NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 120<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

19. Financial instruments (continued)<br />

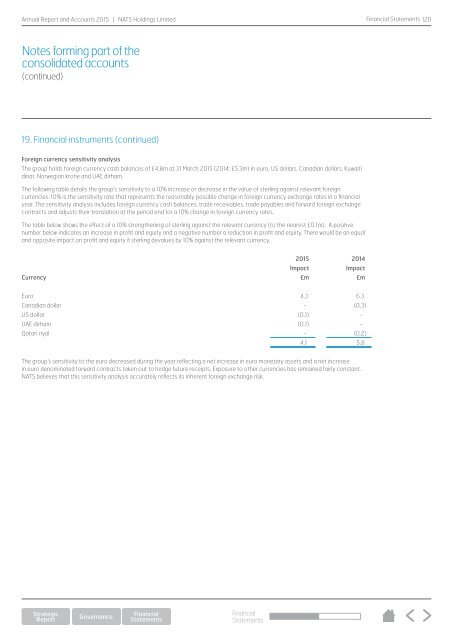

Foreign currency sensitivity analysis<br />

The group holds foreign currency cash balances of £4.8m at 31 March <strong>2015</strong> (2014: £5.3m) in euro, US dollars, Canadian dollars, Kuwaiti<br />

dinar, Norwegian krone and UAE dirham.<br />

The following table details the group’s sensitivity to a 10% increase or decrease in the value of sterling against relevant foreign<br />

currencies. 10% is the sensitivity rate that represents the reasonably possible change in foreign currency exchange rates in a financial<br />

year. The sensitivity analysis includes foreign currency cash balances, trade receivables, trade payables and forward foreign exchange<br />

contracts and adjusts their translation at the period end for a 10% change in foreign currency rates.<br />

The table below shows the effect of a 10% strengthening of sterling against the relevant currency (to the nearest £0.1m). A positive<br />

number below indicates an increase in profit and equity and a negative number a reduction in profit and equity. There would be an equal<br />

and opposite impact on profit and equity if sterling devalues by 10% against the relevant currency.<br />

<strong>2015</strong> 2014<br />

Impact<br />

Impact<br />

Currency £m £m<br />

Euro 4.3 6.3<br />

Canadian dollar - (0.3)<br />

US dollar (0.1) -<br />

UAE dirham (0.1) -<br />

Qatari riyal - (0.2)<br />

4.1 5.8<br />

The group’s sensitivity to the euro decreased during the year reflecting a net increase in euro monetary assets and a net increase<br />

in euro denominated forward contracts taken out to hedge future receipts. Exposure to other currencies has remained fairly constant.<br />

<strong>NATS</strong> believes that this sensitivity analysis accurately reflects its inherent foreign exchange risk.<br />

Financial<br />

Statements