final version of the self-study document - Keuka College's Middle ...

final version of the self-study document - Keuka College's Middle ...

final version of the self-study document - Keuka College's Middle ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

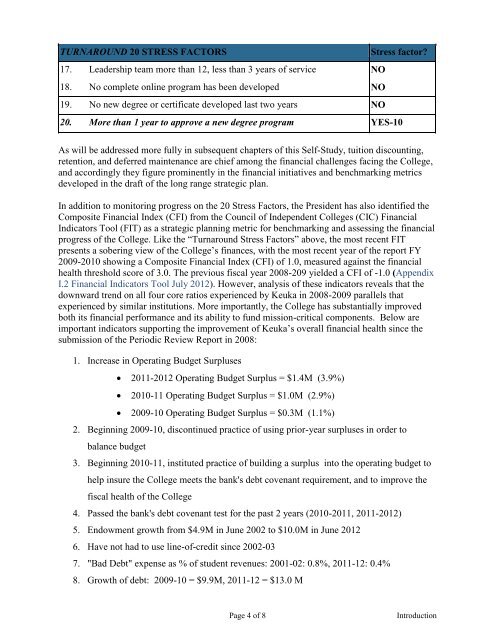

TURNAROUND 20 STRESS FACTORS Stress factor?<br />

17. Leadership team more than 12, less than 3 years <strong>of</strong> service NO<br />

18. No complete online program has been developed NO<br />

19. No new degree or certificate developed last two years NO<br />

20. More than 1 year to approve a new degree program YES-10<br />

As will be addressed more fully in subsequent chapters <strong>of</strong> this Self-Study, tuition discounting,<br />

retention, and deferred maintenance are chief among <strong>the</strong> financial challenges facing <strong>the</strong> College,<br />

and accordingly <strong>the</strong>y figure prominently in <strong>the</strong> financial initiatives and benchmarking metrics<br />

developed in <strong>the</strong> draft <strong>of</strong> <strong>the</strong> long range strategic plan.<br />

In addition to monitoring progress on <strong>the</strong> 20 Stress Factors, <strong>the</strong> President has also identified <strong>the</strong><br />

Composite Financial Index (CFI) from <strong>the</strong> Council <strong>of</strong> Independent Colleges (CIC) Financial<br />

Indicators Tool (FIT) as a strategic planning metric for benchmarking and assessing <strong>the</strong> financial<br />

progress <strong>of</strong> <strong>the</strong> College. Like <strong>the</strong> “Turnaround Stress Factors” above, <strong>the</strong> most recent FIT<br />

presents a sobering view <strong>of</strong> <strong>the</strong> College’s finances, with <strong>the</strong> most recent year <strong>of</strong> <strong>the</strong> report FY<br />

2009-2010 showing a Composite Financial Index (CFI) <strong>of</strong> 1.0, measured against <strong>the</strong> financial<br />

health threshold score <strong>of</strong> 3.0. The previous fiscal year 2008-209 yielded a CFI <strong>of</strong> -1.0 (Appendix<br />

I.2 Financial Indicators Tool July 2012). However, analysis <strong>of</strong> <strong>the</strong>se indicators reveals that <strong>the</strong><br />

downward trend on all four core ratios experienced by <strong>Keuka</strong> in 2008-2009 parallels that<br />

experienced by similar institutions. More importantly, <strong>the</strong> College has substantially improved<br />

both its financial performance and its ability to fund mission-critical components. Below are<br />

important indicators supporting <strong>the</strong> improvement <strong>of</strong> <strong>Keuka</strong>’s overall financial health since <strong>the</strong><br />

submission <strong>of</strong> <strong>the</strong> Periodic Review Report in 2008:<br />

1. Increase in Operating Budget Surpluses<br />

2011-2012 Operating Budget Surplus = $1.4M (3.9%)<br />

2010-11 Operating Budget Surplus = $1.0M (2.9%)<br />

2009-10 Operating Budget Surplus = $0.3M (1.1%)<br />

2. Beginning 2009-10, discontinued practice <strong>of</strong> using prior-year surpluses in order to<br />

balance budget<br />

3. Beginning 2010-11, instituted practice <strong>of</strong> building a surplus into <strong>the</strong> operating budget to<br />

help insure <strong>the</strong> College meets <strong>the</strong> bank's debt covenant requirement, and to improve <strong>the</strong><br />

fiscal health <strong>of</strong> <strong>the</strong> College<br />

4. Passed <strong>the</strong> bank's debt covenant test for <strong>the</strong> past 2 years (2010-2011, 2011-2012)<br />

5. Endowment growth from $4.9M in June 2002 to $10.0M in June 2012<br />

6. Have not had to use line-<strong>of</strong>-credit since 2002-03<br />

7. "Bad Debt" expense as % <strong>of</strong> student revenues: 2001-02: 0.8%, 2011-12: 0.4%<br />

8. Growth <strong>of</strong> debt: 2009-10 = $9.9M, 2011-12 = $13.0 M<br />

Page 4 <strong>of</strong> 8 Introduction