NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Financial Statements 129<br />

Notes forming part of the<br />

consolidated accounts<br />

(continued)<br />

19. Financial instruments (continued)<br />

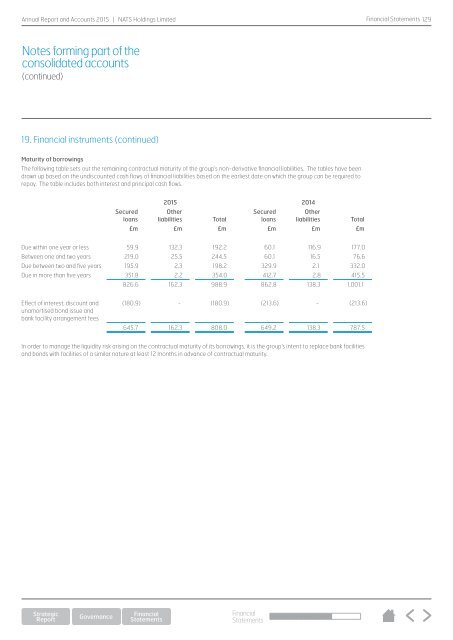

Maturity of borrowings<br />

The following table sets out the remaining contractual maturity of the group’s non-derivative financial liabilities. The tables have been<br />

drawn up based on the undiscounted cash flows of financial liabilities based on the earliest date on which the group can be required to<br />

repay. The table includes both interest and principal cash flows.<br />

<strong>2015</strong> 2014<br />

Secured<br />

loans<br />

Other<br />

liabilities<br />

Total<br />

Secured<br />

loans<br />

Other<br />

liabilities<br />

Total<br />

£m £m £m £m £m £m<br />

Due within one year or less 59.9 132.3 192.2 60.1 116.9 177.0<br />

Between one and two years 219.0 25.5 244.5 60.1 16.5 76.6<br />

Due between two and five years 195.9 2.3 198.2 329.9 2.1 332.0<br />

Due in more than five years 351.8 2.2 354.0 412.7 2.8 415.5<br />

826.6 162.3 988.9 862.8 138.3 1,001.1<br />

Effect of interest, discount and<br />

unamortised bond issue and<br />

bank facility arrangement fees<br />

(180.9) - (180.9) (213.6) - (213.6)<br />

645.7 162.3 808.0 649.2 138.3 787.5<br />

In order to manage the liquidity risk arising on the contractual maturity of its borrowings, it is the group’s intent to replace bank facilities<br />

and bonds with facilities of a similar nature at least 12 months in advance of contractual maturity.<br />

Financial<br />

Statements