NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 130<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

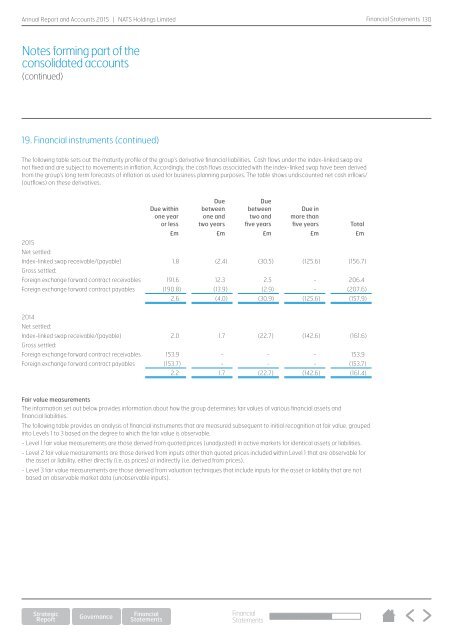

19. Financial instruments (continued)<br />

The following table sets out the maturity profile of the group’s derivative financial liabilities. Cash flows under the index-linked swap are<br />

not fixed and are subject to movements in inflation. Accordingly, the cash flows associated with the index-linked swap have been derived<br />

from the group’s long term forecasts of inflation as used for business planning purposes. The table shows undiscounted net cash inflows/<br />

(outflows) on these derivatives.<br />

Due within<br />

one year<br />

or less<br />

Due<br />

between<br />

one and<br />

two years<br />

Due<br />

between<br />

two and<br />

five years<br />

Due in<br />

more than<br />

five years<br />

Total<br />

£m £m £m £m £m<br />

<strong>2015</strong><br />

Net settled:<br />

Index-linked swap receivable/(payable) 1.8 (2.4) (30.5) (125.6) (156.7)<br />

Gross settled:<br />

Foreign exchange forward contract receivables 191.6 12.3 2.5 - 206.4<br />

Foreign exchange forward contract payables (190.8) (13.9) (2.9) - (207.6)<br />

2.6 (4.0) (30.9) (125.6) (157.9)<br />

2014<br />

Net settled:<br />

Index-linked swap receivable/(payable) 2.0 1.7 (22.7) (142.6) (161.6)<br />

Gross settled:<br />

Foreign exchange forward contract receivables 153.9 - - - 153.9<br />

Foreign exchange forward contract payables (153.7) - - - (153.7)<br />

2.2 1.7 (22.7) (142.6) (161.4)<br />

Fair value measurements<br />

The information set out below provides information about how the group determines fair values of various financial assets and<br />

financial liabilities.<br />

The following table provides an analysis of financial instruments that are measured subsequent to initial recognition at fair value, grouped<br />

into Levels 1 to 3 based on the degree to which the fair value is observable.<br />

- Level 1 fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets or liabilities.<br />

- Level 2 fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are observable for<br />

the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).<br />

- Level 3 fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are not<br />

based on observable market data (unobservable inputs).<br />

Financial<br />

Statements