Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

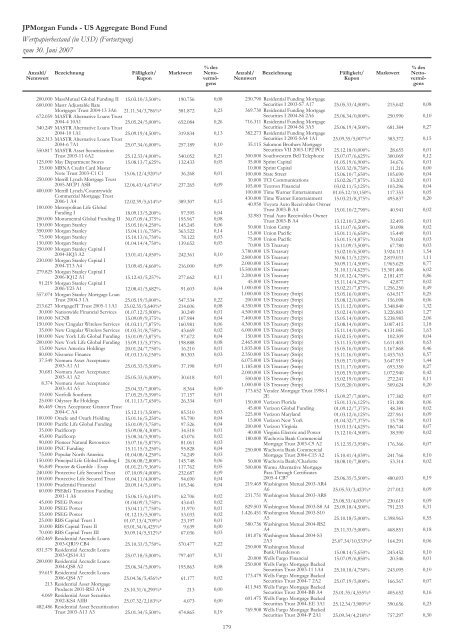

<strong>JPMorgan</strong> <strong>Funds</strong> - US Aggregate Bond Fund<br />

Wertpapierbestand (in USD) (Fortsetzung)<br />

zum 30. Juni 2007<br />

Anzahl/<br />

Nennwert<br />

Bezeichnung Fälligkeit/<br />

Kupon<br />

Marktwert<br />

% des<br />

Nettovermögens<br />

200.000 MassMutual Global Funding II 15.03.10/3,500% 190.756 0,08<br />

600.000 Mastr Adjustable Rate<br />

Mortgages Trust 2004-13 3A6 21.11.34/3,786%* 581.872 0,23<br />

672.059 MASTR Alternative Loans Trust<br />

2004-4 10A1 25.05.24/5,000% 652.084 0,26<br />

340.249 MASTR Alternative Loans Trust<br />

2004-10 1A1 25.09.19/4,500% 319.834 0,13<br />

262.313 MASTR Alternative Loans Trust<br />

2004-6 7A1 25.07.34/6,000% 257.189 0,10<br />

550.817 MASTR Asset Securitization<br />

Trust 2003-11 6A2 25.12.33/4,000% 540.052 0,21<br />

125.000 May Department Stores 15.08.13/7,625% 132.433 0,05<br />

35.000 MBNA Credit Card Master<br />

Note Trust 2003-C1 C1 15.06.12/4,920%* 36.268 0,01<br />

250.000 Merrill Lynch Mortgage Trust<br />

2005-MCP1 ASB 12.06.43/4,674%* 237.265 0,09<br />

400.000 Merrill Lynch/Countrywide<br />

Commercial Mortgage Trust<br />

2006-1 A4 12.02.39/5,614%* 389.307 0,15<br />

100.000 Metropolitan Life Global<br />

Funding I 18.09.13/5,200% 97.595 0,04<br />

200.000 Monumental Global Funding II 30.07.09/4,375% 195.967 0,08<br />

150.000 Morgan Stanley 15.05.10/4,250% 145.245 0,06<br />

350.000 Morgan Stanley 15.04.11/6,750% 363.522 0,14<br />

75.000 Morgan Stanley 15.10.13/6,750% 78.122 0,03<br />

150.000 Morgan Stanley 01.04.14/4,750% 139.652 0,05<br />

250.000 Morgan Stanley Capital I<br />

2004-HQ3 A2 13.01.41/4,050% 242.361 0,10<br />

230.000 Morgan Stanley Capital I<br />

2004-T13 A4 13.09.45/4,660% 216.000 0,09<br />

279.825 Morgan Stanley Capital I<br />

2006-IQ12 A1 15.12.43/5,257% 277.662 0,11<br />

91.219 Morgan Stanley Capital I<br />

2006-T23 A1 12.08.41/5,682% 91.603 0,04<br />

557.074 Morgan Stanley Mortgage Loan<br />

Trust 2004-3 1A 25.05.19/5,000% 547.534 0,22<br />

213.627 MortgageIT Trust 2005-1 1A1 25.02.35/5,640%* 214.606 0,08<br />

30.000 Nationwide Financial Services 01.07.12/5,900% 30.249 0,01<br />

100.000 NCNB 15.09.09/9,375% 107.984 0,04<br />

150.000 New Cingular Wireless Services 01.03.11/7,875% 160.981 0,06<br />

35.000 New Cingular Wireless Services 01.03.31/8,750% 43.669 0,02<br />

100.000 New York Life Global Funding 15.01.09/3,875% 97.672 0,04<br />

200.000 New York Life Global Funding 15.09.13/5,375% 198.888 0,08<br />

15.000 News America Holdings 20.01.24/7,750% 16.210 0,01<br />

80.000 Nisource Finance 01.03.13/6,150% 80.303 0,03<br />

37.549 Nomura Asset Acceptance<br />

2003-A1 A1 25.05.33/5,500% 37.198 0,01<br />

30.681 Nomura Asset Acceptance<br />

2003-A1 A2 25.05.33/6,000% 30.618 0,01<br />

8.374 Nomura Asset Acceptance<br />

2003-A1 A5 25.04.33/7,000% 8.364 0,00<br />

19.000 Norfolk Southern 17.05.25/5,590% 17.157 0,01<br />

25.000 Odyssey Re Holdings 01.11.13/7,650% 26.334 0,01<br />

86.469 Onyx Acceptance Grantor Trust<br />

2004-C A4 15.12.11/3,500% 85.510 0,03<br />

100.000 Oracle and Ozark Holding 15.01.16/5,250% 95.790 0,04<br />

100.000 Pacific Life Global Funding 15.01.09/3,750% 97.526 0,04<br />

35.000 Pacificorp 15.09.08/4,300% 34.518 0,01<br />

45.000 Pacificorp 15.08.34/5,900% 43.076 0,02<br />

90.000 Pioneer Natural Resources 15.07.16/5,875% 81.061 0,03<br />

100.000 PNC Funding 15.11.15/5,250% 95.828 0,04<br />

75.000 Popular North America 01.04.08/4,250% 74.249 0,03<br />

150.000 Principal Life Global Funding I 26.06.08/2,800% 145.748 0,06<br />

96.849 Procter & Gamble - Esop 01.01.21/9,360% 117.762 0,05<br />

240.000 Protective Life Secured Trust 07.10.09/4,000% 232.687 0,09<br />

100.000 Protective Life Secured Trust 01.04.11/4,000% 94.690 0,04<br />

110.000 Prudential Financial 20.09.14/5,100% 105.346 0,04<br />

60.000 PSE&G Transition Funding<br />

2001-1 A6 15.06.15/6,610% 62.706 0,02<br />

45.000 PSEG Power 01.04.09/3,750% 43.643 0,02<br />

30.000 PSEG Power 15.04.11/7,750% 31.970 0,01<br />

55.000 PSEG Power 01.12.15/5,500% 53.033 0,02<br />

25.000 RBS Capital Trust I 01.07.13/4,709%* 23.197 0,01<br />

10.000 RBS Capital Trust II 03.01.34/6,425%* 9.639 0,00<br />

70.000 RBS Capital Trust III 30.09.14/5,512%* 67.036 0,03<br />

602.469 Residential Accredit Loans<br />

2003-QR19 CB4 25.10.33/5,750% 570.477 0,22<br />

831.579 Residential Accredit Loans<br />

2003-QS14 A1 25.07.18/5,000% 797.407 0,31<br />

200.000 Residential Accredit Loans<br />

2004-QS8 A2 25.06.34/5,000% 195.863 0,08<br />

59.619 Residential Accredit Loans<br />

2006-QS4 A7 25.04.36/5,456%* 61.177 0,02<br />

213 Residential Asset Mortgage<br />

Products 2001-RS3 A14 25.10.31/6,290%* 213 0,00<br />

4.069 Residential Asset Securities<br />

2002-KS4 AIIB 25.07.32/2,183%* 4.073 0,00<br />

482.486 Residential Asset Securitization<br />

Trust 2003-A13 A3 25.01.34/5,500% 474.865 0,19<br />

179<br />

Anzahl/<br />

Nennwert<br />

Bezeichnung Fälligkeit/<br />

Kupon<br />

Marktwert<br />

% des<br />

Nettovermögens<br />

230.790 Residential Funding Mortgage<br />

Securities I 2003-S7 A17 25.05.33/4,000% 215.642 0,08<br />

369.730 Residential Funding Mortgage<br />

Securities I 2004-S6 2A6 25.06.34/0,000% 250.990 0,10<br />

716.311 Residential Funding Mortgage<br />

Securities I 2004-S6 3A5 25.06.19/4,500% 681.384 0,27<br />

382.273 Residential Funding Mortgage<br />

Securities I 2005-SA4 1A1 25.09.35/5,007%* 383.372 0,15<br />

35.115 Salomon Brothers Mortgage<br />

Securities VII 2003-UP2 PO1 25.12.18/0,000% 28.655 0,01<br />

300.000 Southwestern Bell Telephone 15.07.07/6,625% 300.069 0,12<br />

35.000 Sprint Capital 01.05.19/6,900% 34.676 0,01<br />

10.000 Sprint Capital 15.03.32/8,750% 11.216 0,00<br />

100.000 State Street 15.06.10/7,650% 105.690 0,04<br />

30.000 TCI Communications 15.02.26/7,875% 33.202 0,01<br />

105.000 Textron Financial 03.02.11/5,125% 103.296 0,04<br />

100.000 Time Warner Entertainment 01.05.12/10,150% 117.353 0,05<br />

430.000 Time Warner Entertainment 15.03.23/8,375% 495.837 0,20<br />

40.950 Toyota Auto Receivables Owner<br />

Trust 2003-B A4 15.01.10/2,790% 40.941 0,02<br />

32.983 Triad Auto Receivables Owner<br />

Trust 2003-B A4 13.12.10/3,200% 32.495 0,01<br />

50.000 Union Camp 15.11.07/6,500% 50.098 0,02<br />

15.000 Union Pacific 15.01.11/6,650% 15.449 0,01<br />

75.000 Union Pacific 15.01.15/4,875% 70.024 0,03<br />

70.000 US Treasury 15.11.09/3,500% 67.780 0,03<br />

3.780.000 US Treasury 15.02.10/6,500% 3.924.113 1,54<br />

2.800.000 US Treasury 30.06.11/5,125% 2.819.031 1,11<br />

2.000.000 US Treasury 30.09.11/4,500% 1.965.625 0,77<br />

15.500.000 US Treasury 31.10.11/4,625% 15.301.406 6,02<br />

2.200.000 US Treasury 31.01.12/4,750% 2.181.437 0,86<br />

45.000 US Treasury 15.11.14/4,250% 42.877 0,02<br />

1.000.000 US Treasury 15.02.21/7,875% 1.256.250 0,49<br />

1.000.000 US Treasury (Strip) 15.05.16/0,000% 634.517 0,25<br />

200.000 US Treasury (Strip) 15.08.12/0,000% 156.098 0,06<br />

4.350.000 US Treasury (Strip) 15.11.12/0,000% 3.348.840 1,32<br />

4.500.000 US Treasury (Strip) 15.02.14/0,000% 3.226.883 1,27<br />

7.400.000 US Treasury (Strip) 15.05.14/0,000% 5.238.985 2,06<br />

4.300.000 US Treasury (Strip) 15.08.14/0,000% 3.007.415 1,18<br />

6.000.000 US Treasury (Strip) 15.11.14/0,000% 4.131.085 1,63<br />

150.000 US Treasury (Strip) 15.02.15/0,000% 102.309 0,04<br />

2.465.000 US Treasury (Strip) 15.11.15/0,000% 1.611.403 0,63<br />

1.835.000 US Treasury (Strip) 15.05.16/0,000% 1.167.868 0,46<br />

2.350.000 US Treasury (Strip) 15.11.16/0,000% 1.453.763 0,57<br />

6.075.000 US Treasury (Strip) 15.05.17/0,000% 3.647.919 1,44<br />

1.185.000 US Treasury (Strip) 15.11.17/0,000% 693.350 0,27<br />

2.000.000 US Treasury (Strip) 15.05.19/0,000% 1.072.940 0,42<br />

500.000 US Tressury (Strip) 15.02.19/0,000% 272.241 0,11<br />

1.000.000 US Treasury (Strip) 15.05.20/0,000% 509.624 0,20<br />

173.652 Vendee Mortgage Trust 1998-1<br />

2E 15.09.27/7,000% 177.382 0,07<br />

150.000 Verizon Florida 15.01.13/6,125% 151.108 0,06<br />

45.000 Verizon Global Funding 01.09.12/7,375% 48.381 0,02<br />

225.000 Verizon Maryland 01.03.12/6,125% 227.961 0,09<br />

15.000 Verizon New York 01.04.32/7,375% 15.738 0,01<br />

200.000 Verizon Virginia 15.03.13/4,625% 186.744 0,07<br />

40.000 Virginia Electric and Power 15.12.10/4,500% 38.590 0,02<br />

180.000 Wachovia Bank Commercial<br />

Mortgage Trust 2003-C9 A2 15.12.35/3,958% 176.366 0,07<br />

250.000 Wachovia Bank Commercial<br />

Mortgage Trust 2004-C15 A2 15.10.41/4,039% 241.766 0,10<br />

50.000 Wachovia Bank/Charlotte 18.08.10/7,800% 53.314 0,02<br />

500.000 Wamu Alternative Mortgage<br />

Pass-Through Certificates<br />

2005-4 CB7 25.06.35/5,500% 480.693 0,19<br />

219.469 Washington Mutual 2003-AR4<br />

A6 25.05.33/3,423%* 217.012 0,09<br />

231.751 Washington Mutual 2003-AR8<br />

A 25.08.33/4,030%* 230.619 0,09<br />

829.503 Washington Mutual 2003-S8 A4 25.09.18/4,500% 791.233 0,31<br />

1.426.451 Washington Mutual 2003-S10<br />

A5 25.10.18/5,000% 1.398.963 0,55<br />

580.736 Washington Mutual 2004-RS2<br />

A4 25.11.33/5,000% 468.851 0,18<br />

181.076 Washington Mutual 2004-S3<br />

2A3 25.07.34/10,533%* 164.291 0,06<br />

250.000 Washington Mutual<br />

Bank/Henderson 15.08.14/5,650% 243.452 0,10<br />

20.000 Wells Fargo Financial 15.07.09/6,850% 20.546 0,01<br />

250.000 Wells Fargo Mortgage Backed<br />

Securities Trust 2003-11 1A4 25.10.18/4,750% 243.095 0,10<br />

173.479 Wells Fargo Mortgage Backed<br />

Securities Trust 2004-7 2A2 25.07.19/5,000% 166.567 0,07<br />

411.945 Wells Fargo Mortgage Backed<br />

Securities Trust 2004-BB A4 25.01.35/4,555%* 405.652 0,16<br />

601.475 Wells Fargo Mortgage Backed<br />

Securities Trust 2004-EE 3A1 25.12.34/3,989%* 590.656 0,23<br />

769.908 Wells Fargo Mortgage Backed<br />

Securities Trust 2004-P 2A1 25.09.34/4,218%* 757.297 0,30