ASEAN: Regional Trends in Economic Integration, Export ... - USITC

ASEAN: Regional Trends in Economic Integration, Export ... - USITC

ASEAN: Regional Trends in Economic Integration, Export ... - USITC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

has a healthcare MOU with Cambodia. 49 These MOUs are <strong>in</strong>tended to <strong>in</strong>crease the<br />

cooperation <strong>in</strong> healthcare services between the respective countries across a number of<br />

areas, <strong>in</strong>clud<strong>in</strong>g tra<strong>in</strong><strong>in</strong>g, research, <strong>in</strong>vestment, and the spread of <strong>in</strong>fectious diseases.<br />

<strong>Export</strong> Competitiveness<br />

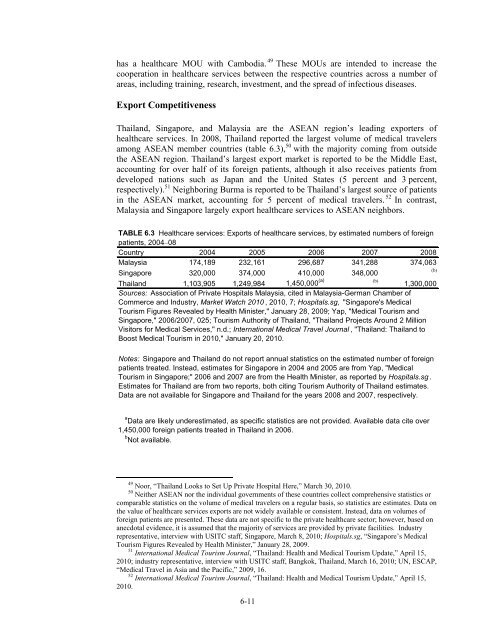

Thailand, S<strong>in</strong>gapore, and Malaysia are the <strong>ASEAN</strong> region’s lead<strong>in</strong>g exporters of<br />

healthcare services. In 2008, Thailand reported the largest volume of medical travelers<br />

among <strong>ASEAN</strong> member countries (table 6.3), 50 with the majority com<strong>in</strong>g from outside<br />

the <strong>ASEAN</strong> region. Thailand’s largest export market is reported to be the Middle East,<br />

account<strong>in</strong>g for over half of its foreign patients, although it also receives patients from<br />

developed nations such as Japan and the United States (5 percent and 3 percent,<br />

respectively). 51 Neighbor<strong>in</strong>g Burma is reported to be Thailand’s largest source of patients<br />

<strong>in</strong> the <strong>ASEAN</strong> market, account<strong>in</strong>g for 5 percent of medical travelers. 52 In contrast,<br />

Malaysia and S<strong>in</strong>gapore largely export healthcare services to <strong>ASEAN</strong> neighbors.<br />

TABLE 6.3 Healthcare services: <strong>Export</strong>s of healthcare services, by estimated numbers of foreign<br />

patients, 2004–08<br />

Country 2004 2005 2006 2007 2008<br />

Malaysia 174,189 232,161 296,687 341,288 374,063<br />

S<strong>in</strong>gapore 320,000 374,000 410,000 348,000<br />

(b)<br />

Thailand 1,103,905 1,249,984 1,450,000 (a) (b) 1,300,000<br />

Sources: Association of Private Hospitals Malaysia, cited <strong>in</strong> Malaysia-German Chamber of<br />

Commerce and Industry, Market Watch 2010 , 2010, 7; Hospitals.sg, "S<strong>in</strong>gapore's Medical<br />

Tourism Figures Revealed by Health M<strong>in</strong>ister," January 28, 2009; Yap, "Medical Tourism and<br />

S<strong>in</strong>gapore," 2006/2007, 025; Tourism Authority of Thailand, "Thailand Projects Around 2 Million<br />

Visitors for Medical Services," n.d.; International Medical Travel Journal , "Thailand: Thailand to<br />

Boost Medical Tourism <strong>in</strong> 2010," January 20, 2010.<br />

Notes: S<strong>in</strong>gapore and Thailand do not report annual statistics on the estimated number of foreign<br />

patients treated. Instead, estimates for S<strong>in</strong>gapore <strong>in</strong> 2004 and 2005 are from Yap, "Medical<br />

Tourism <strong>in</strong> S<strong>in</strong>gapore;" 2006 and 2007 are from the Health M<strong>in</strong>ister, as reported by Hospitals.sg .<br />

Estimates for Thailand are from two reports, both cit<strong>in</strong>g Tourism Authority of Thailand estimates.<br />

Data are not available for S<strong>in</strong>gapore and Thailand for the years 2008 and 2007, respectively.<br />

a Data are likely underestimated, as specific statistics are not provided. Available data cite over<br />

1,450,000 foreign patients treated <strong>in</strong> Thailand <strong>in</strong> 2006.<br />

b Not available.<br />

49 Noor, “Thailand Looks to Set Up Private Hospital Here,” March 30, 2010.<br />

50 Neither <strong>ASEAN</strong> nor the <strong>in</strong>dividual governments of these countries collect comprehensive statistics or<br />

comparable statistics on the volume of medical travelers on a regular basis, so statistics are estimates. Data on<br />

the value of healthcare services exports are not widely available or consistent. Instead, data on volumes of<br />

foreign patients are presented. These data are not specific to the private healthcare sector; however, based on<br />

anecdotal evidence, it is assumed that the majority of services are provided by private facilities. Industry<br />

representative, <strong>in</strong>terview with <strong>USITC</strong> staff, S<strong>in</strong>gapore, March 8, 2010; Hospitals.sg, “S<strong>in</strong>gapore’s Medical<br />

Tourism Figures Revealed by Health M<strong>in</strong>ister,” January 28, 2009.<br />

51 International Medical Tourism Journal, “Thailand: Health and Medical Tourism Update,” April 15,<br />

2010; <strong>in</strong>dustry representative, <strong>in</strong>terview with <strong>USITC</strong> staff, Bangkok, Thailand, March 16, 2010; UN, ESCAP,<br />

“Medical Travel <strong>in</strong> Asia and the Pacific,” 2009, 16.<br />

52 International Medical Tourism Journal, “Thailand: Health and Medical Tourism Update,” April 15,<br />

2010.<br />

6-11