) $ (2.0) $ — $ — $ (1.0)<br />

Accounting St<strong>and</strong>ard Change — (11.9)<br />

Net Cash Used in Investing<br />

Activities<br />

decreases, then a reader can conclude that an<br />

increased amount of cash was disbursed, thereby<br />

requiring a reduction to net income/cost; alternately,<br />

in a year when the overall liability balance increases,<br />

a reader can conclude that a lesser amount of cash<br />

was disbursed.<br />

The investment of property, plant, <strong>and</strong> equipment is a<br />

cash transaction that has not been accounted for in<br />

net income/cost. This investment reduces net<br />

income/cost further for calculating cash flow. Investments<br />

decreased in FY 2010 as the <strong>USPTO</strong> chose to<br />

refocus IT investing modifications. Instead, the <strong>USPTO</strong><br />

is beginning to completely re-invent our IT systems<br />

from end-to-end, which resulted in increases<br />

beginning in FY 2011 in IT software <strong>and</strong> software in<br />

development values. In addition, the <strong>USPTO</strong> began<br />

deploying ULs agency-wide in FY 2011, replacing<br />

outdated desktop computers <strong>and</strong> work-at-home<br />

laptops.<br />

Adjustments to financing-type activities are infrequent<br />

at the <strong>USPTO</strong>. Non-expenditure transfers at the<br />

<strong>USPTO</strong> are the movement of appropriated fee collections<br />

to other federal governmental entities, without<br />

an impact to net income/cost. In addition, due to<br />

the implementation of Statement of Federal Financial<br />

$ (1.0) $ (13.9) $<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

Accounting St<strong>and</strong>ard (SFFAS) 31, Accounting for<br />

Fiduciary Activities, in FY 2009, the presentation of<br />

fiduciary funds were removed from the Balance Sheet<br />

<strong>and</strong> are therefore reflected as a decrease of cash.<br />

Limitation on Financial Statements<br />

The principal financial statements included in this<br />

report have been prepared by <strong>USPTO</strong> management to<br />

report the financial position <strong>and</strong> results of operations<br />

of the <strong>USPTO</strong>, pursuant to the requirements of 31 U.S.C.<br />

3515(b). While the statements have been prepared<br />

from the books <strong>and</strong> records of the <strong>USPTO</strong> in accordance<br />

with generally accepted accounting principals<br />

(GAAP) for federal entities <strong>and</strong> the formats prescribed<br />

by OMB in OMB Circular A-136 (revised), the statements<br />

are in addition to the financial reports used to<br />

monitor <strong>and</strong> control budgetary resources, which are<br />

prepared from the same books <strong>and</strong> records. The statements<br />

should be read with the underst<strong>and</strong>ing that<br />

they are for a component of the U.S. Government, a<br />

sovereign entity.<br />

Management Responsibilities<br />

— — —<br />

— $ — $ (1.0)<br />

Net Cash Provided/(Used) $ 25.9 $ (122.6) $ 126.6 $ 194.7 $ 97.0<br />

<strong>USPTO</strong> management is responsible for the fair presentation<br />

of information contained in the principal<br />

financial statements, in conformity with GAAP, the<br />

www.uspto.gov<br />

79

![Printable version [PDF] - United States Patent and Trademark Office](https://img.yumpu.com/51835259/1/184x260/printable-version-pdf-united-states-patent-and-trademark-office.jpg?quality=85)