NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 110<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

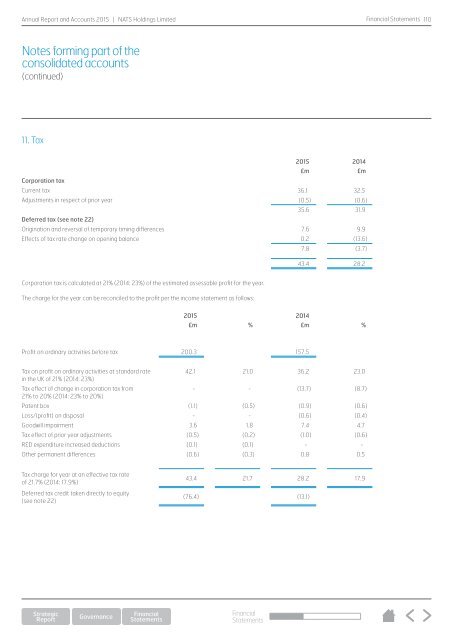

11. Tax<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Corporation tax<br />

Current tax 36.1 32.5<br />

Adjustments in respect of prior year (0.5) (0.6)<br />

35.6 31.9<br />

Deferred tax (see note 22)<br />

Origination and reversal of temporary timing differences 7.6 9.9<br />

Effects of tax rate change on opening balance 0.2 (13.6)<br />

7.8 (3.7)<br />

43.4 28.2<br />

Corporation tax is calculated at 21% (2014: 23%) of the estimated assessable profit for the year.<br />

The charge for the year can be reconciled to the profit per the income statement as follows:<br />

<strong>2015</strong> 2014<br />

£m % £m %<br />

Profit on ordinary activities before tax 200.3 157.5<br />

Tax on profit on ordinary activities at standard rate<br />

42.1 21.0 36.2 23.0<br />

in the UK of 21% (2014: 23%)<br />

Tax effect of change in corporation tax from<br />

- - (13.7) (8.7)<br />

21% to 20% (2014: 23% to 20%)<br />

Patent box (1.1) (0.5) (0.9) (0.6)<br />

Loss/(profit) on disposal - - (0.6) (0.4)<br />

Goodwill impairment 3.6 1.8 7.4 4.7<br />

Tax effect of prior year adjustments (0.5) (0.2) (1.0) (0.6)<br />

R&D expenditure increased deductions (0.1) (0.1) - -<br />

Other permanent differences (0.6) (0.3) 0.8 0.5<br />

Tax charge for year at an effective tax rate<br />

of 21.7% (2014: 17.9%)<br />

Deferred tax credit taken directly to equity<br />

(see note 22)<br />

43.4 21.7 28.2 17.9<br />

(76.4) (13.1)<br />

Financial<br />

Statements