INDUSTRIAL LAND IN A POST-INDUSTRIAL CITY District of ...

INDUSTRIAL LAND IN A POST-INDUSTRIAL CITY District of ...

INDUSTRIAL LAND IN A POST-INDUSTRIAL CITY District of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>District</strong> <strong>of</strong> Columbia Industrial Areas Study DC Office <strong>of</strong> Planning<br />

Prepared by Phillips Preiss Shapiro Associates, Inc.<br />

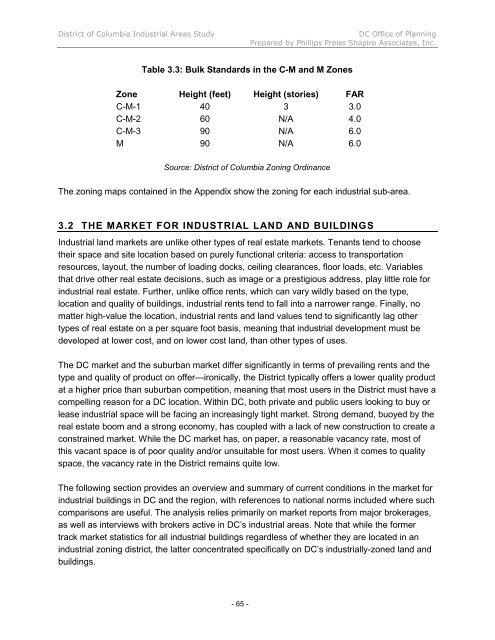

Table 3.3: Bulk Standards in the C-M and M Zones<br />

Zone Height (feet) Height (stories) FAR<br />

C-M-1 40 3 3.0<br />

C-M-2 60 N/A 4.0<br />

C-M-3 90 N/A 6.0<br />

M 90 N/A 6.0<br />

Source: <strong>District</strong> <strong>of</strong> Columbia Zoning Ordinance<br />

The zoning maps contained in the Appendix show the zoning for each industrial sub-area.<br />

3.2 THE MARKET FOR <strong><strong>IN</strong>DUSTRIAL</strong> <strong>LAND</strong> AND BUILD<strong>IN</strong>GS<br />

Industrial land markets are unlike other types <strong>of</strong> real estate markets. Tenants tend to choose<br />

their space and site location based on purely functional criteria: access to transportation<br />

resources, layout, the number <strong>of</strong> loading docks, ceiling clearances, floor loads, etc. Variables<br />

that drive other real estate decisions, such as image or a prestigious address, play little role for<br />

industrial real estate. Further, unlike <strong>of</strong>fice rents, which can vary wildly based on the type,<br />

location and quality <strong>of</strong> buildings, industrial rents tend to fall into a narrower range. Finally, no<br />

matter high-value the location, industrial rents and land values tend to significantly lag other<br />

types <strong>of</strong> real estate on a per square foot basis, meaning that industrial development must be<br />

developed at lower cost, and on lower cost land, than other types <strong>of</strong> uses.<br />

The DC market and the suburban market differ significantly in terms <strong>of</strong> prevailing rents and the<br />

type and quality <strong>of</strong> product on <strong>of</strong>fer—ironically, the <strong>District</strong> typically <strong>of</strong>fers a lower quality product<br />

at a higher price than suburban competition, meaning that most users in the <strong>District</strong> must have a<br />

compelling reason for a DC location. Within DC, both private and public users looking to buy or<br />

lease industrial space will be facing an increasingly tight market. Strong demand, buoyed by the<br />

real estate boom and a strong economy, has coupled with a lack <strong>of</strong> new construction to create a<br />

constrained market. While the DC market has, on paper, a reasonable vacancy rate, most <strong>of</strong><br />

this vacant space is <strong>of</strong> poor quality and/or unsuitable for most users. When it comes to quality<br />

space, the vacancy rate in the <strong>District</strong> remains quite low.<br />

The following section provides an overview and summary <strong>of</strong> current conditions in the market for<br />

industrial buildings in DC and the region, with references to national norms included where such<br />

comparisons are useful. The analysis relies primarily on market reports from major brokerages,<br />

as well as interviews with brokers active in DC’s industrial areas. Note that while the former<br />

track market statistics for all industrial buildings regardless <strong>of</strong> whether they are located in an<br />

industrial zoning district, the latter concentrated specifically on DC’s industrially-zoned land and<br />

buildings.<br />

- 65 -