NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 126<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

19. Financial instruments (continued)<br />

Inflation rate risk<br />

The regulatory charge control conditions that apply to NERL‘s UK en route and North Atlantic services determines a revenue allowance<br />

for financing charges that is linked to inflation (now CPI but previously RPI). To achieve an economic hedge of part of this income, in<br />

August 2003 coincident with the issue of its £600m 5.25% fixed rate bond, NERL entered into an amortising index-linked swap with a<br />

notional principal of £200m for the period up to March 2017 reducing semi-annually thereafter and expiring in March 2026. Under the<br />

terms of this swap, NERL receives fixed interest at 5.25% and pays interest at a rate of 3.43% adjusted for the movement in RPI. The<br />

index-linked swap cannot be designated as a cash flow hedge under IFRS, although it provides an economic hedge of certain of NERL‘s<br />

inflation-linked revenues.<br />

The value of the notional principal of £200m of the index-linked swap is also linked to movements in RPI. Commencing on 31 March<br />

2017, semi-annual payments will be made relating to the inflation uplift on the amortisation of the notional principal.<br />

Inflation rate sensitivity analysis<br />

The sensitivity analysis below has been determined based on the exposure to breakeven inflation arising from the index-linked swap.<br />

The difference between fixed rate and index-linked gilts reflects the market‘s expectations of future RPI and is a proxy for the breakeven<br />

inflation rate. The analysis is prepared assuming that the index-linked swap at the balance sheet date was in place for the whole year.<br />

A 1% increase or decrease in breakeven inflation is considered to represent a reasonably possible change in inflation. An increase in<br />

the rate of RPI will increase the future index-linked payments that NERL is required to make under the swap contract and so impacts its<br />

mark to market value.<br />

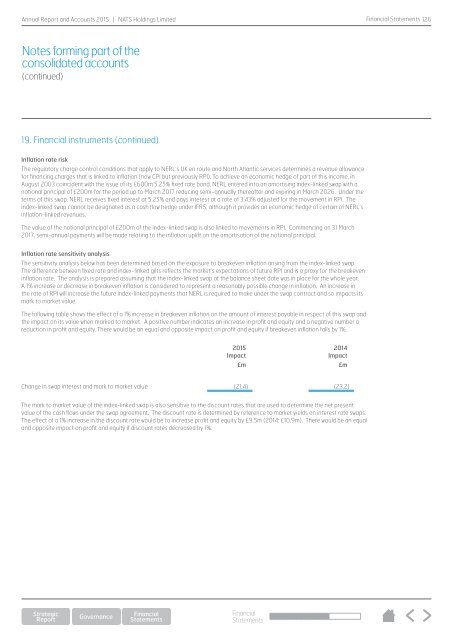

The following table shows the effect of a 1% increase in breakeven inflation on the amount of interest payable in respect of this swap and<br />

the impact on its value when marked to market. A positive number indicates an increase in profit and equity and a negative number a<br />

reduction in profit and equity. There would be an equal and opposite impact on profit and equity if breakeven inflation falls by 1%.<br />

<strong>2015</strong><br />

Impact<br />

2014<br />

Impact<br />

£m £m<br />

Change in swap interest and mark to market value (21.4) (23.2)<br />

The mark to market value of the index-linked swap is also sensitive to the discount rates that are used to determine the net present<br />

value of the cash flows under the swap agreement. The discount rate is determined by reference to market yields on interest rate swaps.<br />

The effect of a 1% increase in the discount rate would be to increase profit and equity by £9.5m (2014: £10.9m). There would be an equal<br />

and opposite impact on profit and equity if discount rates decreased by 1%.<br />

Financial<br />

Statements