NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 118<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

19. Financial instruments<br />

Capital risk management<br />

The group manages its capital to ensure that entities in the group are able to continue as going concerns, to ensure that NERL is able to<br />

meet its obligations under the air traffic services licence, for <strong>NATS</strong> Services to meet obligations to its customers, and to fund returns to<br />

shareholders.<br />

The capital structure of the group consists of debt as disclosed in note 17, cash and cash equivalents and short term investments, as<br />

shown in this note, and equity attributable to shareholders as disclosed in the consolidated statement of changes in equity.<br />

External capital requirements<br />

NERL’s air traffic services licence requires the company to use reasonable endeavours to maintain an investment grade issuer credit<br />

rating (BBB-/Baa3 or better). Separately, it is the objective of the group to target a credit profile for NERL that exceeds BBB-/Baa3.<br />

As at 31 March <strong>2015</strong>, NERL had a corporate rating of AA- from Standard & Poor’s (2014: AA-) and A2 from Moody’s (2014: A2).<br />

Gearing ratio<br />

The group does not seek to maintain a target gearing level at group level but rather sets a gearing target for NERL, the economically regulated<br />

subsidiary, based on a ratio of net debt to its Regulatory Asset Base (RAB). In addition, the CAA has set NERL a gearing target of 60% and a<br />

cap of 65% of net debt to RAB with a requirement for NERL to remedy the position if this cap is exceeded. NERL’s gearing ratio at 31 March<br />

<strong>2015</strong> was 53.4% (2014: 54.0%). <strong>NATS</strong> Services and <strong>NATS</strong> Limited, the group’s intermediate holding company, have no borrowings.<br />

Significant accounting policies<br />

Details of the significant accounting policies and methods adopted, including the criteria for recognition, the basis of measurement<br />

and the basis on which income and expenses are recognised, in respect of each class of financial asset, financial liability and equity<br />

instrument are disclosed in note 2 to the financial statements.<br />

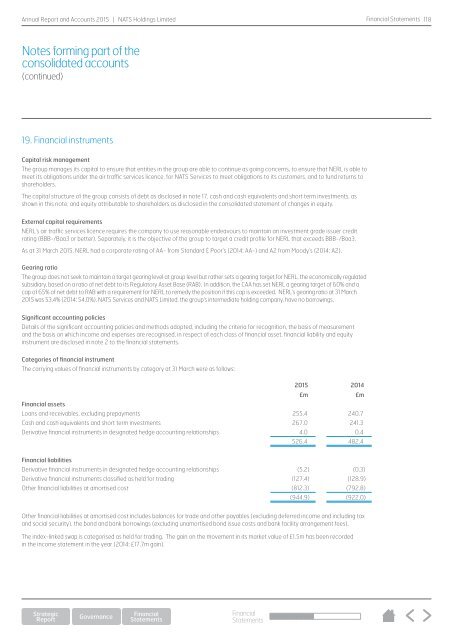

Categories of financial instrument<br />

The carrying values of financial instruments by category at 31 March were as follows:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Financial assets<br />

Loans and receivables, excluding prepayments 255.4 240.7<br />

Cash and cash equivalents and short term investments 267.0 241.3<br />

Derivative financial instruments in designated hedge accounting relationships 4.0 0.4<br />

526.4 482.4<br />

Financial liabilities<br />

Derivative financial instruments in designated hedge accounting relationships (5.2) (0.3)<br />

Derivative financial instruments classified as held for trading (127.4) (128.9)<br />

Other financial liabilities at amortised cost (812.3) (792.8)<br />

(944.9) (922.0)<br />

Other financial liabilities at amortised cost includes balances for trade and other payables (excluding deferred income and including tax<br />

and social security), the bond and bank borrowings (excluding unamortised bond issue costs and bank facility arrangement fees).<br />

The index-linked swap is categorised as held for trading. The gain on the movement in its market value of £1.5m has been recorded<br />

in the income statement in the year (2014: £17.7m gain).<br />

Financial<br />

Statements