NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 107<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

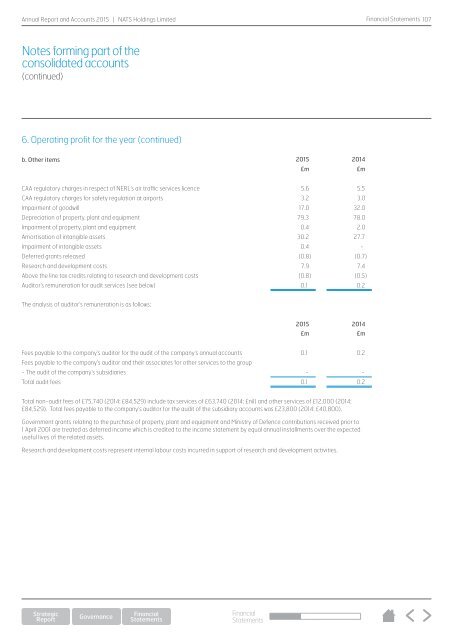

6. Operating profit for the year (continued)<br />

b. Other items <strong>2015</strong> 2014<br />

£m £m<br />

CAA regulatory charges in respect of NERL’s air traffic services licence 5.6 5.5<br />

CAA regulatory charges for safety regulation at airports 3.2 3.0<br />

Impairment of goodwill 17.0 32.0<br />

Depreciation of property, plant and equipment 79.3 78.0<br />

Impairment of property, plant and equipment 0.4 2.0<br />

Amortisation of intangible assets 30.2 27.7<br />

Impairment of intangible assets 0.4 -<br />

Deferred grants released (0.8) (0.7)<br />

Research and development costs 7.9 7.4<br />

Above the line tax credits relating to research and development costs (0.8) (0.5)<br />

Auditor’s remuneration for audit services (see below) 0.1 0.2<br />

The analysis of auditor’s remuneration is as follows:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Fees payable to the company’s auditor for the audit of the company’s annual accounts 0.1 0.2<br />

Fees payable to the company’s auditor and their associates for other services to the group<br />

- The audit of the company’s subsidiaries - -<br />

Total audit fees 0.1 0.2<br />

Total non-audit fees of £75,740 (2014: £84,529) include tax services of £63,740 (2014: £nil) and other services of £12,000 (2014:<br />

£84,529). Total fees payable to the company’s auditor for the audit of the subsidiary accounts was £23,800 (2014: £40,800).<br />

Government grants relating to the purchase of property, plant and equipment and Ministry of Defence contributions received prior to<br />

1 April 2001 are treated as deferred income which is credited to the income statement by equal annual installments over the expected<br />

useful lives of the related assets.<br />

Research and development costs represent internal labour costs incurred in support of research and development activities.<br />

Financial<br />

Statements