INDUSTRIAL LAND IN A POST-INDUSTRIAL CITY District of ...

INDUSTRIAL LAND IN A POST-INDUSTRIAL CITY District of ...

INDUSTRIAL LAND IN A POST-INDUSTRIAL CITY District of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>District</strong> <strong>of</strong> Columbia Industrial Areas Study DC Office <strong>of</strong> Planning<br />

Prepared by Phillips Preiss Shapiro Associates, Inc.<br />

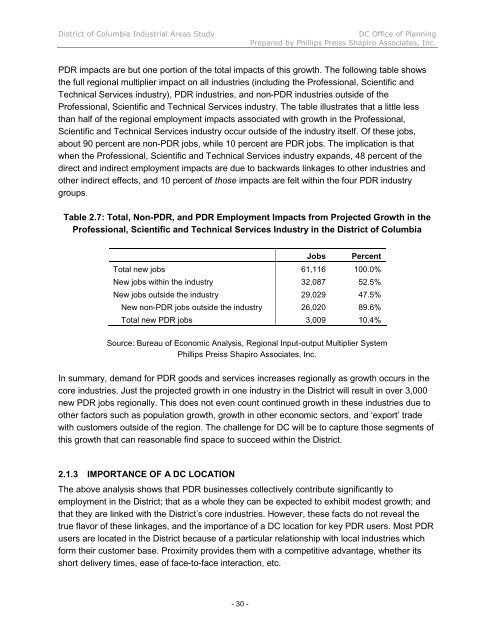

PDR impacts are but one portion <strong>of</strong> the total impacts <strong>of</strong> this growth. The following table shows<br />

the full regional multiplier impact on all industries (including the Pr<strong>of</strong>essional, Scientific and<br />

Technical Services industry), PDR industries, and non-PDR industries outside <strong>of</strong> the<br />

Pr<strong>of</strong>essional, Scientific and Technical Services industry. The table illustrates that a little less<br />

than half <strong>of</strong> the regional employment impacts associated with growth in the Pr<strong>of</strong>essional,<br />

Scientific and Technical Services industry occur outside <strong>of</strong> the industry itself. Of these jobs,<br />

about 90 percent are non-PDR jobs, while 10 percent are PDR jobs. The implication is that<br />

when the Pr<strong>of</strong>essional, Scientific and Technical Services industry expands, 48 percent <strong>of</strong> the<br />

direct and indirect employment impacts are due to backwards linkages to other industries and<br />

other indirect effects, and 10 percent <strong>of</strong> those impacts are felt within the four PDR industry<br />

groups.<br />

Table 2.7: Total, Non-PDR, and PDR Employment Impacts from Projected Growth in the<br />

Pr<strong>of</strong>essional, Scientific and Technical Services Industry in the <strong>District</strong> <strong>of</strong> Columbia<br />

- 30 -<br />

Jobs Percent<br />

Total new jobs 61,116 100.0%<br />

New jobs within the industry 32,087 52.5%<br />

New jobs outside the industry 29,029 47.5%<br />

New non-PDR jobs outside the industry 26,020 89.6%<br />

Total new PDR jobs 3,009 10.4%<br />

Source: Bureau <strong>of</strong> Economic Analysis, Regional Input-output Multiplier System<br />

Phillips Preiss Shapiro Associates, Inc.<br />

In summary, demand for PDR goods and services increases regionally as growth occurs in the<br />

core industries. Just the projected growth in one industry in the <strong>District</strong> will result in over 3,000<br />

new PDR jobs regionally. This does not even count continued growth in these industries due to<br />

other factors such as population growth, growth in other economic sectors, and ‘export’ trade<br />

with customers outside <strong>of</strong> the region. The challenge for DC will be to capture those segments <strong>of</strong><br />

this growth that can reasonable find space to succeed within the <strong>District</strong>.<br />

2.1.3 IMPORTANCE OF A DC LOCATION<br />

The above analysis shows that PDR businesses collectively contribute significantly to<br />

employment in the <strong>District</strong>; that as a whole they can be expected to exhibit modest growth; and<br />

that they are linked with the <strong>District</strong>’s core industries. However, these facts do not reveal the<br />

true flavor <strong>of</strong> these linkages, and the importance <strong>of</strong> a DC location for key PDR users. Most PDR<br />

users are located in the <strong>District</strong> because <strong>of</strong> a particular relationship with local industries which<br />

form their customer base. Proximity provides them with a competitive advantage, whether its<br />

short delivery times, ease <strong>of</strong> face-to-face interaction, etc.