NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 115<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

16. Financial and other assets (continued)<br />

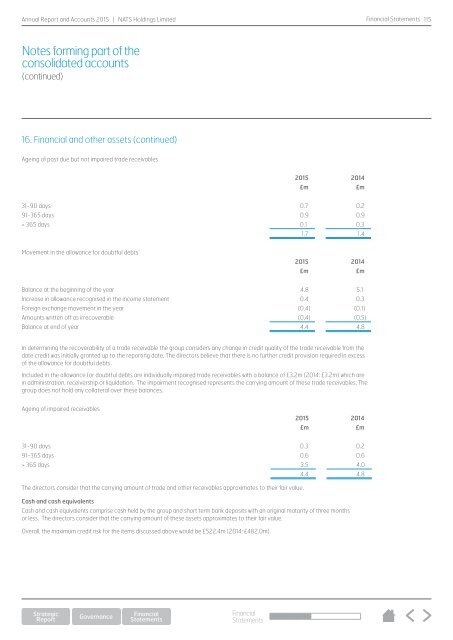

Ageing of past due but not impaired trade receivables<br />

<strong>2015</strong> 2014<br />

£m £m<br />

31-90 days 0.7 0.2<br />

91-365 days 0.9 0.9<br />

> 365 days 0.1 0.3<br />

1.7 1.4<br />

Movement in the allowance for doubtful debts<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Balance at the beginning of the year 4.8 5.1<br />

Increase in allowance recognised in the income statement 0.4 0.3<br />

Foreign exchange movement in the year (0.4) (0.1)<br />

Amounts written off as irrecoverable (0.4) (0.5)<br />

Balance at end of year 4.4 4.8<br />

In determining the recoverability of a trade receivable the group considers any change in credit quality of the trade receivable from the<br />

date credit was initially granted up to the reporting date. The directors believe that there is no further credit provision required in excess<br />

of the allowance for doubtful debts.<br />

Included in the allowance for doubtful debts are individually impaired trade receivables with a balance of £3.2m (2014: £3.2m) which are<br />

in administration, receivership or liquidation. The impairment recognised represents the carrying amount of these trade receivables. The<br />

group does not hold any collateral over these balances.<br />

Ageing of impaired receivables<br />

<strong>2015</strong> 2014<br />

£m £m<br />

31-90 days 0.3 0.2<br />

91-365 days 0.6 0.6<br />

> 365 days 3.5 4.0<br />

The directors consider that the carrying amount of trade and other receivables approximates to their fair value.<br />

4.4 4.8<br />

Cash and cash equivalents<br />

Cash and cash equivalents comprise cash held by the group and short term bank deposits with an original maturity of three months<br />

or less. The directors consider that the carrying amount of these assets approximates to their fair value.<br />

Overall, the maximum credit risk for the items discussed above would be £522.4m (2014: £482.0m).<br />

Financial<br />

Statements