USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

USPTO Performance and Accountability Report - U.S. Patent and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

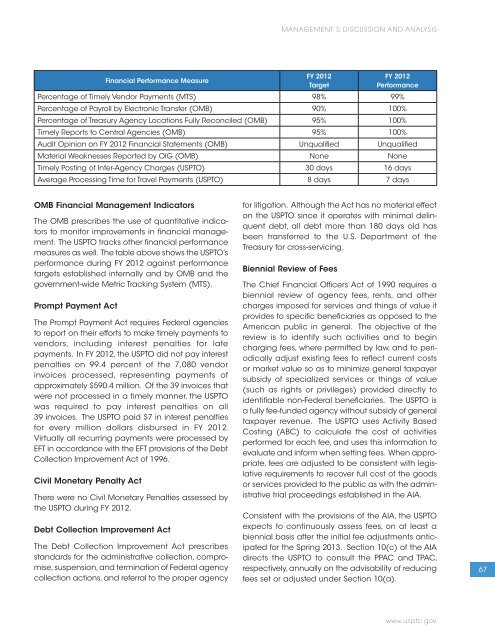

OMB Financial Management Indicators<br />

The OMB prescribes the use of quantitative indicators<br />

to monitor improvements in financial management.<br />

The <strong>USPTO</strong> tracks other financial performance<br />

measures as well. The table above shows the <strong>USPTO</strong>’s<br />

performance during FY 2012 against performance<br />

targets established internally <strong>and</strong> by OMB <strong>and</strong> the<br />

government-wide Metric Tracking System (MTS).<br />

Prompt Payment Act<br />

The Prompt Payment Act requires Federal agencies<br />

to report on their efforts to make timely payments to<br />

vendors, including interest penalties for late<br />

payments. In FY 2012, the <strong>USPTO</strong> did not pay interest<br />

penalties on 99.4 percent of the 7,080 vendor<br />

invoices processed, representing payments of<br />

approximately $590.4 million. Of the 39 invoices that<br />

were not processed in a timely manner, the <strong>USPTO</strong><br />

was required to pay interest penalties on all<br />

39 invoices. The <strong>USPTO</strong> paid $7 in interest penalties<br />

for every million dollars disbursed in FY 2012.<br />

Virtually all recurring payments were processed by<br />

EFT in accordance with the EFT provisions of the Debt<br />

Collection Improvement Act of 1996.<br />

Civil Monetary Penalty Act<br />

Financial <strong>Performance</strong> Measure<br />

There were no Civil Monetary Penalties assessed by<br />

the <strong>USPTO</strong> during FY 2012.<br />

Debt Collection Improvement Act<br />

The Debt Collection Improvement Act prescribes<br />

st<strong>and</strong>ards for the administrative collection, compromise,<br />

suspension, <strong>and</strong> termination of Federal agency<br />

collection actions, <strong>and</strong> referral to the proper agency<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS<br />

FY 2012<br />

Target<br />

for litigation. Although the Act has no material effect<br />

on the <strong>USPTO</strong> since it operates with minimal delinquent<br />

debt, all debt more than 180 days old has<br />

been transferred to the U.S. Department of the<br />

Treasury for cross-servicing.<br />

Biennial Review of Fees<br />

FY 2012<br />

<strong>Performance</strong><br />

Percentage of Timely Vendor Payments (MTS) 98% 99%<br />

Percentage of Payroll by Electronic Transfer (OMB) 90% 100%<br />

Percentage of Treasury Agency Locations Fully Reconciled (OMB) 95% 100%<br />

Timely <strong>Report</strong>s to Central Agencies (OMB) 95% 100%<br />

Audit Opinion on FY 2012 Financial Statements (OMB) Unqualified Unqualified<br />

Material Weaknesses <strong>Report</strong>ed by OIG (OMB) None None<br />

Timely Posting of Inter-Agency Charges (<strong>USPTO</strong>) 30 days 16 days<br />

Average Processing Time for Travel Payments (<strong>USPTO</strong>) 8 days 7 days<br />

The Chief Financial Officers Act of 1990 requires a<br />

biennial review of agency fees, rents, <strong>and</strong> other<br />

charges imposed for services <strong>and</strong> things of value it<br />

provides to specific beneficiaries as opposed to the<br />

American public in general. The objective of the<br />

review is to identify such activities <strong>and</strong> to begin<br />

charging fees, where permitted by law, <strong>and</strong> to periodically<br />

adjust existing fees to reflect current costs<br />

or market value so as to minimize general taxpayer<br />

subsidy of specialized services or things of value<br />

(such as rights or privileges) provided directly to<br />

identifiable non-Federal beneficiaries. The <strong>USPTO</strong> is<br />

a fully fee-funded agency without subsidy of general<br />

taxpayer revenue. The <strong>USPTO</strong> uses Activity Based<br />

Costing (ABC) to calculate the cost of activities<br />

performed for each fee, <strong>and</strong> uses this information to<br />

evaluate <strong>and</strong> inform when setting fees. When appropriate,<br />

fees are adjusted to be consistent with legislative<br />

requirements to recover full cost of the goods<br />

or services provided to the public as with the administrative<br />

trial proceedings established in the AIA.<br />

Consistent with the provisions of the AIA, the <strong>USPTO</strong><br />

expects to continuously assess fees, on at least a<br />

biennial basis after the initial fee adjustments anticipated<br />

for the Spring 2013. Section 10(c) of the AIA<br />

directs the <strong>USPTO</strong> to consult the PPAC <strong>and</strong> TPAC,<br />

respectively, annually on the advisability of reducing<br />

fees set or adjusted under Section 10(a).<br />

www.uspto.gov<br />

67

![Printable version [PDF] - United States Patent and Trademark Office](https://img.yumpu.com/51835259/1/184x260/printable-version-pdf-united-states-patent-and-trademark-office.jpg?quality=85)