NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 131<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

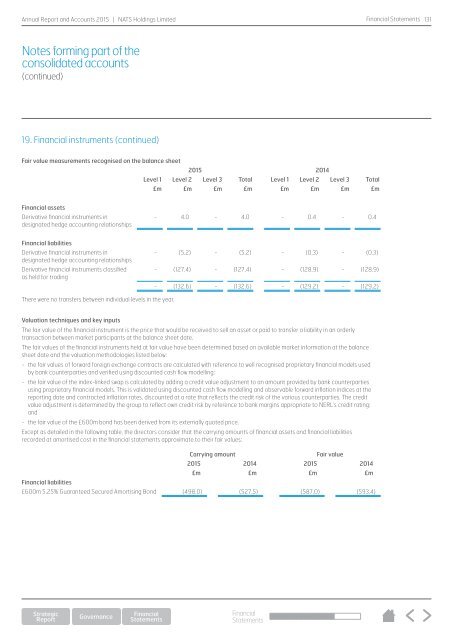

19. Financial instruments (continued)<br />

Fair value measurements recognised on the balance sheet<br />

<strong>2015</strong> 2014<br />

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total<br />

£m £m £m £m £m £m £m £m<br />

Financial assets<br />

Derivative financial instruments in<br />

designated hedge accounting relationships<br />

- 4.0 - 4.0 - 0.4 - 0.4<br />

Financial liabilities<br />

Derivative financial instruments in<br />

designated hedge accounting relationships<br />

Derivative financial instruments classified<br />

as held for trading<br />

- (5.2) - (5.2) - (0.3) - (0.3)<br />

- (127.4) - (127.4) - (128.9) - (128.9)<br />

- (132.6) - (132.6) - (129.2) - (129.2)<br />

There were no transfers between individual levels in the year.<br />

Valuation techniques and key inputs<br />

The fair value of the financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly<br />

transaction between market participants at the balance sheet date.<br />

The fair values of the financial instruments held at fair value have been determined based on available market information at the balance<br />

sheet date and the valuation methodologies listed below:<br />

- the fair values of forward foreign exchange contracts are calculated with reference to well recognised proprietary financial models used<br />

by bank counterparties and verified using discounted cash flow modelling;<br />

- the fair value of the index-linked swap is calculated by adding a credit value adjustment to an amount provided by bank counterparties<br />

using proprietary financial models. This is validated using discounted cash flow modelling and observable forward inflation indices at the<br />

reporting date and contracted inflation rates, discounted at a rate that reflects the credit risk of the various counterparties. The credit<br />

value adjustment is determined by the group to reflect own credit risk by reference to bank margins appropriate to NERL’s credit rating;<br />

and<br />

- the fair value of the £600m bond has been derived from its externally quoted price.<br />

Except as detailed in the following table, the directors consider that the carrying amounts of financial assets and financial liabilities<br />

recorded at amortised cost in the financial statements approximate to their fair values:<br />

Carrying amount<br />

Fair value<br />

<strong>2015</strong> 2014 <strong>2015</strong> 2014<br />

£m £m £m £m<br />

Financial liabilities<br />

£600m 5.25% Guaranteed Secured Amortising Bond (498.0) (527.5) (587.0) (593.4)<br />

Financial<br />

Statements