NATS-Annual-Report-2015

NATS-Annual-Report-2015

NATS-Annual-Report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2015</strong> | <strong>NATS</strong> Holdings Limited<br />

Governance<br />

81<br />

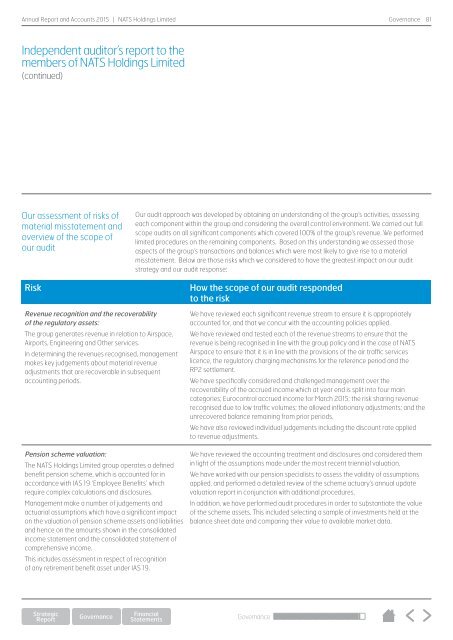

Independent auditor’s report to the<br />

members of <strong>NATS</strong> Holdings Limited<br />

(continued)<br />

Our assessment of risks of<br />

material misstatement and<br />

overview of the scope of<br />

our audit<br />

Risk<br />

Our audit approach was developed by obtaining an understanding of the group’s activities, assessing<br />

each component within the group and considering the overall control environment. We carried out full<br />

scope audits on all significant components which covered 100% of the group’s revenue. We performed<br />

limited procedures on the remaining components. Based on this understanding we assessed those<br />

aspects of the group’s transactions and balances which were most likely to give rise to a material<br />

misstatement. Below are those risks which we considered to have the greatest impact on our audit<br />

strategy and our audit response:<br />

How the scope of our audit responded<br />

to the risk<br />

Revenue recognition and the recoverability<br />

of the regulatory assets:<br />

The group generates revenue in relation to Airspace,<br />

Airports, Engineering and Other services.<br />

In determining the revenues recognised, management<br />

makes key judgements about material revenue<br />

adjustments that are recoverable in subsequent<br />

accounting periods.<br />

Pension scheme valuation:<br />

The <strong>NATS</strong> Holdings Limited group operates a defined<br />

benefit pension scheme, which is accounted for in<br />

accordance with IAS 19 ‘Employee Benefits’ which<br />

require complex calculations and disclosures.<br />

Management make a number of judgements and<br />

actuarial assumptions which have a significant impact<br />

on the valuation of pension scheme assets and liabilities<br />

and hence on the amounts shown in the consolidated<br />

income statement and the consolidated statement of<br />

comprehensive income.<br />

This includes assessment in respect of recognition<br />

of any retirement benefit asset under IAS 19.<br />

We have reviewed each significant revenue stream to ensure it is appropriately<br />

accounted for, and that we concur with the accounting policies applied.<br />

We have reviewed and tested each of the revenue streams to ensure that the<br />

revenue is being recognised in line with the group policy and in the case of <strong>NATS</strong><br />

Airspace to ensure that it is in line with the provisions of the air traffic services<br />

licence, the regulatory charging mechanisms for the reference period and the<br />

RP2 settlement.<br />

We have specifically considered and challenged management over the<br />

recoverability of the accrued income which at year end is split into four main<br />

categories; Eurocontrol accrued income for March <strong>2015</strong>; the risk sharing revenue<br />

recognised due to low traffic volumes; the allowed inflationary adjustments; and the<br />

unrecovered balance remaining from prior periods.<br />

We have also reviewed individual judgements including the discount rate applied<br />

to revenue adjustments.<br />

We have reviewed the accounting treatment and disclosures and considered them<br />

in light of the assumptions made under the most recent triennial valuation.<br />

We have worked with our pension specialists to assess the validity of assumptions<br />

applied, and performed a detailed review of the scheme actuary’s annual update<br />

valuation report in conjunction with additional procedures.<br />

In addition, we have performed audit procedures in order to substantiate the value<br />

of the scheme assets. This included selecting a sample of investments held at the<br />

balance sheet date and comparing their value to available market data.<br />

Governance