NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 125<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

19. Financial instruments (continued)<br />

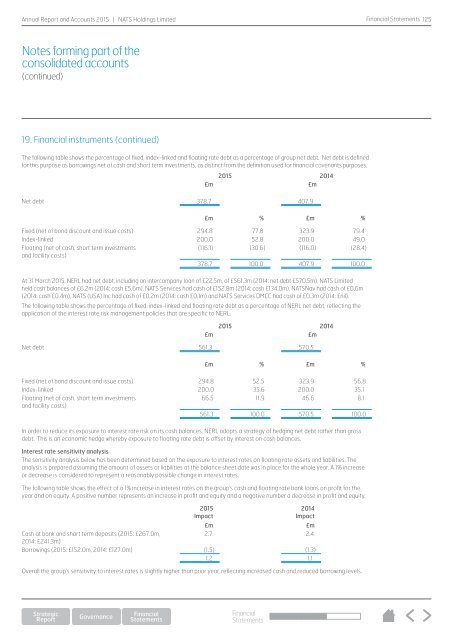

The following table shows the percentage of fixed, index-linked and floating rate debt as a percentage of group net debt. Net debt is defined<br />

for this purpose as borrowings net of cash and short term investments, as distinct from the definition used for financial covenants purposes.<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Net debt 378.7 407.9<br />

£m % £m %<br />

Fixed (net of bond discount and issue costs) 294.8 77.8 323.9 79.4<br />

Index-linked 200.0 52.8 200.0 49.0<br />

Floating (net of cash, short term investments<br />

(116.1) (30.6) (116.0) (28.4)<br />

and facility costs)<br />

378.7 100.0 407.9 100.0<br />

At 31 March <strong>2015</strong>, NERL had net debt, including an intercompany loan of £22.5m, of £561.3m (2014: net debt £570.5m), <strong>NATS</strong> Limited<br />

held cash balances of £6.2m (2014: cash £5.6m), <strong>NATS</strong> Services had cash of £152.8m (2014: cash £134.0m), <strong>NATS</strong>Nav had cash of £0.6m<br />

(2014: cash £0.4m), <strong>NATS</strong> (USA) Inc had cash of £0.2m (2014: cash £0.1m) and <strong>NATS</strong> Services DMCC had cash of £0.3m (2014: £nil).<br />

The following table shows the percentage of fixed, index-linked and floating rate debt as a percentage of NERL net debt, reflecting the<br />

application of the interest rate risk management policies that are specific to NERL.<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Net debt 561.3 570.5<br />

£m % £m %<br />

Fixed (net of bond discount and issue costs) 294.8 52.5 323.9 56.8<br />

Index-linked 200.0 35.6 200.0 35.1<br />

Floating (net of cash, short term investments<br />

66.5 11.9 46.6 8.1<br />

and facility costs)<br />

561.3 100.0 570.5 100.0<br />

In order to reduce its exposure to interest rate risk on its cash balances, NERL adopts a strategy of hedging net debt rather than gross<br />

debt. This is an economic hedge whereby exposure to floating rate debt is offset by interest on cash balances.<br />

Interest rate sensitivity analysis<br />

The sensitivity analysis below has been determined based on the exposure to interest rates on floating rate assets and liabilities. The<br />

analysis is prepared assuming the amount of assets or liabilities at the balance sheet date was in place for the whole year. A 1% increase<br />

or decrease is considered to represent a reasonably possible change in interest rates.<br />

The following table shows the effect of a 1% increase in interest rates on the group’s cash and floating rate bank loans on profit for the<br />

year and on equity. A positive number represents an increase in profit and equity and a negative number a decrease in profit and equity.<br />

<strong>2015</strong><br />

Impact<br />

2014<br />

Impact<br />

£m £m<br />

Cash at bank and short term deposits (<strong>2015</strong>: £267.0m,<br />

2.7 2.4<br />

2014: £241.3m)<br />

Borrowings (<strong>2015</strong>: £152.0m, 2014: £127.0m) (1.5) (1.3)<br />

1.2 1.1<br />

Overall the group’s sensitivity to interest rates is slightly higher than prior year, reflecting increased cash and reduced borrowing levels.<br />

Financial<br />

Statements