NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 143<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

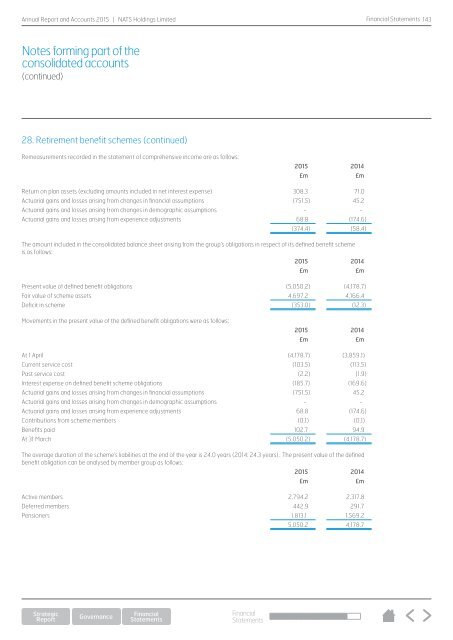

28. Retirement benefit schemes (continued)<br />

Remeasurements recorded in the statement of comprehensive income are as follows:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Return on plan assets (excluding amounts included in net interest expense) 308.3 71.0<br />

Actuarial gains and losses arising from changes in financial assumptions (751.5) 45.2<br />

Actuarial gains and losses arising from changes in demographic assumptions - -<br />

Actuarial gains and losses arising from experience adjustments 68.8 (174.6)<br />

(374.4) (58.4)<br />

The amount included in the consolidated balance sheet arising from the group’s obligations in respect of its defined benefit scheme<br />

is as follows:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Present value of defined benefit obligations (5,050.2) (4,178.7)<br />

Fair value of scheme assets 4,697.2 4,166.4<br />

Deficit in scheme (353.0) (12.3)<br />

Movements in the present value of the defined benefit obligations were as follows:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

At 1 April (4,178.7) (3,859.1)<br />

Current service cost (103.5) (113.5)<br />

Past service cost (2.2) (1.9)<br />

Interest expense on defined benefit scheme obligations (185.7) (169.6)<br />

Actuarial gains and losses arising from changes in financial assumptions (751.5) 45.2<br />

Actuarial gains and losses arising from changes in demographic assumptions - -<br />

Actuarial gains and losses arising from experience adjustments 68.8 (174.6)<br />

Contributions from scheme members (0.1) (0.1)<br />

Benefits paid 102.7 94.9<br />

At 31 March (5,050.2) (4,178.7)<br />

The average duration of the scheme’s liabilities at the end of the year is 24.0 years (2014: 24.3 years). The present value of the defined<br />

benefit obligation can be analysed by member group as follows:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Active members 2,794.2 2,317.8<br />

Deferred members 442.9 291.7<br />

Pensioners 1,813.1 1,569.2<br />

5,050.2 4,178.7<br />

Financial<br />

Statements