NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 153<br />

Notes forming part of<br />

the company accounts<br />

Notes to the financial statements<br />

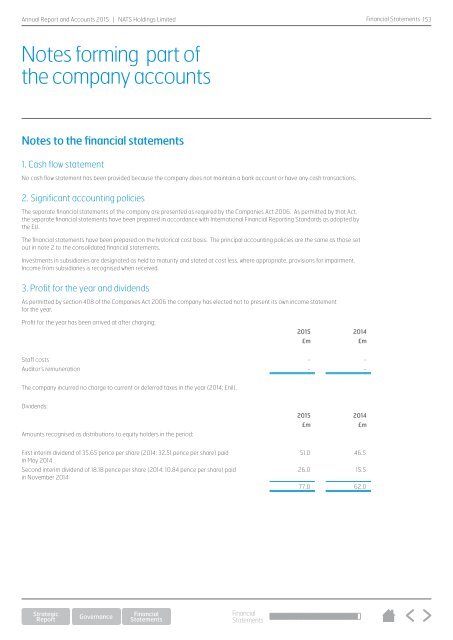

1. Cash flow statement<br />

No cash flow statement has been provided because the company does not maintain a bank account or have any cash transactions.<br />

2. Significant accounting policies<br />

The separate financial statements of the company are presented as required by the Companies Act 2006. As permitted by that Act,<br />

the separate financial statements have been prepared in accordance with International Financial <strong>Report</strong>ing Standards as adopted by<br />

the EU.<br />

The financial statements have been prepared on the historical cost basis. The principal accounting policies are the same as those set<br />

out in note 2 to the consolidated financial statements.<br />

Investments in subsidiaries are designated as held to maturity and stated at cost less, where appropriate, provisions for impairment.<br />

Income from subsidiaries is recognised when received.<br />

3. Profit for the year and dividends<br />

As permitted by section 408 of the Companies Act 2006 the company has elected not to present its own income statement<br />

for the year.<br />

Profit for the year has been arrived at after charging:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

Staff costs - -<br />

Auditor’s remuneration - -<br />

The company incurred no charge to current or deferred taxes in the year (2014: £nil).<br />

Dividends:<br />

Amounts recognised as distributions to equity holders in the period:<br />

<strong>2015</strong> 2014<br />

£m £m<br />

First interim dividend of 35.65 pence per share (2014: 32.51 pence per share) paid<br />

in May 2014<br />

Second interim dividend of 18.18 pence per share (2014: 10.84 pence per share) paid<br />

in November 2014<br />

51.0 46.5<br />

26.0 15.5<br />

77.0 62.0<br />

Financial<br />

Statements