NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 134<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

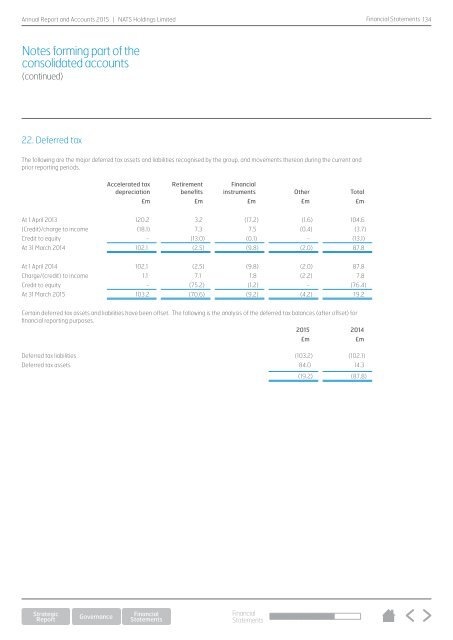

22. Deferred tax<br />

The following are the major deferred tax assets and liabilities recognised by the group, and movements thereon during the current and<br />

prior reporting periods.<br />

Accelerated tax<br />

depreciation<br />

Retirement<br />

benefits<br />

Financial<br />

instruments Other Total<br />

£m £m £m £m £m<br />

At 1 April 2013 120.2 3.2 (17.2) (1.6) 104.6<br />

(Credit)/charge to income (18.1) 7.3 7.5 (0.4) (3.7)<br />

Credit to equity - (13.0) (0.1) - (13.1)<br />

At 31 March 2014 102.1 (2.5) (9.8) (2.0) 87.8<br />

At 1 April 2014 102.1 (2.5) (9.8) (2.0) 87.8<br />

Charge/(credit) to income 1.1 7.1 1.8 (2.2) 7.8<br />

Credit to equity - (75.2) (1.2) - (76.4)<br />

At 31 March <strong>2015</strong> 103.2 (70.6) (9.2) (4.2) 19.2<br />

Certain deferred tax assets and liabilities have been offset. The following is the analysis of the deferred tax balances (after offset) for<br />

financial reporting purposes.<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Deferred tax liabilities (103.2) (102.1)<br />

Deferred tax assets 84.0 14.3<br />

(19.2) (87.8)<br />

Financial<br />

Statements