ASEAN: Regional Trends in Economic Integration, Export ... - USITC

ASEAN: Regional Trends in Economic Integration, Export ... - USITC

ASEAN: Regional Trends in Economic Integration, Export ... - USITC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

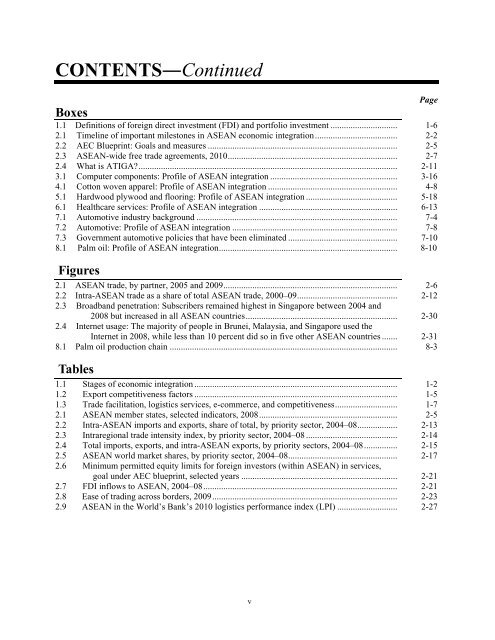

CONTENTS―Cont<strong>in</strong>ued<br />

Page<br />

Boxes<br />

1.1 Def<strong>in</strong>itions of foreign direct <strong>in</strong>vestment (FDI) and portfolio <strong>in</strong>vestment .............................. 1-6<br />

2.1 Timel<strong>in</strong>e of important milestones <strong>in</strong> <strong>ASEAN</strong> economic <strong>in</strong>tegration ..................................... 2-2<br />

2.2 AEC Bluepr<strong>in</strong>t: Goals and measures ..................................................................................... 2-5<br />

2.3 <strong>ASEAN</strong>-wide free trade agreements, 2010 ............................................................................ 2-7<br />

2.4 What is ATIGA? .................................................................................................................... 2-11<br />

3.1 Computer components: Profile of <strong>ASEAN</strong> <strong>in</strong>tegration ......................................................... 3-16<br />

4.1 Cotton woven apparel: Profile of <strong>ASEAN</strong> <strong>in</strong>tegration .......................................................... 4-8<br />

5.1 Hardwood plywood and floor<strong>in</strong>g: Profile of <strong>ASEAN</strong> <strong>in</strong>tegration ......................................... 5-18<br />

6.1 Healthcare services: Profile of <strong>ASEAN</strong> <strong>in</strong>tegration .............................................................. 6-13<br />

7.1 Automotive <strong>in</strong>dustry background .......................................................................................... 7-4<br />

7.2 Automotive: Profile of <strong>ASEAN</strong> <strong>in</strong>tegration .......................................................................... 7-8<br />

7.3 Government automotive policies that have been elim<strong>in</strong>ated ................................................. 7-10<br />

8.1 Palm oil: Profile of <strong>ASEAN</strong> <strong>in</strong>tegration ................................................................................ 8-10<br />

Figures<br />

2.1 <strong>ASEAN</strong> trade, by partner, 2005 and 2009 .............................................................................. 2-6<br />

2.2 Intra-<strong>ASEAN</strong> trade as a share of total <strong>ASEAN</strong> trade, 2000–09 ............................................. 2-12<br />

2.3 Broadband penetration: Subscribers rema<strong>in</strong>ed highest <strong>in</strong> S<strong>in</strong>gapore between 2004 and<br />

2008 but <strong>in</strong>creased <strong>in</strong> all <strong>ASEAN</strong> countries .................................................................... 2-30<br />

2.4 Internet usage: The majority of people <strong>in</strong> Brunei, Malaysia, and S<strong>in</strong>gapore used the<br />

Internet <strong>in</strong> 2008, while less than 10 percent did so <strong>in</strong> five other <strong>ASEAN</strong> countries ....... 2-31<br />

8.1 Palm oil production cha<strong>in</strong> ...................................................................................................... 8-3<br />

Tables<br />

1.1 Stages of economic <strong>in</strong>tegration ........................................................................................... 1-2<br />

1.2 <strong>Export</strong> competitiveness factors ........................................................................................... 1-5<br />

1.3 Trade facilitation, logistics services, e-commerce, and competitiveness ............................ 1-7<br />

2.1 <strong>ASEAN</strong> member states, selected <strong>in</strong>dicators, 2008 .............................................................. 2-5<br />

2.2 Intra-<strong>ASEAN</strong> imports and exports, share of total, by priority sector, 2004–08 .................. 2-13<br />

2.3 Intraregional trade <strong>in</strong>tensity <strong>in</strong>dex, by priority sector, 2004–08 ......................................... 2-14<br />

2.4 Total imports, exports, and <strong>in</strong>tra-<strong>ASEAN</strong> exports, by priority sectors, 2004–08 ............... 2-15<br />

2.5 <strong>ASEAN</strong> world market shares, by priority sector, 2004–08 ................................................. 2-17<br />

2.6 M<strong>in</strong>imum permitted equity limits for foreign <strong>in</strong>vestors (with<strong>in</strong> <strong>ASEAN</strong>) <strong>in</strong> services,<br />

goal under AEC bluepr<strong>in</strong>t, selected years ...................................................................... 2-21<br />

2.7 FDI <strong>in</strong>flows to <strong>ASEAN</strong>, 2004–08 ....................................................................................... 2-21<br />

2.8 Ease of trad<strong>in</strong>g across borders, 2009 ................................................................................... 2-23<br />

2.9 <strong>ASEAN</strong> <strong>in</strong> the World’s Bank’s 2010 logistics performance <strong>in</strong>dex (LPI) ........................... 2-27<br />

v