NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Strategic <strong>Report</strong><br />

37<br />

Review of service<br />

line performance<br />

Service line performance<br />

We organise our activities according to service lines, which<br />

reflect the products and services that we offer. A brief<br />

description is provided under the section entitled ‘Our<br />

business model’. This section explains the financial and<br />

operational performance of each service. The principal<br />

financial measures are revenue and contribution. The<br />

former includes intra-group revenue, while the latter reflects<br />

the operating costs which managers are able to influence<br />

directly. A reconciliation of service line contribution to the<br />

group’s operating profit is provided in the notes to the<br />

financial statements.<br />

<strong>NATS</strong> Airspace<br />

<strong>2015</strong> 2014<br />

Financial performance:<br />

Revenue (£m) 738.5 740.7<br />

Service line contribution (£m) 380.2 391.6<br />

Capital expenditure (£m) 152.3 125.5<br />

Operational performance:<br />

Flights handled (‘000s) 2,216 2,162<br />

Risk-bearing airprox (no.) 1 1<br />

Average delay per flight (seconds) 2.2 5.4<br />

Enabled fuel savings (tonnes) 189,000 21,000*<br />

* restated<br />

<strong>NATS</strong> Airspace includes all of NERL’s economically<br />

regulated activities. It generated revenue of £738.5m, a<br />

0.3% reduction on the previous year. This included the<br />

impact of RP2 price reductions from January <strong>2015</strong> which<br />

offset an improved service incentive and the impact of<br />

pricing below the level of permitted revenue allowances in<br />

2014. Last year’s income also included a one-off benefit for<br />

the back-up Galileo satellite monitoring facility at Swanwick.<br />

Service line contribution of £380.2m was 2.9% lower and<br />

reflected higher budgeted pension costs (used in assessing<br />

service line performance only and reflecting market<br />

conditions when the budget was set), pay awards and nonstaff<br />

cost increases which offset the benefit of headcount<br />

reductions and higher capitalised internal labour.<br />

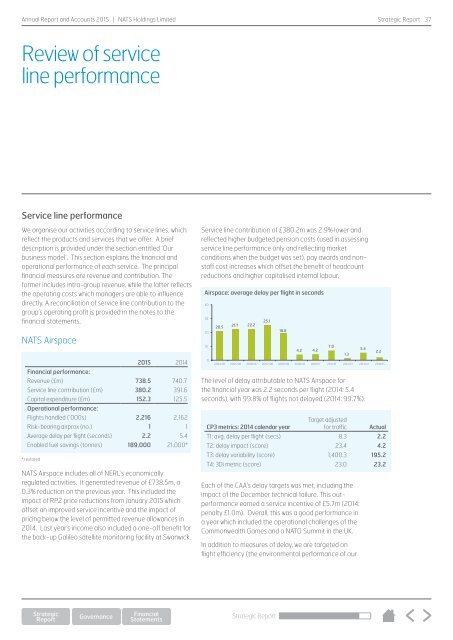

Airspace: average Airspace: delay average per flight delay per in seconds flight in seconds<br />

40<br />

30<br />

20<br />

10<br />

0<br />

20.5<br />

21.7 22.2<br />

25.1<br />

The level of delay attributable to <strong>NATS</strong> Airspace for<br />

the financial year was 2.2 seconds per flight (2014: 5.4<br />

seconds), with 99.8% of flights not delayed (2014: 99.7%).<br />

Each of the CAA’s delay targets was met, including the<br />

impact of the December technical failure. This outperformance<br />

earned a service incentive of £5.7m (2014:<br />

penalty £1.0m). Overall, this was a good performance in<br />

a year which included the operational challenges of the<br />

Commonwealth Games and a NATO Summit in the UK.<br />

In addition to measures of delay, we are targeted on<br />

flight efficiency (the environmental performance of our<br />

18.8<br />

4.2 4.2<br />

2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 2014/15<br />

CP3 metrics: 2014 calendar year<br />

Target adjusted<br />

for traffic Actual<br />

T1: avg. delay per flight (secs) 8.3 2.2<br />

T2: delay impact (score) 23.4 4.2<br />

T3: delay variability (score) 1,400.3 195.2<br />

T4: 3Di metric (score) 23.0 23.2<br />

7.0<br />

1.3<br />

5.4<br />

2.2<br />

Strategic <strong>Report</strong>